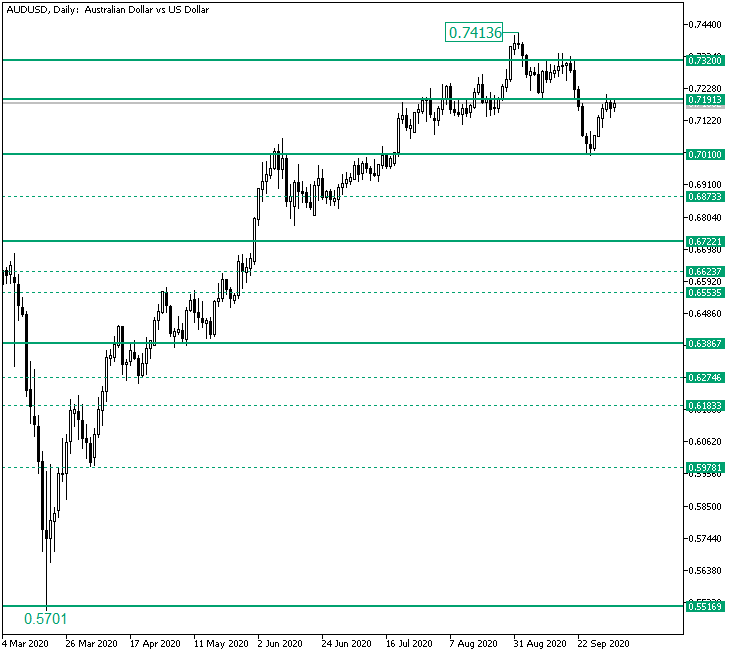

The Australian versus the US dollar currency pair slipped under the 0.7193 level and looks like it has difficulties in regaining it. Could this be a bearish sign?

Long-term perspective

The appreciation that started from the 0.5701 low advanced until the 0.7413 high. However, after falling beneath 0.7320, the price began a descending movement, as the bullish attempt to validate 0.7191 as support failed.

The bullish missed effort left the bears with enough confidence to be able to break 0.7191. After they succeded in this direction, they extended the fall until the 0.7010 old resistance level.

At this point, the market participants could expect that, as it turned to support, 0.7010 is ready to fuel the resumption of the rise. However, on October the 2nd, the market printed a hanging man, a pattern that usually signals a change of direction, from bullish to bearish, or, at least, a pause of the appreciation.

So, as long as 0.7191 remains resistance, then a new fall could commence. In this scenario, 0.7010 would be the first target, followed by 0.6873.

On the other hand, if the bulls do regain control over 0.7191, then they could eye 0.7320.

Short-term perspective

The fall that started from the 0.7345 high, after the 0.7341 intermediary level was confirmed as resistance, ended up at the 0.7002 firm area.

Along its way, it pierced to important levels, 0.7236 and 0.7170, respectively.

From the 0.7002 level, the bulls did recover, regaining the 0.7081 intermediary level, and etching the high at 0.7209, above 0.7170.

However, bullish advancement seems to have stopped in its tracks, as after reaching the midpoint, at 0.7209, it dropped under 0.7170 instead of validating it as support.

So, if the bulls do manage to confirm 0.7170, then they can hope for 0.7236. On the flip side, if 0.7170 cedes, then 0.7081 is the first target, and 0.7002 comes next.

Levels to keep an eye on:

D1: 0.7191 0.7010 0.6873 0.7320

H4: 0.7170 0.7236 0.7081 0.7002

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment