The US dollar versus the Japanese yen currency pair seems to be lacking traction to reach 106.12. Are the bears just around the corner?

Long-term perspective

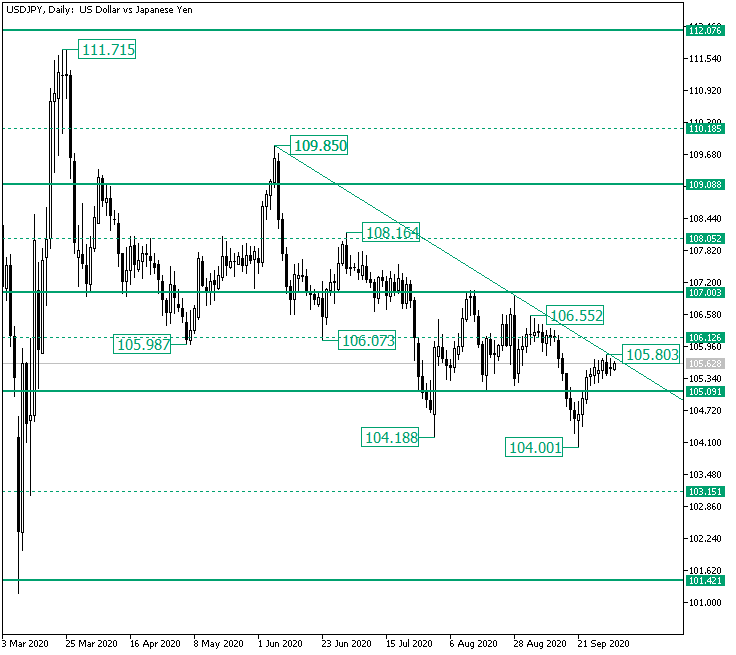

The depreciation from the 111.71 high lead to a more or less sideways movement which, from the 109.85 lower high, ebbed and crafted the low of 104.18.

From the 104.18 low, a new side sideways movement started, one contained by the 107.00 and 105.09 levels, respectively.

After the support was pierced, a new fall took place, printing the 104.00 low. Following that, the bulls were able to recuperate, only to find themselves not being ready to define a new movement toward the north after a well-defined consolidation phase above the firm 105.09 support.

So, one possible scenario is to see the bears heading for 105.09. If they succeed validating the level as resistance, then they could note another movement towards the south, with 104.00 being the intermediary target, and 103.15 the main one.

But if the bears fail in their attempt, or if the bulls simply take out the 105.80 high, thus piercing the descending trendline that starts from the 109.85 high, then they can place the price above 106.12.

If the intermediary level of 106.12 becomes support, then 107.00 is the main bullish objective.

Short-term perspective

The drop that started from the 106.26 high ended at the 104.00 low. Afterward, the price confirmed the firm level of 104.44 as support.

This sparked a rally that extended until the 105.80 high and submitted to the consolidation phase that unfolds above 105.27.

If 105.27 remains support, then the bulls have a shot for 106.02. On the flip side, 104.44 could be the next bearish stop. If the latter occurs, then 104.44 may become resistance, aiding to a revisit of the 104.00 low.

Levels to keep an eye on:

D1: 105.09 103.15 106.12 107.00

H4: 105.27 106.02 104.44

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment