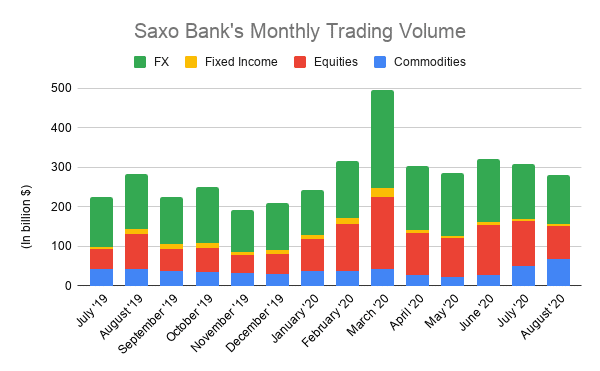

The Saxo Bank Group has published the overall monthly trading volumes for August, showing a month-on-month decrease by 9 percent.

In absolute numbers, the Copenhagen-based multiasset broker recorded $279.4 billion in monthly trading volumes in August, compared to July’s $307.1 billion. The retail forex business of the company also took a massive hit as August volumes dropped 10.9 percent to $123.4 billion.

Similar to most of the major brokers, Saxo’s with $496.8 billion overall, while FX stood at $248.6 billion. However, since then, the numbers continued to drop drastically, and August being the worst month in 2020, in terms of volumes, only behind January.

According to the reported numbers, the bank’s daily FX volumes slumped to $5.9 billion last month, compared to $6.3 billion in July.

The month-on-month downtrend can also be seen for the equities market as well with $83.7 billion in monthly volumes declining from $115.4 billion in the previous month.

However, the monthly volumes increased in the commodities market, as well as for fixed incomes. Though commodities trading contributes significantly to the total volume, Saxo’s fixed income market is still minor.

August 2020 also saw a decline when compared year-on-year – last year the broker saw $282.9 billion in August’s total trading volume, whereas FX volume stood at $139.1 billion.

A solid first half

As Finance Magnates reported, Saxo also published its detailed financials for the first half of 2020, showing a , pivoting from a net loss of $22.08 million in the first half of last year. The multiasset broker cited the increased demand due to the market volatility induced by COVID-19 and also revealed an addition of over 80,000 new traders on its platform in the period.

In an earlier statement, Saxo Bank CEO Andrew Edwards towards the market performance post the impact of COVID-19 on it, however, with the declining volumes, the situation seems to be the opposite.

Be First to Comment