The Australian versus the New Zealand dollar currency pair extended all the way to the firm 1.0983 resistance level and started correcting from there. Is this a sustainable bearish sign?

Long-term perspective

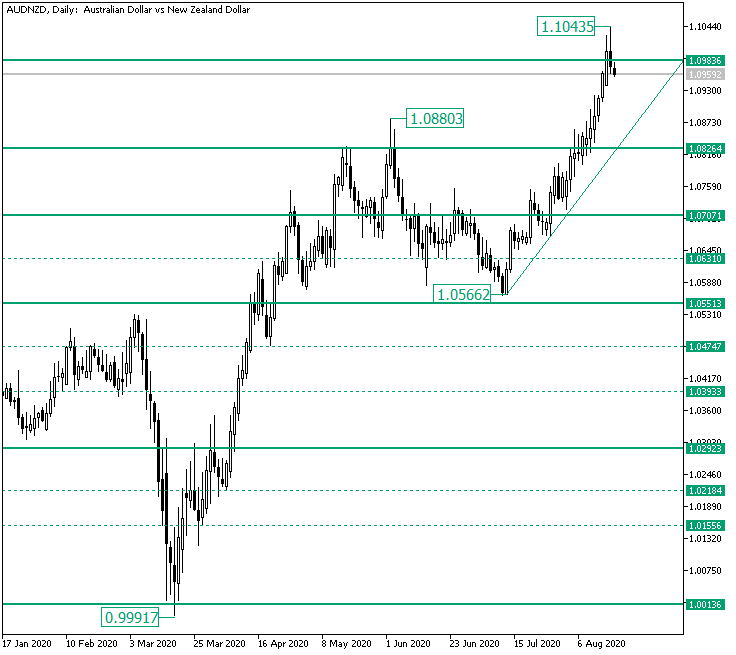

The rally that started from the 0.9991 low, after validating the 1.0013 support level, extended all the way to the 1.0880 high. From there, a correction phase began, one that found support a hair away from 1.0551, etching the 1.0566 low.

What followed was another determined progress towards the north, the price defining the 1.1043 high, before retracing under the solid 1.0983 resistance area.

Of course, the failure of the bulls to keep the price above 1.0983 is seen by the bears as an opportunity, based on the lack of bullish power to continue further after the progress made form 1.0566.

The truth is somewhere in the middle. First, the bulls are booking their profits, and as a result, the price devaluates. Secondly, the bears consider the false piercing of 1.0983 as a shorting occasion. So, the price has the catalysts needed to depreciate.

However, it is important to consider — at least for the time being — this is a correction of the prevailing up-trend. So, as long as the ascending line that starts from the 1.0566 low remains intact, another run towards 1.0983 to convert it to a support level is in the cards.

But even if the trendline fails, the 1.0826 level is there to back the bulls. Only if 1.0826 turns to resistance, then the bears could push the price further, having 1.0707 and 1.0551 as their first and second targets, respectively.

Short-term perspective

From the 1.0717 low, the price is in an ascending trend. As of writing, the trend extended until the 1.0143 high.

As long as the trendline is considered by the price, the bulls could make new attempts to break the 1.1030 resistance area.

However, if the double support defined by the ascending trendline and the 1.0921 intermediary level cedes, then the price could continue to fall until 1.0866, with the possibility for an extension until 1.0820.

Levels to keep an eye on:

D1: 1.0826 1.0707 1.0551

H4: 1.0921 1.0866 1.0820

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment