Between July and August, Decentralized Finance (DeFi) cryptocurrencies have experienced unprecedented growth, and have largely outpaced the gains seen by top five cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Many experts now believe that the bull run is still far from over and that these assets have attained just a fraction of their potential growth. Here’s what you need to do to get in on the action.

Do Your Own Fundamental and Technical Analyses

Although you have probably heard that some traders are making incredible profits by trading DeFi and other promising coins, it’s important to understand that identifying profitable cryptocurrencies and capitalizing on opportunities is a learned skill.

By performing fundamental analysis, you can find out whether a cryptocurrency has the right attributes needed to achieve success over your desired investment timeframe.

This means looking into the project’s , team experience, partnerships and roadmap, market sentiment, and more to see whether it is undervalued, overvalued, or just right.

If the project is overvalued or undervalued, then performing technical analyses can help to determine an optimal entry point to either go long (on undervalued assets) or short (overvalued assets).

One of the simplest ways to spot profitable market setups is with a market tracking platform like , which has a range of tools and indicators—including predefined charts for a range of cryptocurrencies, performance indicators, and a simple coin calendar of important upcoming events.

NewsCrypto will also be adding its own DeFi tracker soon, allowing traders to easily keep tabs on promising projects.

These features can be used to perform your own market analyses to help easily spot opportunities less well-equipped traders would likely miss.

The platform also has a range of intermediate and advanced tools, like arbitrage and sentiment indicators.

Traders looking to get an edge on the market can using a variety of payment methods, including Google Pay, PayPal, and Visa, which can then be used to unlock these tools.

Identify Opportunities

Once you’ve got a handle on technical and fundamental analysis, the next step is finding coins that may be poised to appreciate in value. In the world of cryptocurrency, it isn’t uncommon to find digital assets that manage to rack up gains of 10 to even 100x in a year.

However, spotting these ahead of time can be a challenging, but highly rewarding endeavor.

Arguably the simplest way to do this is by participating in the earliest funding rounds of the promising projects. This allows you to purchase or earn tokens at the lowest possible price and stand the best chance of turning a positive return on your investment.

This can mean participating in , security token offerings (STOs), and initial exchange offerings (IEOs).

It’s also worth looking into projects that are being launched under novel funding models, as these have historically generated impressive returns for investors.

For example, the first coin (Orion Protocol) launched through a generated a peak return of almost 8,000% for investors between July and August 2020.

Now, with the advent of a new type of investment method known as a , interest is so high that the first SHO project (OpenPredict) has had to divide its token sale into five phases to help manage demand.

This is a strong demonstrator of the continued hype surrounding DeFi projects.

Overall, the hype associated with decentralized finance has led to many micro, small, and even medium-cap cryptocurrencies exploding in value in recent weeks.

Nonetheless, it’s important to stick to the fundamentals, and apply fundamental and technical analysis where possible to maximize your odds of making a profitable pick.

Place Your Order and Manage Risk

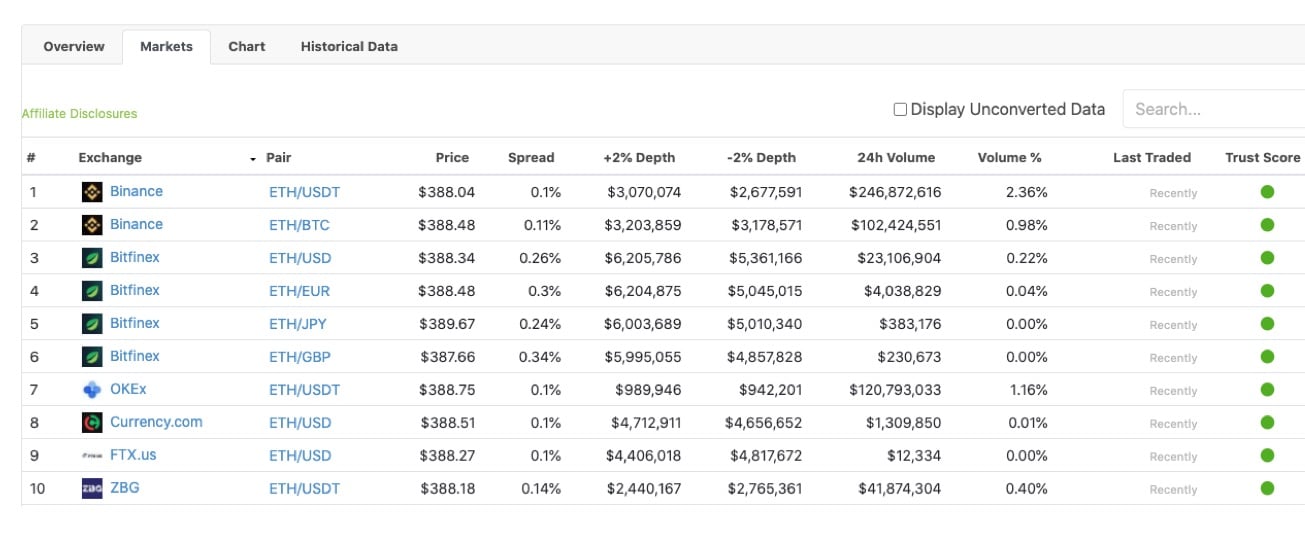

After you’ve found the ideal asset and identified your entry and exit points, you’ll then need to find a suitable exchange that supports the trading pair you want.

One of the simplest ways to do is by checking the cryptocurrency page on one of the numerous price tracking platforms, such as or .

Here, you’ll be able to find a list of available markets and the exchange platforms they can be traded on. It’s usually best to trade on the platform with the most liquidity, but be sure to consider security, reputation, and trading fees when making your decision.

It’s important to note that newer cryptocurrencies may only be listed on decentralized exchange platforms like . These are often some of the riskiest assets, but some have been known to generate impressive returns for those with a high risk, high reward appetite.

After placing your order, it’s important to set a reasonable . Depending on the volatility of the cryptocurrency and the liquidity of the exchange you are using, this might be as tight as 10% below your entry price (for relatively stable assets), to potentially much lower if the asset is prone to dramatic price swings.

Once you’re in profit, you might want to consider opening a . This will work to move the stop to a fixed percentage or value below the current value in a climbing market. This can be used to maintain a stop loss even while the asset is appreciating.

Be First to Comment