Morgan Stanley has agreed to pay a fine of $175,000 in order to settle charges from the (FINRA) regarding short-term trades of corporate bonds.

In particular, according to a document signed on the 12th of August 2020 seen by Finance Magnates, FINRA has accused the of failing to reasonably supervise a registered representative, referred as KG in the document, who recommended short-term trades of corporate bonds and preferred securities in the accounts of ten customers between January 2012 through December 2017.

According to the financial authority, this lack of adequate supervision is in violation of NASD Rule 3010 (for conduct before December 1, 2014), FINRA Rule 3110 (for conduct on or after December 1, 2014), and FINRA Rule 2010.

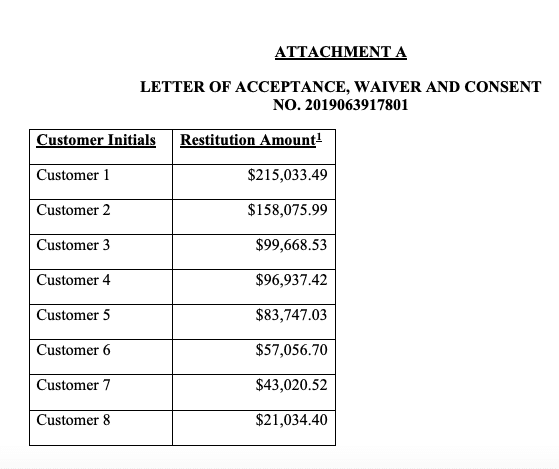

As Morgan Stanley has agreed to pay the $175,000 fine, a censure and restitution to the customers listed on Attachment A (pictured below) in the total amount of $774,574.08 plus interest. The US-headquartered bank has accepted to do so without admitting or denying the findings from the regulator.

“Specifically, on hundreds of occasions during the Relevant Period, KG recommended that the customers buy, and then promptly sell, corporate bonds or preferred securities, which due to their upfront sales charges, were typically only suitable for customers if held long-term.”

FINRA: Morgan Stanley failed to respond to alerts

During the period spanning from January 2012 through to December 2017, Morgan Stanley used a number of automated alerts which were used to identify trading activity and accounts that needed further review from a supervisor.

According to the agency, Morgan Stanley received nearly 100 alerts regarding KG’s trading in accounts of the ten affected customers from January 2012 until December of 2014. However, the US authority said the bank failed to take reasonable steps to review the red flags.

“Instead, from January 2012 through September 2014, Morgan Stanley discussed the alerts with KG and contacted the affected customers to confirm whether they were satisfied with KG and his recommendations,” FINRA outlined.

Be First to Comment