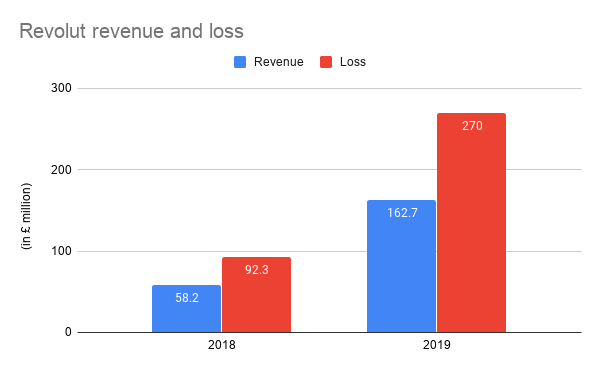

, a leading challenger bank in the United Kingdom, has published its annual financials for 2019 with the Companies House – it has tripled its annual revenue for the period to £162.7 million, as compared to £58.2 million in the previous year.

The company highlighted that the growth was boosted by the expansion of its product line and an increase in its customer base and customer activity. By the end of the year, the platform added 10 million customers.

The current retail customer count on the platform went up to 13 million, despite a slowdown in business by the ongoing pandemic.

Revolut offers electronic money and payments services to its retail customers in various modes, including a pre-paid card, currency exchange, and peer-to-peer payments. The company is also targeting businesses with its multi-currency exchange, pre-paid corporate card, and a few other services.

The platform had 220,000 business customers by the end of 2019.

Entering global markets after capturing Europe

Launched in 2017, the fintech company is also offering to its clients, but unlike dedicated crypto platforms, Revolut customers cannot move their crypto holdings to external wallets.

As the company is focusing on the growth of its services and also geographical expansion, its annual direct and administrative costs from £92.3 million in 2018 to £270 million in 2019. It also reported an operating loss of £107.4 million, up from the previous year’s £34.01 million.

The gross margin of the platform improved to 39 percent by the final quarter of last year, compared to the initial quarter’s 17 percent.

Revolut operated with an e-money license from the Financial Conduct Authority (FCA) and uses passporting rights to offer services in the European Economic Area (EEA). Apart from Europe, the company also initiated global expansion last year.

The UK-headquartered challenger bank now operates in the United States, Australia, Japan, and Australia, apart from the European countries.

Be First to Comment