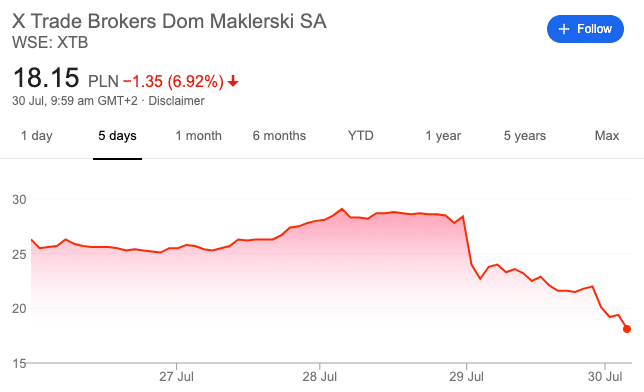

After releasing its financial results on Tuesday the 28th of July, the share price of XTB, which has been on an upward trend since around March, has taken a turn for the worst.

In fact, since releasing its financial report on Tuesday, XTB’s share price has fallen by more than 35 per cent as of the time of publishing, falling from PLN 29.10 (EUR 6.60) at its peak on the 28th of July. On Wednesday, the broker’s share price fell down to PLN 19.50 by the end of the session and has continued to move up and down this morning.

Investors flock to broker’s stock

It is also interesting that on the 29th of July when XTB’s shares did the majority of the downward movement, trading of the company’s stock was at historically high with a volume of PLN 170.31 million, with more than 7.57 million stocks traded.

Source: XTB

“Unfortunately, the broad market’s expectations concerning Q2 results, especially of individual investors which recently were extraordinary active in trading of XTB shares, were in our view far higher.”

XTB reports solid H1 of 2020, but Q2 lags

As , XTB reported a stellar first half of 2020, driven by the broker’s performance in the first quarter of 2020 which captured the heightened market volatility seen towards the end of February and throughout March.

Although the broker reported positive metrics for the first half overall, the financial report did show a notable slow down during the second quarter, which might be the reason behind the drop in share price.

In particular, in the second quarter, net profit was PLN 117,519, whereas the first quarter of 2020 recorded a net profit of PLN 175,969, which is lower by 49.7 per cent. Net operating income also fell from PLN 306.7 million in the first three months of the year down to PLN 211.5 million (31.0 per cent drop).

However, the situation definitely wasn’t all bad for the Polish broker during the second quarter. In fact, the firm added more clients in the second quarter than it did in the first (39.3 per cent growth), and trading in contracts for difference (CFDs) was also stronger in Q2 (5.6 per cent growth).

Be First to Comment