The Australian versus the New Zealand dollar currency pair seems to have the bulls on its side. But is it really so?

Long-term perspective

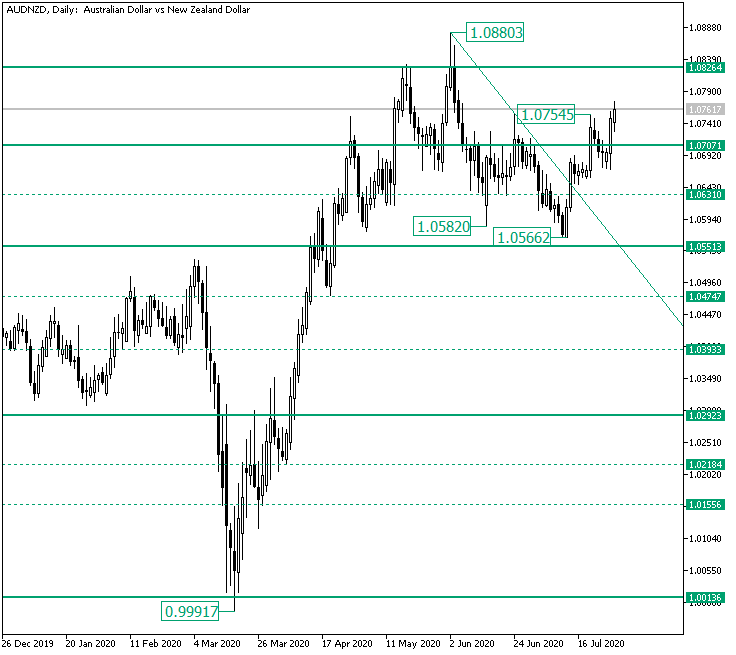

The rally that started from the 0.9991 low extended to as high as 1.0880. This peak acted as a false piercing of the firm 1.0826 resistance level, and as a consequence, the bears took the opportunity to send the price lower. As a result, the next major support, 1.0707, was passed, leading to the piercing of the 1.0631 intermediary level and the formation of the 1.0582 low.

As the price began a consolidation that found support at 1.0631, the bulls attempted to reconquer the resistance, 1.0707, but all they could do is to etch a lower high. As a result, the bears, once more, sent the price towards the south, defining the 1.0566 low. From here, the bulls, again, strived for a comeback, which this time paid off, as the resistance trendline — starting from the 1.0880 high — got pierced and the 1.0754 high printed.

However, the price slipped under 1.0707 yet again, and still, the bulls recovered. As the bulls did not actually confirm the 1.0707 level as support, a throwback towards it is to be expected. After it is validated as support, the bulls could push the price towards 1.0826. But if they are not able to overshoot the high of the still open daily candle, then 1.0707 may not be that supportive anymore, allowing the price to go to 1.0631. This outcome is also possible if the initial throwback does not find support at 1.0707.

Short-term perspective

The appreciation that started from the 1.0565 low almost touched the 1.0778 intermediary level. If with or without a throwback towards 1.0741, the price will validate 1.0778 as support, then the bulls can reach the 1.0820 firm level (not highlighted on the chart).

On the other hand, if 1.0741 becomes resistance, then the price could once more visit the double support etched by the ascending trendline and the 1.0681 intermediary level.

Levels to keep an eye on:

D1: 1.0707 1.0826 1.0631

H4: 1.0741 1.0778 1.0820 1.0681

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment