The most ‘visible’ effect of the coronavirus on cryptocurrency markets has undoubtedly been the major fluctuations in crypto prices, particularly Bitcoin’s.

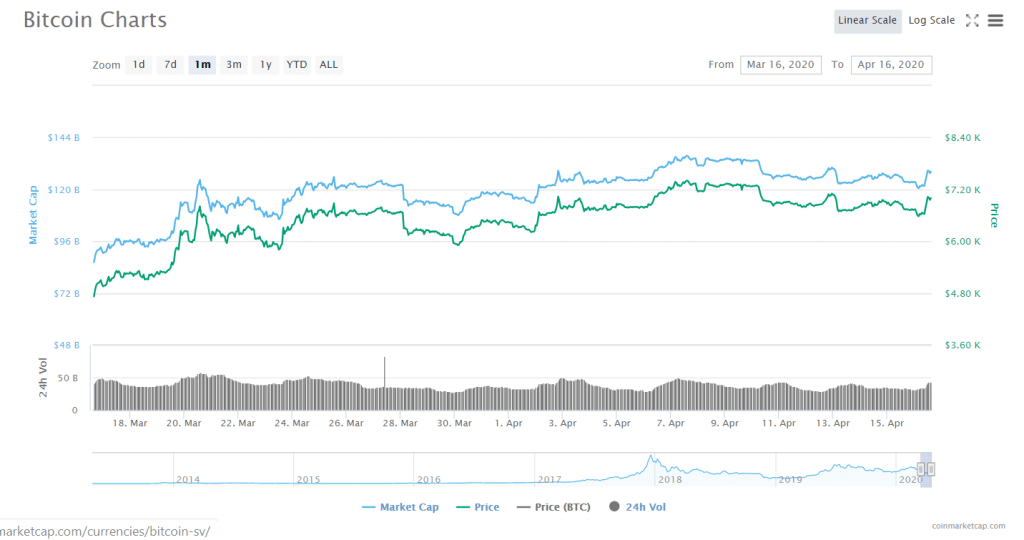

Indeed, after several weeks of hovering between in the $8,000-$10,5000 range Bitcoin plummeted from roughly $8,000 to nearly $4,000 before recovering to about $6,100. Since April 1st, the price of Bitcoin has floated between $6,900 and $7,300. The fluctuations in price caused the discussion around Bitcoin’s status as a ‘safe haven’ asset to change considerably.

Beyond the price, however, the coronavirus has also brought several other important, albeit less ‘visible’, changes to the cryptocurrency industry.

“Fraudsters are leveraging increased fear and uncertainty during the COVID-19.”

Perhaps the most urgent–and the most problematic–of these changes is the

Indeed, earlier this week, the United States’ Federal Bureau of Investigations warned that fraudsters are on the verge of unleashing a huge wave of cryptocurrency scams related to the coronavirus.

“Fraudsters are leveraging increased fear and uncertainty during the COVID-19 pandemic to steal your money and launder it through the complex cryptocurrency ecosystem,” a from the FBI said, adding that the intended victims of the scams are “people of all ages, including the elderly.”

The announcement also said that “many traditional financial crimes and money laundering schemes are now orchestrated via cryptocurrency,” specifically mentioning several kinds of scams that it anticipates to become increasingly popular in the wake of the coronavirus, including “work from home scams”, “blackmail attempts”, and “investment scams”.

A “perfect storm” for crypto scammers

Why are these scams so prevalent at this particular moment in time? In a way, the outbreak of the coronavirus has created a sort of “perfect storm” for scammers: a world-wide sense of fear and anxiety (causing panic-buying and investing), a wave of altruism (inspiring charitable actions), and billions of dollars in stimulus package cash (cha-ching).

Indeed, “while governments are rapidly deploying massive amounts of capital to mitigate the health and economic impacts of the novel coronavirus, bad actors are taking advantage of the resulting lack of oversight and a sense of urgency,” said John Jefferies, Chief Financial Analyst at cybersecurity firm , in an email to Finance Magnates.

For example, “some established dark market vendors have transitioned from selling their traditional illicit products to masks and drugs such as chloroquine that claim to cure the COVID-19,” Jefferies explained.

“Additionally, scammers and fraudsters are benefiting from fear created by the health crisis selling non-existent treatments such as vaccines and life-saving drugs to unaware consumers. According to the FTC, bad actors have made off with almost $13 million from such coronavirus-related scams in the United States alone.”

Other fraudsters are taking advantage of corona-related altruism

Additionally, there are a number of fraudsters posing as charitable organizations that are allegedly collecting money for individuals and communities affected by the coronavirus. For example, Chester Wisniewski, security researcher at Sophos, tweeted a phishing email impersonating the World Health Organization (WHO) in mid-March.

The scammers impersonating the COVID-19 Solidarity Response Fund are evolving. First samples seen on 16 March and have put a bit more spit and polish on the 18 March run. Please donate to the real fund here:

— Chester Wisniewski (@chetwisniewski)

Some scams are also soliciting their “customers” into “paying for non-existent treatments or equipment” related to the coronavirus, or to invest in companies that produce medical equipment that could be used to treat coronavirus.

CoinDesk posted one such example of this last kind of scam earlier this week: “our company is a major producer and global supplier of COVID-19 safety and treatment products,” the email says, inviting the reader to either purchase the supplies at a discounted price or to act as an affiliate with a 25 percent sales commission.

“We are just looking for a good opportunity to market our product and at the same time save the lives of people across the world,” the email reads.

Ponzi schemes and other large scams are making off with less capital–but not for the reason you may think

Despite the surge in corona-related scams, however, the virus seems to have had a bit of a silver lining (when it comes to fraud, at least): research from blockchain analytics firm Chainalysis showed that “Covid-19 has wiped out 33% of cryptocurrency scammers’ revenue” (albeit, however, this is “not the whole story.”)

Indeed, “data shows that cryptocurrency scams overall are making less than ever since early March, when the Covid-19 crisis intensified in the western world,” the report explained.

According to Chainalysis, the reasons for the losses have to do with the fact that large ponzi schemes and investment scams lost quite a bit of their potency

“Ponzi schemes and investment scams take in much more than all other cryptocurrency scam types,” the report said. “Together, they received 95% of all funds sent to cryptocurrency scams in 2019.”

However, the fact that these large schemes are raking in less cash is likely not because the virus has made crypto holders wiser and more skeptical; after all, Chainalysis found that “until this past week, the number of individual transfers to Ponzi schemes and investment scams remained consistent, suggesting they reached the same number of victims.”

“However, the weekly total value received by those scams fell, suggesting those victims were sending less value per transfer,” the report said.

Cryptocurrency is simply worth less at this particular moment in time

In other words, people involved in crypto trading and investing are likely spending less on schemes: this could be because they either have less capital than usual (due to the market crash), or because they are too spooked from the crash to be sending out as much money as they normally would; however, Chainalysis believes that still another explanation is more likely.

In fact, “digging deeper, we find that the loss of value is caused almost entirely by cryptocurrency price drops,” Chainalsysis said. “Most of these scams have received the same or more value per day in their native coins since the crisis intensified in early March.”

Covid-19 has reduced revenue for the biggest cryptocurrency scammers, but given others a new narrative to fool victims with. We dig into the data and assess the threat in our latest blog.

— Chainalysis (@chainalysis)

In other words, the same number of scam victims are sending the same decimal amounts of cryptocurrencies–but their coins are simply worth less.

“We believe scammers are still receiving those same payments from roughly the same number of victims per month. The payments are just worth less now due to cryptocurrency price drops,” the report explained.

Crypto scammers are feeling the same pains that the rest of the industry is enduring

Therefore, it follows that fraudsters aren’t the only ones feeling the sting of the economic crisis that the coronavirus has brought on the entire world. A number of legitimate crypto companies have also reportedly had to lay off their employees due to corona-related economic losses.

Indeed, citing a “100% user-generated” list of companies on recruiting site Candor, NewsBTC reported earlier this week that “Bitcoin.com, crypto mining firm Bitfarms, and mining hardware manufacturer Bitfury are among the firms in this industry that have begun to lay off staff over the past few weeks.”

In addition, Factom, which was founded in 2014, has gone into liquidation–this, in spite of millions of dollars worth of funding over the past five years and a grant from the U.S. Energy Department.

Additionally, the coronavirus has also put a bit of a damper on fundraising efforts in the crypto and fintech space more broadly. Specifically, multinational professional services firm that “the global headwinds caused by the coronavirus and other related events are having an impact on many industries globally, including the crypto industry,” in a report earlier this month.

“We believe that the crypto industry is not immune to these conditions and the number and value of fundraising and M&A deals may be impacted as a consequence in 2020.”

Fraud-prevention fintech solutions could ‘save the day’, if they are used effectively

However, changes in other parts of the global financial landscape could mean that we will emerge from the coronavirus quarantine with less instances of fraud than before.

However, it’s also true that in addition to the opportunity for SBA loan facilitation, fintech firms have an opportunity to meet the needs of the financial industry in other ways–including an increased need for fraud prevention.

Indeed, “the increased threat of fraud must be addressed,” said Brian Drozdowicz, Manager of Customer Acquisition & Growth Solutions at Bottomline Technologies, in an email to Finance Magnates.

Indeed, “FinTech has streamlined our ability to order goods online, reduced financial fraud, optimized the speed of home deliveries, and has been a literal safety net for millions of people,” said Monica Eaton-Cardone, owner, co-founder and COO of Chargebacks911. “Without this technology, we wouldn’t be able to weather the storm nearly as well as we have.”

Hopefully, at the end of this all, the crypto industry will be able to say the same thing.

What are your thoughts on the way that the coronavirus has affected the evolution of fraud in the cryptosphere or any other aspect of the crypto industry? Let us know in the comments below.

Be First to Comment