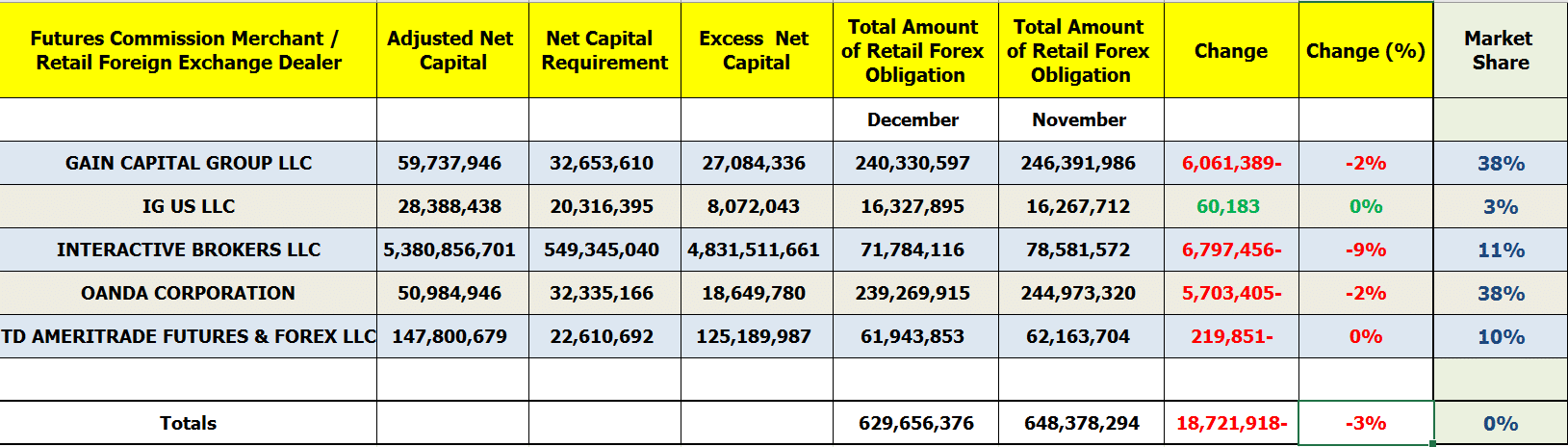

Data from the US securities regulator for December shows that has lost nearly $6.8 million, or nine percent on a monthly basis, in retail forex deposits. Overall, the CFTC’s monthly report shows that the balances of US retail traders have been largely skewed lower during December 2019.

According to the agency, the FX funds held at registered brokerages operating in the United States, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, came in at $629 million in December 2019, which is three percent lower month-over-month compared with the $648 million reported in .

Meanwhile, also dropped by $6.0 million, or nearly two percent from a month earlier. However, the largest FX broker in the United States remained the leader in terms of market share, with $246 million in retail deposits and a 38 percent share, unchanged from the November ranking.

Market share distribution unchanged

Further, retail deposits at fell $5.7 million in December 2019. The leader in corporate FX solutions also maintained its stance as the second largest in the US with $244 million in deposits and 38.0 percent market share, the same chunk as of last month. , a broker-dealer subsidiary of TD Ameritrade Holding Corporation, saw a muted change across its clients’ assets, which lost -$220,000 the previous month.

Only one of the five FX firms listed notched a slight increase in Retail Forex Obligations, namely IG US, which boosted its client’s assets to $16.32 million in December, up from $16.26 million in the month prior. This figure was also five times bigger than the $3.5 million it collected when the company re-launched its operations back in June.

Looking at the market share of other brokers, Interactive Brokers and TD Ameritrade retained a 11 and 10 percent share, respectively, while acquired three percent share. IG US has been slowly but surely clawing market share from traditional big players, with the growth of its slice is readily apparent.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on December 31, 2019 – for purposes of comparison, the figures have been included against their November 2019 counterparts to illustrate disparities.

Be First to Comment