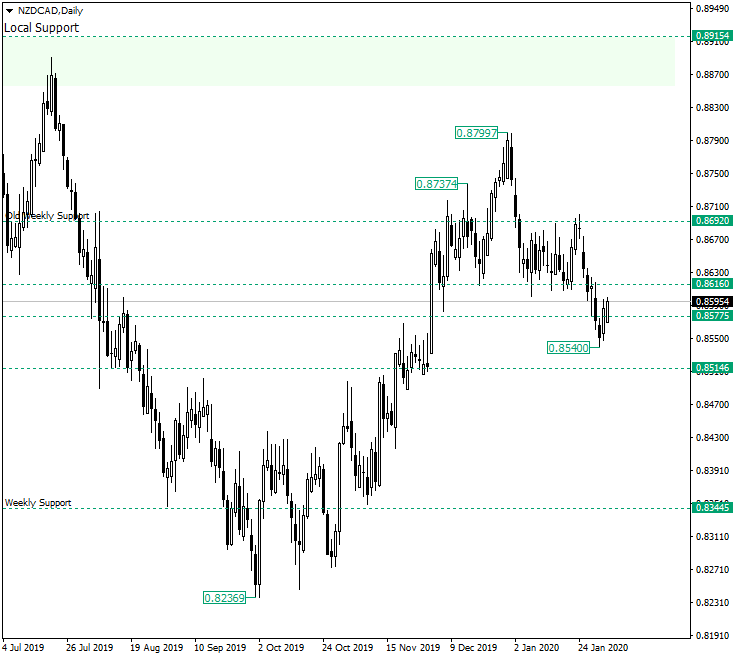

The New Zealand dollar versus the Canadian dollar currency made its first step towards what may very well be the first target, 0.8540 respectively.

Long-term perspective

The ascending movement that began after printing the low of 0.8236 tried to reconquer the old weekly support of 0.8692.

But the bulls did not succeed in this endeavor, as the only thing they were able to do was to etch the high of 0.8799, which ended up to be the head of a head and shoulders pattern.

From the high, the price retraced to 0.8616, a level that played the role of support and at the same time as the patter’s neck-line.

From 0.8616, any appreciation attempts were limited by 0.8692. As a result, at the end of January, the support gave way, allowing an extension to 0.8540.

From 0.8540 the price started what seems to be a throwback. In other words, this appreciation seeks a resistance to confirm it and continue the movement towards the south.

Such resistance can be found in 0.8616, as usually the neck-line after it is pierced is confirmed by the price which then springs in the direction of the piercing.

So, the bears are expected to confirm 0.8616 as resistance and continue the depreciation towards the main target, 0.8514 respectively.

Only if the bulls manage to reconquer 0.8616, then this bearish profile could get canceled and the price may aim for 0.8692.

Short-term perspective

The price consolidated just above the support represented by the psychological level of 0.8600. But the last day of January facilitated a movement that ended up as a piercing of the support.

The price had not yet touched the next support level — 0.8516 — but seems to be willing to firstly confirm the pierced level as resistance before going any further.

So, if the bears manage to confirm 0.8600 as resistance, then 0.8516 is to be paid a visit.

But just as in the case of the long-term perspective, if the bulls are able to bring the price back above 0.8600, then a new appreciation may sparkle, one that would target 0.8667

Levels to keep an eye on:

D1: 0.8616 0.8514 0.8692

H4: 0.8600 0.8516 0.8667

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment