Though many believed that the day would never come, Brexit is now less than a month away after being approved by the UK’s parliament last month–and though, as the Wall Street Journal reported, “the U.K. will keep its practical ties to the EU until at least the end of 2020,” preparations are already underway across the board.

While the change may not have an acute effect on firms that operate internally within the UK, UK-based companies that operate internationally are currently seeking pathways to continue their business operations without a hitch–and it really doesn’t get any more international than crypto.

Vlad Miller, chief executive officer of the Ethereum Express Company, which describes itself as the ‘world’s first community-driven ecosystem on the blockchain’ told Finance Magnates that cryptocurrency, as part of the UK’s fintech industry (allegedly one of the fastest-growing UK sectors), “may face some problems after Britain leaves the EU.”

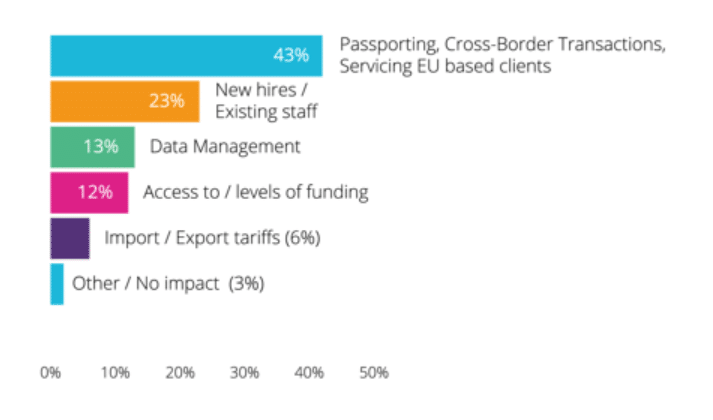

Specifically, Miller cited a September study entitled the , which showed that 43 percent of respondents–who were members of the UK’s “FinTech community”–believe that “passporting, cross border transactions, and servicing EU clients will be the areas most affected by Brexit.”

23 percent of respondents “would appreciate additional information from the government about trade.”

Therefore, while it can be argued that the fintech sector–and the cryptocurrency sector more specifically–are fairly fast-moving and agile industries, Brexit will bring challenges, many of them unknown.

However, with less than a month until Brexit’s scheduled commencement, how are UK- and EU-based cryptocurrency companies preparing for the split? How could Brexit affect crypto companies’ internal and external operations? And where will the split be felt most acutely?

Customer interactions with crypto companies affected by Brexit likely won’t change very much

Danial Daychopan, chief executive officer of UK-based crypto finance company Plutus, said that he believes that the primary impact of Brexit on crypto companies will likely affect a company’s internal operations rather than its interactions with customers.

And indeed, Daychopan sees Brexit as an opportunity: “FinTech companies that are flexible in offering financial services for both sides of the English Channel actually have great potential to thrive,” he said, adding that for companies like his own, “the ability to conveniently exchange between currencies or interact with cross-border cryptocurrencies will prove hugely beneficial for consumers.”

A €340 invoice paid via wire transfer to Europe took 24 hours and cost £31.20 in FX & fees. A larger invoice using crypto to a service provider in Europe arrived in minutes and it cost fraction of a cent.

Still worried about Brexit?

— Danial Daychopan (@DDhopn)

Ollie Smith, chief executive officer of Card Accounts, a UK-based payment service reviewing company, echoed Daychopan’s sentiments: “in my opinion, Brexit will have little impact on crypto-payments for British and European Union customers…as most transactions will continue to be processed as SEPA payments, there should be little disruption to trading volumes between Britain and EU states.”

Banking and regulatory issues could be exacerbated by the split

However, at the same time, Danial Daychopan pointed out that “banking has always been an issue for crypto companies in the UK and in Europe, especially those who operate a multi-currency platform; hurdles are expected for them;” in other words, banking problems that existed for crypto companies pre-Brexit could be exacerbated by post-Brexit regulations.

To avoid possible complications, companies that wish to continue operating in both the UK and the EU may have to take steps to ensure that adequate regulatory requirements are met.

Vlad Miller told Finance Magnates that for some UK-based companies, staying operational in the European Union may mean “[transferring] or [opening] offices in European countries, as well as to [obtaining] a license in order to carry out financial activities in this economic zone,” particularly if those companies happen to be exchanges, or happen to partake in “crowdfunding and other activities that involve money transactions.”

Indeed, there have already been reports of certain UK-based crypto companies pre-emptively establishing offices in the EU as a preparatory move for Brexit. Reuters reported that cryptocurrency exchange Coinbase, which is headquartered in the United States and has offices in the UK, , Ireland to prepare for Brexit all the way back in October of 2018.

At the time, Reuters wrote that Coinbase was “joining the growing ranks of banks and financial firms with major British businesses developing European Union outposts as Britain’s exit from the bloc looms.”

UK-based companies must stay abreast of changing regulations abroad, but could find themselves in a more flexible regulatory environment at home

Additionally, Miller pointed out that “there is some uncertainty about user data protection and potential restrictions that may apply to data transferred from the EU to the UK as a result of the fact that the UK will no longer be part of the GDPR regime.”

Therefore, “organizations must keep abreast of recent developments and consult with law companies to avoid unpleasant incidents.”

On the other hand, however, it’s possible that cryptocurrency companies could find themselves in a more relaxed regulatory situation within the UK after the split.

In Danial Daychopan’s eyes, “the UK has always recognised the importance of FinTech and thankfully encouraged innovation within this sector. By decoupling from the EU, we may find the government is able to implement more lenient laws and regulations that allow crypto companies to thrive. It will be far easier for the UK to pass through new policies if it is irrespective of European discussions.”

Possible opportunities could arise for crypto companies as a result of Brexit

And there could be other positives for crypto companies that come about as a result of Brexit–Ollie Smith sees the split as a possible opportunity for increased usage of cryptocurrency as a method of cross-border finance: “as a consequence, customers could increasingly use [cryptocurrency] to move money internationally, in place of the traditional banking system,” he explained. “Therefore, instead of harming crypto trading Brexit could actually create a crypto-boom.”

Vlad Miller also pointed out the fact that according to the Bank of England, “Bitcoin and other cryptocurrencies are now freely used in the UK, as they do not pose a significant risk to the monetary or financial stability of the United Kingdom.”

As such, “Britain’s exit from the EU could allow a small island country to become even more flexible in terms of regulating these new technologies and promoting innovation.”

“Since the UK government will lose a significant amount of tax revenue from the traditional banking sector due to the move of financial institutions to continental Europe, it is possible that the government will want to make more efforts to develop technologies, in particular, cryptocurrency and blockchain.”

A dubious future

However, where there is opportunity, there is risk–just as the UK government may take a more flexible approach toward regulating crypto, it could crack down on the industry.

Ray Walsh, digital technology and privacy expert at ProPrivacy, told Finance Magnates that this uncertainty may eventually cause some UK-based startups to move their headquarters abroad.

“The City of London is the UK’s primary business district, and has traditionally been the world’s leading financial hub; far outweighing Wall Street in importance. However, unless the UK’s financial nerve center can hold on to innovative FinTech startups, it runs the risk of slowly beginning to lose its status.”

Will Brexit cause crypto to be seen as a risk-off asset in the UK and the EU?

For many members of the crypto community, however, whether Brexit is good or bad for crypto companies is beside the point–it’s the effect on the markets themselves that

Why? A number of analysts agree that the de-stabilizing effect that Brexit could have on both the British pound and the euro could bring more money into crypto.

Vlad Miller explained that “investors and funds can switch to cryptocurrencies, as we have already seen more than once on the example of, and , experiencing economic changes. Cryptocurrency is similar to gold in terms of protection against economic crisis, and during a period of financial uncertainty, the population turns to such assets.”

According to some, this has already begun to happen–on December 19th of last year, Xen Baynham-Herd — executive vice president of product at Blockchain — Cointelegraph that with Brexit looming, the exchange has seen a record number of first-time deposits from U.K. users.

“Bitcoin, despite being virtual, is the world’s hardest asset,” he said. “Throughout history, savvy investors have relied on hard assets (like gold) to manage risk and protect long-term value in the face of instability and economic downturns.”

What are your predictions for crypto as Brexit continues to approach? How has your company been preparing for Brexit? Let us know in the comments below.

Be First to Comment