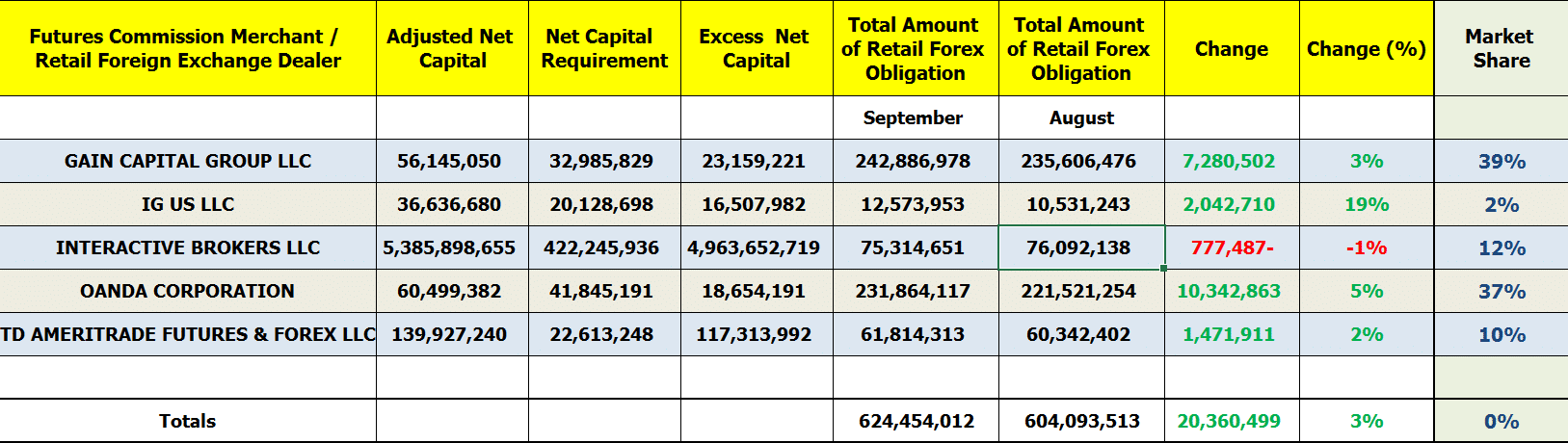

The newest comer to the US FX industry, IG US, continues to take a bigger chunk of the overall retail funds, after racking up $12.57 in customer deposits in September 2019. This figure is higher by 20 percent from and was also three times bigger than the $3.5 million it collected when the company re-launched its operations back in June.

IG US is starting to take market share away from traditional big players, but the US subsidiary of the London-based spread better still has a long way to challenge the likes of and Oanda, which command nearly 80 percent of the US retail market.

Overall, the CFTC’s latest monthly report shows that balances of US retail traders have skewed slightly higher during the reported period.

According to the agency, the FX funds held at registered brokerages operating in the United States, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, came in at $624 million in September 2019, which is a mild increase of three percent month-over-month compared with the $604. million reported in August 2019.

Interactive Brokers loses one third of retail deposits

GAIN Capital’s clients’ funds grew by $7.2 million, or nearly three percent month-over-month. Further, retail deposits at TD Ameritrade also rose by nearly $1.47 million in September, while OANDA was the best performer, having added more than $10.3 million in the same month.

lost nearly $777,000 in retail forex deposits, or less than one percent compared to the figure of August which stood at $76 million.

The Connecticut-based company was the worst performer over the last two months after recording an overall drop in FX traders’ deposits by nearly 30 percent, which surpassed $100 million for the first time in June 2019.

Be First to Comment