The relationship between the cryptosphere and the United States Securities and Exchange Commission has been growing both closer and more tenuous over the last several years. For better or for worse, the cryptocurrency industry has been increasingly shaped by the SEC’s actions and rulings within the space.

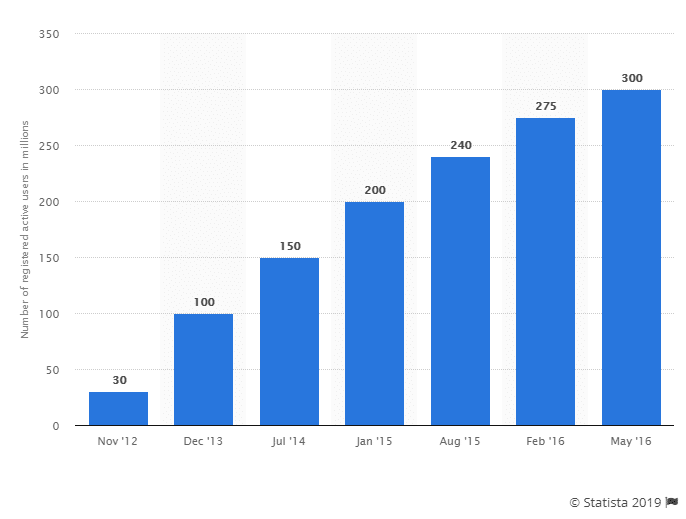

Perhaps the most prominent example of this at the moment is Kik, a messaging app that has 300 million active users around the world, announced last week that it would be shutting down on October 19th–nine years to the day after the first message was sent on its platform. Instead of operating as a messaging platform, and “converting Kin users into Kin buyers.” If the company is successful at convering users into buyers, the ecosystem would 100 million more users than Telegram’s cryptocurrency ecosystem . (Telegram, another messaging service last year; its token in the next few weeks. At press time, it had roughly 200 million users.

How did we get to this point? And what does this case mean for the industry?

What happened?

Kik’s and was marketed as a tradable token within the Kik ecosystem: users could send KIN tokens to each other, and developers could build applications on top of. At press time, the KIN website said that “built to scale for mass usage and supports an Ecosystem-wide digital economy where app developers and mainstream consumers make millions of micro-transactions.” $55 million of the roughly $100 million raised during the sale is said to have come from US citizens.

A beta version of the Kin cryptocurrency wallet, called Kinit, was launched in July of last year. At the time it was launched, the app’s Google Play Store description said that “Kinit is a fun, easy way to earn Kin, a new cryptocurrency made for your digital life. Earning Kin is just like playing a game, only better, because you get rewarded for completing fun daily activities like surveys, quizzes, interactive videos and more.”

In May of this year, when talks with the SEC seemed to be leading toward a legal battle, Kik announced that it would be setting $5 million aside for “Defend Crypto”, a fund that was specifically dedicated to fighting Kik’s court battle as well as other legal battles that crypto companies were fighting against the SEC.

Venture capitalist Fred Wilson was counted amongst the fund’s backers.

“It is my hope that DefendCrypto will be an inspiration for the many other important crypto projects that are silently battling with the SEC to come public and raise capital from the crypto sector to fund these efforts.”

— Fred Wilson (@fredwilson)

Then, in June, the lawsuit came: a statement on Defend Crypto’s website at the time read that ‘“after months of trying to find a reasonable solution, Kin has been unable to reach a settlement that wouldn’t severely impact the Kin project and everyone in the space. So Kin is going to take on the SEC in court to make sure there is a foundation for innovation going forward.”

The firm seemed to be aware of the fact that the results of the battle with the SEC could set important precedents: Kik said that it wanted not only to fight for its own future, but also “to fight this out on behalf of the industry.”

The language in the lawsuit was unusually slanderous

So, exactly what had Kik done wrong in the SEC’s eyes? Essentially, the The SEC alleged that the company should have registered KIN tokens as securities before the sale was conducted.

In my view, among other things, Paragraph 91 of the ‘s against is notable. It appears to make clear the view that, not only was the Kik SAFT a security, but so were the underlying Kin tokens sold pursuant to the SAFT.

— Joshua Ashley Klayman (@josh_blockchain)

However, the lawsuit also included details that seemed to have no other purpose besides painting Kik as a desperate, money-hungry company that turned to an ICO as a last resort.

“In late 2016 and early 2017, Kik faced a crisis. Fewer and fewer people were using Kik Messenger,” the lawsuit reads. “The company expected to run out of cash to fund its operations by the end of 2017, but its revenues were insignificant, and executives had no realistic plan to increase revenues through its existing operations. In late 2016 and early 2017, Kik hired an investment bank to try to sell itself to a larger technology company, but no one was interested.

One of those times when the “it’s better to seek forgiveness than to ask for permission” advice didn’t work.

— Ketharaman Swaminathan (@s_ketharaman)

So, said the SEC, “Kik decided to ‘pivot’ to an entirely different business and attempt what a board member called a ‘hail Mary pass’: “Kik would offer and sell one trillion digital tokens in return for cash to fund company operations and a speculative new Venture.”

The SEC noted in particular that “ Kik described Kin as an opportunity for both Kik and early Kin investors to ‘make a ton of money’”–which is the reason that the SEC claims that KIN tokens were unregistered securities rather than stable-value security tokens.

“By selling $100 million in securities without registering the offers or sales, we allege that Kik deprived investors of information to which they were legally entitled, and prevented investors from making informed investment decisions,” said Steven Peikin, co-director of the SEC’s Division of Enforcement, in an official statement. “Companies do not face a binary choice between innovation and compliance with the federal securities laws.”

Word of caution to anyone who hasn’t been involved in litigation before: the complaint *always* evokes a feeling of “ooo this is bad.”

Without further comment, here’s the complaint against wrt token sale:

— Sarah Hody (@SHodyEsq)

Kik’s response was equally as firey: “the Commission’s Complaint reflects a consistent effort to twist the facts”

Of course, against these allegations and against the accusations that the company had decided to hold an ICO as a last-ditch attempt to save itself.

In Kik’s counter-filing to the SEC’s lawsuit, the company wrote that “the Commission’s Complaint reflects a consistent effort to twist the facts by removing quotes from their context and misrepresenting the documents and testimony that the Commission gathered in its investigation.”

Shortly after the counter-filing went public, Tanner Philp, the technical adviser to Kik’s CEO, told Finance Magnates that “the introduction to our answer highlighted just how misleading the SEC was in their complaint. They repeatedly twisted facts, presumably to make up for a weak case.”

“What resulted [from Kik] was a 131-page document going point by point to share the full context and let the facts speak for themselves. Given how important this is for the industry, we felt it was important that anyone reading the answer understood just how far the SEC will go to support their agenda instead of focusing on what is important: the facts and circumstances of the case.”

But Jay Arcata, VP of client operations at BX3 Capital, told Finance Magnates that the frankness of Kik’s response “is a tactic in which we do not typically see defendants engage.”

What does this mean?

If the decision to hold an ICO in the first place was a “hail-mary pass”, the company’s Kik’s latest choice to focusing entirely on blockchain and cryptocurrency could be considered as the ultimate “hold-my-beer” move: a company that is so committed to calling the SEC’s bluff that it is willing to sacrifice anything, including the well-being and livelihoods of its own employees.

But in another light, the company’s latest choice could be seen as the smartest way to move forward and to maintain its integrity: to scale down into a light, agile entity that may be able to scale up into a larger company again once the storm with the SEC is over.

Either way, the cryptocurrency industry as a whole–as well as Kik itself–does certainly seem to have something at stake here: whether the company succeeds in turning itself around or dying in the process, important legal precedents will be formed.

Setting precedents

Marc Boiron, partner at FisherBroyles, told Decrypt tha specifically, Kik’s case could set standards for any company that is thinking of holding an ICO: “Kik’s downfall makes it clear that the risks associated with an ICO are significant enough to threaten the existence of a business,” he said. As such, companies that are currently holding ICOs should take heed: “an existing ICO should objectively look at its situation and seek advice from legal counsel.”

If not, they may run the risk of falling victim to a similar fate: “in the end, this means that most ICO-funded startups, especially those who did their ICOs when crypto prices were at all-time highs, are likely to shut down similar to Kik.”

But on a larger scale, the SEC may have to revisit some of its past decisions: “strictly as a legal matter, there is no difference between the 2014 Ethereum crowdsale and an ICO-funded startup,” Boiron said. “However, the SEC has decided to treat them differently based on the lack of clarity regarding the securities laws as applied to Ethereum’s crowdsale in 2014 relative to the clarity the SEC believes it creates with the DAO Report in mid-2017.”

The best outcome for the in the vs case is the SEC has to explain why ETH or even EOS for that matter isn’t a security under US law and KIN is. Otherwise I think it’s going to be a major step back for the US and to a smaller degree the industry generally

— Jamie Burke (@jamie247)

In any case, Livingston believes that the most dangerous precedent of all would be to give up the fight. “Becoming a security would kill the usability of any cryptocurrency and set a dangerous precedent for the industry,” Livingston wrote in the blog post announcing the restructuring. “So with the SEC working to characterize almost all cryptocurrencies as securities we made the decision to step forward and fight.”

Be First to Comment