The number of deposits made by retail FX traders in the United States, which had grown slightly over the past few months, has cooled off in August as the summer’s low volatility and prolonged strict regulations dampened enthusiasm.

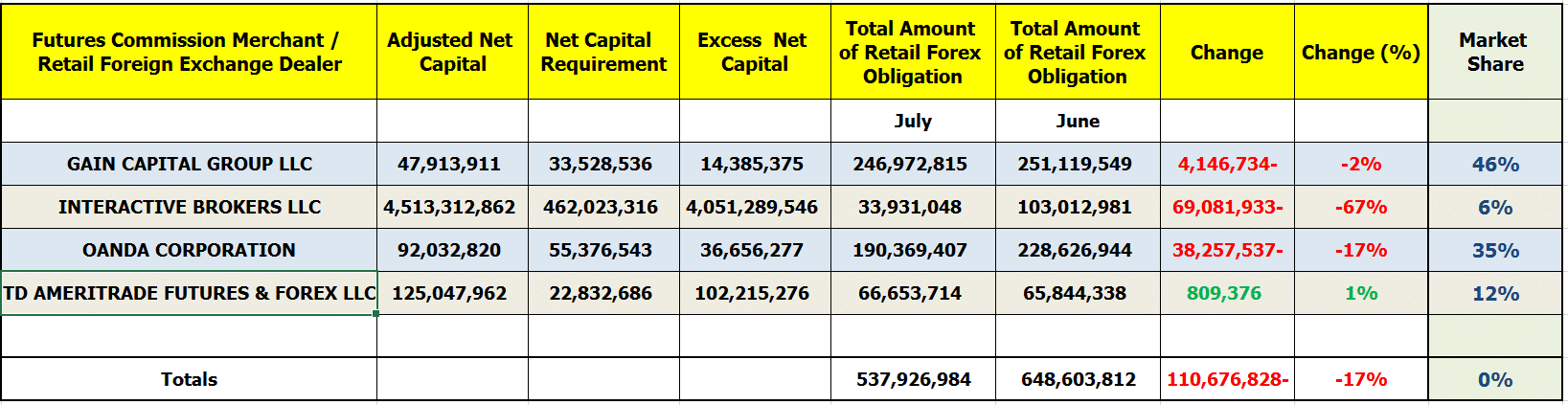

According to the CFTC’s monthly report, the FX funds held at brokerages operating in the country, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, came in at $537.9 million. This figure is $110 million or -17 percent lower than the $648.6 million reported in July.

Data from the US securities regulator also showed that lost nearly $70 million in retail forex deposits. The company’s loss was also the biggest on a percentage basis, as the broker lost more than 67 percent of its clients’ deposits.

The Connecticut-based company was the best performer over the last two months after recording an overall rise of nearly 30 percent. The largest , as measured by DARTs, has also managed to overtake TD Ameritrade as the US third-largest holder of retail FX funds.

Only one of the four FX firms listed notched increases in Retail Forex Obligations, which was this time .

Meanwhile, GAIN Capital saw a drop of $4.1 million, or nearly two percent month-over-month. Further, retail funds at OANDA Corporation slumped by nearly $38 million or -17 percent in August.

Looking at the market share of different brokers, distribution changed in August relative to the month prior. GAIN Capital remained the leader in terms of market share, commanding a 46 percent share, up from less than 40 percent in July. OANDA also solidified its stance as the second largest in the US with 35 percent market share – TD Ameritrade and Interactive Brokers retain a 12 and six percent share respectively.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending in August 31, 2019 – for purposes of comparison, the figures have been included against their July 2019 counterparts to illustrate disparities.

Be First to Comment