Although May is often a month in which investors already start to think about summer vacation, this year, their trading activity remained very high. May data from revealed by , shows a growing trading trend.

As in months prior, the most active traders in May were found in China. On average they performed 170.2 transactions per month. While the size of these transactions is not known to us, the number of transactions has been constantly growing for the past 12 months – as it has in the rest of the world.

This trend becomes especially clear when looking at the average number of transactions, as presented in our chart. Interestingly, although the lowest registered activity among the top 10 most active countries (in the lower line) is growing, it is getting closer to the highest activity represented by the upper line.

We are either observing real global growth of activity among retail traders – or something else. It is possible that traders are trading more, but that the size of transactions is lower due to increased regulatory pressure on leverage by ESMA.

Growing first-time deposits

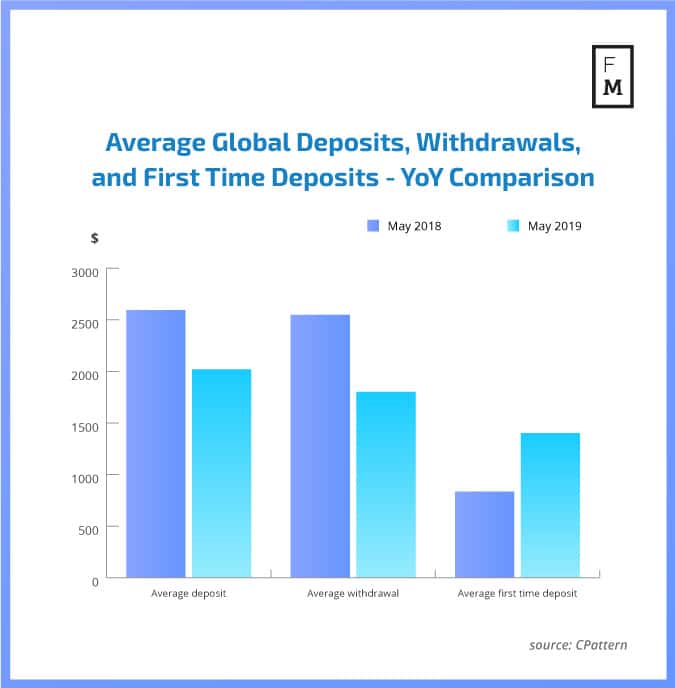

Compared to the year prior, May brought smaller deposits and withdrawals. On average, retail traders sent $2,019.3 per one funding to their account, compared to $2,593.2 a year ago. The average withdrawal was equal to $1,802.2, much lower than the $2,548.2 seen last year.

Contrary to both of these indicators, the size of the average first time deposit (FTD) was higher this year, coming in at $1,401.4 – far more than the $833.8 seen in May of 2018. Could this be a sign of better things to come in June?

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, cryptocurrencies, Forex, and CFDs trading.

For this reason, the Department has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts, that will serve as a valuable knowledge base for your decision making.

Be First to Comment