More than a year has passed in between the time that the Intercontinental Exchange (ICE) announced that it would be launching Bakkt, its new bitcoin futures exchange and digital assets platform.

A lot has changed over the course of that year. Bitcoin prices, and then recovered remarkably; , and a number of new players entered it. Additionally, regulators in the US and elsewhere have placed an unprecedented amount of attention on the cryptocurrency industry.

As such, Bakkt is entering a rather different industry than it would have been if it was launched in November of 2018, when it was originally expected to go live. When the platform was originally announced, a number of analysts and the cryptocurrency industry as a whole.

But now–a year later–how could Bakkt’s possible impact on cryptocurrency markets have changed?

Why was the Bakkt launch delayed in the first place?

When the launch of the Bakkt platform was originally announced on August 3rd of 2018, futures contracts were expected to be available in November of the same year–subject to CFTC approval, of course.:

“These regulated venues will establish new protocols for managing the specific security and settlement requirements of digital currencies,” the announcement proclaimed.

However, when November arrived, the approval from the CFTC that was needed in order for the platform to move forward had not yet come. Instead, and , explaining that “the new listing timeframe will provide additional time for customer and clearing member onboarding prior to the start of trading and warehousing of the new contract.”

But January came and went. Then, in March, “people familiar with the matter” that the CFTC had concerns over Bakkt’s custody practices. The regulator told ICE that if Bakkt planned to keep custody of its users assets, additional steps would need to be taken in order to adequately comply with the law.

Specifically, the CFTC would “require disclosures of the venture’s business plan and a public comment period, which would have further delayed approval.” At the time, a spokesperson for ICE told the Wall Street Journal that “we are working through the regulatory review process and are looking forward to updating the market soon.”

Price movements: then, now, and (possibly) soon to come

So when the official launch of the Bakkt platform was finally announced more than a year after the project was originally unveiled, plenty of time had passed for anticipation to build.

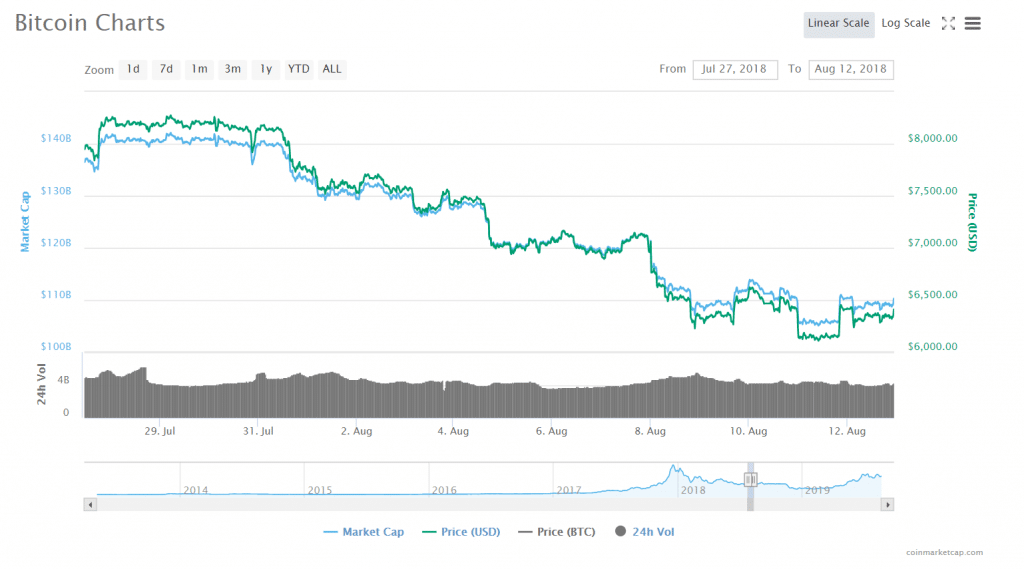

This may have contributed to Bitcoin’s upward price movement in the days since the launch has passed. When the Bakkt platform was originally announced in August of 2018, BTC markets did not seem to react at all; in fact, the announcement coincided with the beginning of a long and steep decline that would eventually bring Bitcoin prices to a new yearly low.

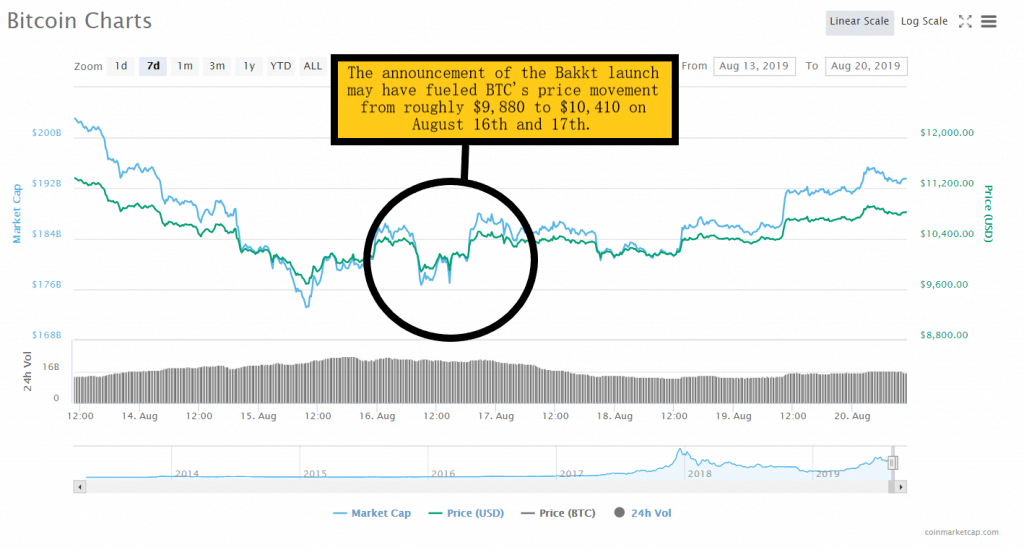

This time around, however, Bitcoin markets seem to have responded to the announcement much more positively.

On August 15th (one day before the announcement of the launch), the price of BTC dipped down to $9500–seeming to lose steam in accordance with the psychological investing phenomena known as “The Curse of 10,000”, which originated in stock trading markets roughly 15 years ago: “the market seemed to have developed a pattern—whenever the Dow reached the 10,000 level it eventually ran out of steam,” a Business Insider report.

However, when Bakkt told the world that it had gotten the go-ahead from the CFTC no August 16th, the price of Bitcoin surged nearly ten percent (from ~$9,880 to ~$10,410) within twenty-four hours. At press time (several days later), the price had climbed all the way to roughly $10,820.

Regulatory delays have become the norm in the US

While the delays in the Bakkt launch may have been frustrating for some members of the cryptocurrency community, they did not exactly come as a shock. After all, regulators–particularly within the United States–have gained a bit of a reputation for taking their time when it comes to the cryptocurrency industry, a factor that has driven some crypto companies overseas.

Take, for example, the SEC’s (the latest delay was announced). The IRS has also took several years before it decided to of its cryptocurrency reporting guidelines.

To be fair, however, regulators do seem to be working diligently on the challenges placed in front of them–it’s just that the industries they are working to keep control of are so much larger than they are.

with Finance Magnates conducted earlier this year: “the people I’ve spoken to at the SEC are incredibly bright and really, really good at their jobs, but there just aren’t enough of them….for example, if you take a regulatory body like the US SEC, they’re about 1% of the size of Goldman Sachs–and they have to regulate Goldman Sachs. That’s a big job.”

In any case, regulation in the United States moves slowly, particularly in new and relatively misunderstood industries. Indeed, “this is new territory for regulators and they are correct in taking a prudent and responsible approach,” wrote Jakob Palmstierna, Director of Investments at GSR, to Finance Magnates.

“We commend both Bakkt and the regulators for this achievement, it’s a positive development. Having more regulated products being offered by reputable institutions like Bakkt helps move crypto towards becoming a legitimate asset class, and hopefully will help achieve the regulatory clarity the industry needs.”

(”Hopefully” being the key word here.)

However, Palmstierna added that “I think it’s too early to celebrate any widespread institutional adoption just yet.”

Indeed, Kyle Asman, partner at BX3 Capital, said that in the grand scheme of things, “Bakkt’s launch doesn’t change anything in terms of compliance issues.”

“I think that we are still a long way away from [the kind of] full regulation that will give comfort to institutional investors.”

Ilan Sterk, VP of Trading at Orbs Group and VP of Business Development at Alef Bit Technologies, echoed this sentiment, adding that “I think that we are still a long way away from [the kind of] full regulation that will give comfort to institutional investors.”

To demonstrate this point, Sterk noted an inconsistency between the way that US regulators treat crypto futures and crypto-based ETFs as one example of this: “the futures fall under the CFTC (US Commodity Futures Trading Commission), which has limited statutory authority. The CBOE futures were cash-settled contracts based on the Gemini’s auction price for bitcoin, denominated in U.S. dollars. Yes, the one and same Gemini whose application for ETF was rejected by the SEC on the grounds it would be too easy to manipulate BTC prices.”

“How can bitcoin futures trade on a regulated exchange where settlement price is based on Gemini exchange and while an ETF whose prices are based on those same Gemini prices be rejected?”, he asked. “Why are authorities inconsistent here?”

In other words, Sterk said, “authorities [need to provide] more transparency on what is right and what is wrong.”

“I don’t think Bakkt’s arrival will be quite as big as originally anticipated.”

As such, the Bakkt launch may not bring quite as much institutional capital that many crypto industry investors and insiders are hoping for–but many analysts agree that it is a step in the right direction.

Indeed, Kyle Asman told Finance Magnates that “I don’t think Bakkt’s arrival will be quite as big as originally anticipated.”

Sterk explained that this could be “because there were delays in the launch”–the delayed announcement “missed some of the expectations of the markets and this has impacted the [effect of BTC’s] price.”

“Although the platform brings innovation with their physical delivery settlement and the digital asset,” this won’t necessarily bring about a wave of institutional investors,” he added. “In my opinion, institutionals that have decided to have exposure to the Bitcoin [and to digital assets more gnerally] have already done this by buying Bitcoin directly via OTC brokers or exchanges, and by buying ETP’s from Grayscale or XBT Provider for example.”

Palmstierna also expressed anticipation for the effect of the Bakkt launch: “we are excited to see the Bakkt’s impact on institutional investing,” he told Finance Magnates, pointing to the platform’s $180M series A fundraising round earlier this year as a sign that institutional capital could come flowing in.

How would more money in BTC futures markets affect BTC spot markets?

If a wave of institutional investors do jump onto the Bakkt crypto futures bandwagon, however–how could this affect trading in Bitcoin spot markets and the price of Bitcoin itself?

“In general, a healthy derivative and options market is pivotal to any institutional asset class,” Palmstierna explained, “so, in that respect, [the effect] is unambiguously positive. It allows investors to go short and trade more efficiently using implied leverage, which in turn allows you to express more dynamic risk views.”

However, “when it comes to price action the result can be mixed,” Palmstierna said, pointing to the infamous crypto craze of nearly two years ago as an example: “in December 2017, the launch of futures was arguably the main factor that led the bitcoin market down after its high of $20,000.

“The price peak coincided with the day bitcoin futures started trading on the Chicago Mercantile Exchange (CME), it allowed for traders to be short bitcoin for the first time,” he said. But the opposite phenomenon can also occur: “conversely, In more recent times, we have seen the volume of futures increase when bullish sentiment returned to the market.”

The futures market has evolved since the unveiling of Bakkt one year ago

It’s also important to consider the ways that the Bitcoin futures ecosystem has grown since Bakkt originally announced its futures platform over a year ago.

Since November of 2018, CBOE–the first platform to ever launch Bitcoin futures trading–discontinued its Bitcoin futures offerings. As a result, the amount of Bitcoin futures contracts traded on rival platform CME surged.

And indeed, trading Bitcoin futures volume has risen considerably throughout the year as a whole: in July, “estimated notional value of CFTC regulated bitcoin futures (combined CME and CBOE historical values) has surged more than 270% since 1Q19, vs. a 150% increase in the price of bitcoin, “ The Block Crypto reported.

As such, a number of smaller players have entered the market, seemingly hoping to get a piece of the Bitcoin futures action: Kraken, TD Ameritrade, LedgerX, Binance, and many others are now offering BTC futures trading.

Interestingly, The Block also noted that the volume seems to be concentrated among a smaller number of high-volume investors: the same report said that “total reportable CFTC bitcoin futures traders is almost half the number of total traders a year ago (due to CBOE unwind), and sits below 50 in total; CME traders hit an all-time high last week.”

How will Bakkt stack up in the Bitcoin futures ecosystem as it stands now?

In any case, the bottom line is this: how will Bakkt fit into the Bitcoin futures landscape as it stands now? In an posted on LinkedIn, Michael Creadon wrote that although “CME is dominating in bitcoin,” Bakkt, as a subsidiary of ICE, “has what everyone in blockchain wants & needs: an established network; or ‘ecosystem’ in banal crypto parlance. They have clients, in other words.”

“All clients need to do is flip a switch and the payments rails, clearing & settlement, margins go live,” he continued. “You trade on ICE? You can launch physically-settled bitcoin futures September 23rd. And you can go short; and hedge risk…of course this will be successful; ICE doesn’t play for second place.”

Palmstierna said that, in his opinion, “it’s too early to say anything about comparable volumes.”

“I can see both contracts co-existing, but at the end of the day, most institutional investors will migrate towards the most liquid contract, regardless of the settlement method.”

Be First to Comment