“Crypto Twitter”, or CT for short, plays an incredibly important role within the industry–arguably, a far greater role than in just about any other indusry. Indeed, Twitter is the place where news breaks, where collaborations and partnerships are born, and–at times–where big egos battle.

As such, Twitter has facilitated the spread of information throughout the cryptosphere in many positive ways. Twitter has been used to quickly spread warnings about exit scams, hacked platforms, phishing sites, and other kinds of fraudulent behavior in the cryptosphere.

( occurred earlier today:)

TLDR: sale under scrutiny by China LE. Chinese Group purchased and issued a paper security offering to the public; then disappeared.

— MΞRCΞR 💯 (@Mercerado)

Indeed, “crypto is a counter-culture to the various ailments brought on by ‘rabid’ capitalism and other societal changes, and crypto twitter is a live representation of these same ‘anarchistic’ values,” wrote Orian Tal, VP of Operations at MarketAcross & InboundJunction, to Finance Magnates. MarketAcross is the crypto arm of InboundJunction, a Tel-Aviv-based PR and marketing agency with a list of clients that includes Binance, TRON, Qtum, Cardano, NEO, and various others.

“By extension, any company acting out of pure greed, negligence or abuse of user funds or data, will be dragged through the muck.”

However, by the same turn, the Twitter culture that governs the cryptosphere can have disastrous effects for companies when it comes to bad press.

”A company’s error could become the basis of a viral thread in mere minutes.”

In the same way that these legitimate warnings against scams and reports of fraudulent behavior can be easily shared, so too can disgruntled users easily spread the news of any of a company’s mis-steps.

Take, for example, Coinbase’s Neutrino debacle. Earlier this year, to improve its ability to prevent theft, investigate ransomware attacks and hacks, and detect suspicious transaction activity.

However, two executive members of Neutrino, CRO Marco Valleri and CTO Alberto Ornaghi, were previously associated with a spyware-for-hire outfit known as “Hacking Team,” an intelligence firm that aided governments in committing humanitarian crimes, including the murder of Washington Post journalist Jamal Khashoggi.

As soon as the acquisition went public, a wave of public backlash erupted on Twitter. #DeleteCoinbase, the new slogan for a movement against the San Francisco-based exchange, spread like wildfire.

Not that I’m ’s biggest customer by any stretch of the imagination, but I’m done.

I was never a fan, but this is too much. Thanks , , for bringing this to light.

Deleted my account and so should you. Share your images with .

— Udi Wertheimer (@udiWertheimer)

As such, “Crypto Twitter,’ as it’s known colloquially, raises the stakes for reputational mistakes,” said Jane Fields, Managing Director at Wachsman, the world’s largest communications firm focusing on the blockchain industry, to Finance Magnates.

“Blockchain’s competitive tribalism becomes amplified by Twitter, where a company’s supporters are often eager to seize upon a rival project’s misstep, however slight, as a way to tear down perceived competition.”

“Adding fuel to the fire, many of the most followed thought leaders in the industry are always online, chronically posting on Twitter to disseminate daily theories and predictions, so a company’s error could become the basis of a viral thread in mere minutes.”

First response

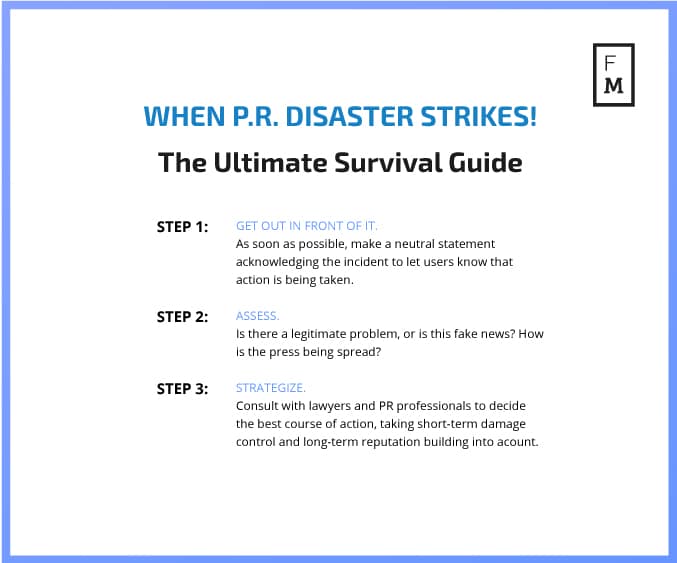

Because PR disasters can strike and grow at such an alarming rate, companies must be swift in their response. But what should that response look like?

Fields explained that a company’s first order of business should be to issue a concise statement acknowledging the problem: “in any crisis, the first response of any organization should be the issuance of a ‘holding statement.’ That single line should provide enough information to provide basic context to media and, through media, to existing and potential customers, partners, and other stakeholders, while providing sufficient room for an investigation to take place and for more thorough responses to be researched and released.”

Take, for example, the holding statement just this morning:

Don’t fall into the “KYC leak” FUD. We are investigating, will update shortly.

— CZ Binance (@cz_binance)

Tal explained that this kind of early acknowledgment of the problem is key: “being first to respond lets companies dictate the narrative rather than hoping for a reporter to tell the full story, or to wait for their comment.”

He added that this is especially important in the era of clickbait news: “by making the first move (given that the crisis, is in fact, a crisis) and coming out with a statement, a reporter, is essentially obligated to refer to it, potentially nipping at the bud misinformation and fake news.”

What next?

Once a ‘holding statement’ has been made to stem initial damage control, the real work begins.

Fields explained that after the crisis has been publicly acknowledged, “a more thorough strategic communications playbook should be formulated with input from attorneys and other company executives; this playbook would include details on the appointment of spokespersons, an approvals checklist for subsequent statements, and meticulously crafted messaging.”

“Honesty remains the best policy,” she continued. Companies that factually describe the challenges they have faced and the pathways they have taken to solve problems and assuage concerns engender public trust more quickly and more permanently. People are by nature good and can forgive a mistake; they are much less likely forgive what appears to be a coverup.”

At the same time, however, saying too much can be an issue. “It’s a delicate game of gain and loss,” Tal explained, “and certain statements can lose out one audience (or agitate it even further) and reconcile another. That’s why a short, concise comment can sometimes be the way to go.”

(Notably, was less than 400 words long:)

I wrote a post about our recent acquisition of Neutrino. These decisions aren’t easy but this is the right outcome.

— Brian Armstrong (@brian_armstrong)

Tal agreed that throughout the process, honesty and transparency are extremely important: “transparency is key, and if a company suffered reputational damage due to malpractice, employee mistake, or a hack, then a statement detailing the chain of events, and an apology, is always a good first step.”

After the crisis has been dealt with, there are steps that companies can take to prevent similar incidents in the future: “in the long term, companies can also implement online reputation management (ORM) tactics including outreach to reporters, bloggers as well as engaging in new PRs in order to retake the Google Search Results Pages with favorable mentions,” Tal said. “However, this won’t make negative mentions go away entirely.”

Indeed, companies need to be careful not to compound one disaster onto another. “In certain extreme cases, crisis can go beyond a point of no return, where no comment would ever be satisfactory,” Tal remarked.

No stone can be left unturned

But what about smaller PR incidents?

Even if a bit of bad PR is relatively ineffectual in the immediate future, Tal explained that being proactive about addressing PR problems–even small-scale issues–can make a big difference further out. “While it may not look impactful in the short-term, user sentiment and brand sentiment is a game-changer in the long-term,” he said. “Doing well, or at least trying to – is usually ROI positive, and companies in the crypto space should be wary of whom they associate themselves with.”

Indeed, “while traders and consumers directly profiting off a product or a token may not be impacted on the spot, in the long-term, certain business opportunities may be sealed off forever for reputation-damaged companies, wanting to collaborate with high-end institutions who are wary of who they get in bed with.”

And negative press can be a sticky wicket when it comes to search results–”on an SEO-level, crisis definitely stick and are there for anyone who invests in due diligence to view and to make up his [or] her own opinions.”

Who has the most to lose?

But certainly, not all kinds of crypto companies are created equal–therefore, certain types of companies may be more susceptible to reputational damage than others.According to Fields, this kind of viral spread of bad press is particularly bad for cryptocurrency exchanges.

“As the largest generators of revenue in the blockchain space, cryptocurrency exchanges stand to gain –– or lose –– the most with a sudden reputational shift,” she explained.“Centralized exchanges, in particular, rely upon trust from thousands or even millions of members to fill order books and maintain liquidity.”

Additionally, competition for users means that one exchange’s loss is another one’s gain: “the hypercompetitive environment for cryptocurrency exchanges has made the stewardship of any individual brand all the more critical; drop-off for one immediately becomes an opportunity for another.”

Tal echoed Fields’ sentiments: “exchanges and trading platforms, however, are by large much more prone to cyber-attacks and are more open to public scrutiny due to their consumer-centric nature, and as such, will often find themselves under the greatest reputational threat.”

He also explained that while the risk of reputational damage extends to “any company handling substantial amounts of user funds”, “exchanges are also ‘physically’ holding client funds on a regular basis, while processors are a ‘means to an end’ solution for facilitating capital transfers.”

What’s worse–when disaster strikes at an early stage, or later in the game?

The particular stage of development that a company is in can also play a role in how reputational damage can affect its future–depending on your perspective, reputational damage can either be worse for a company during its early days or once it is more well-established.

For Kyle Asman, partner at BX3 Capital, reputational damage is generally more severe in a company’s early days: “since they don’t yet have a built-upon reputation, early-stage companies face a much larger reputational risk. If one gets hacked on Day 1, it will be known as ‘the exchange that gets hacked.’”

”We have all the money we need… we can afford to lose money. But we can’t afford to lose reputation.” –Warren Buffet

Fields agrees that larger companies may more quickly become fodder for the media: “The media primarily keeps tabs on large companies, so they are more likely to see coverage if they falter.”

However, she also pointed out that “early stage companies may be at greater risk: as an industry that has seen many unqualified or malicious actors come and go, the blockchain space largely welcomes newcomers and then immediately subjects them to intense scrutiny.”

“During this period, companies in their early stages of growth must prove themselves to a wider community that is watching closely for signs of potential failure. It is therefore imperative to swiftly fix mistakes and to publicize corrective actions.”

Still, in Fields’ view, reputation becomes more valuable in correlation with a company’s size: “‘large companies are even more aware of damage to their reputations [than smaller ones,” she explained.

“In 2005, billionaire value investor Warren Buffett said of himself and Bill Gates: ‘We have all the money we need. While we’d like to have more, we can afford to lose money. But we can’t afford to lose reputation. Not a shred.’ Nothing has changed since then.”

Be First to Comment