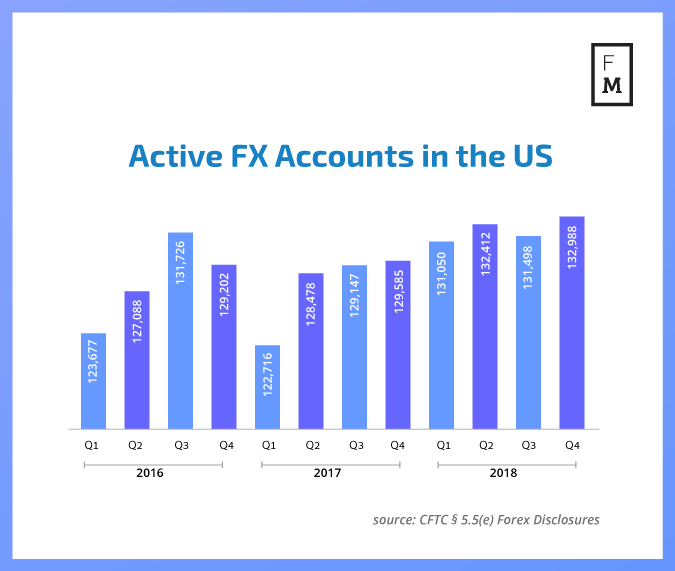

The last quarter of 2018 brought us interesting forex metrics from the US retail market. The number of active accounts across the country grew to their highest level in history, and two outside companies applied for NFA regulation at the same time.

One of the oldest retail FX industries in the world is starting to look more and more interesting at the end of 2018. Such a good year must mean that for some reason, US retail investors decided to become more interested in this segment of the market. And keep in mind that the US market is not an easy one compared to the rest of the world.

Promising start followed by difficulties

The US retail FX market has always been almost inseparably linked with two companies – Forex Capital Markets (FXCM) and Gain Capital. Both started their business in 1999 and became prominent market players in only a matter of a few years. These were the golden years of retail forex trading. Companies were growing fast, and there was no real regulatory framework for this kind of investment.

The cornerstone of all evil was the , which was introduced in 2010 on the back of the 2008 world financial crisis. It aimed to improve financial stability and consumer protection. However, with increased security inevitably came higher requirements for financial institutions.

Rebirth of the US market

Today we observe , despite all the difficulties local authorities have been creating for them for years. It shouldn’t come as a surprise that some brokers, who probably have kept an eye on this industry for a longer time, decided to enter the US retail forex scene. Finance Magnates .

The official entry date of the UK tycoon onto the US scene happened on February 1. There is also another company that is approaching the US forex market right now.

The US retail forex industry went through some truly difficult times. For some reason, it survived these changes and kept evolving. If the market expands even in such a challenging environment, that means there is great potential for additional growth.

If on top of that, we’re willing to take a slightly crazy bet, then maybe one-day regulations will be loosened to the point that there will be a sound basis for long term business for those that are willing to invest substantial capital and wait.

To get the full article and the bigger-picture perspective on the US retail FX industry, get our latest Quarterly Industry Report.

Be First to Comment