2018 marked a year of big changes for the foreign exchange (forex) industry, particularly for the European Union which saw the for the retail sector. However, whilst the market was turned on its head in Europe, across the North Atlantic Ocean forex providers in the United States were quietly making a comeback.

In terms of FX providers in 2018, the market in the United States was small and has been for years. GAIN Capital and OANDA are the only two remaining brokerage companies focused on providing forex trading to US customers. In addition, the sector is also serviced by two discount brokerages: Interactive Brokers and TD Ameritrade, with the latter holding the largest market share of the four firms.

Although fewer in number than the European market, the performance of US trading providers was on an upward trend during 2018, indicating a market recovery.

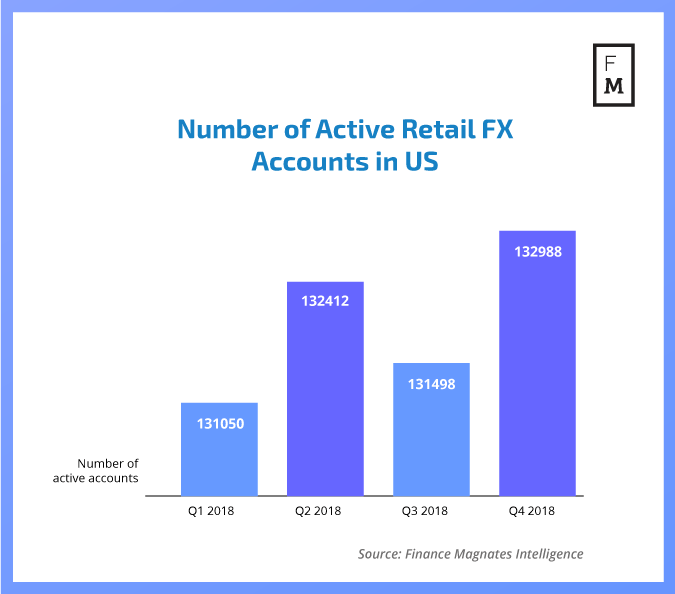

Based on data disclosed by the four companies to the (CFTC), we can see that the number of active retail forex accounts in the US grew dramatically, with the fourth quarter showing the strongest results in years.

Specifically, the number of active accounts in the fourth quarter of 2018 was 132,988. Comparing this to the same quarter in 2017, which had a combined number of retail trading accounts of 129,585 this is a jump of 2.6 per cent. It is also 576 more trading accounts than the next best quarter in 2018, which was Q2.

In the second quarter of 2018, the four firms had a combination of 132,412 accounts, which is also 2.2 per cent more than Q4 of 2017. This figure, whilst less than Q4 of 2018, still represents a jump of around 1 per cent or 1,362 accounts from the first quarter of 2018.

What Caused the US Market Recovery?

The signs of a market recovery in the United States is welcome news, but what has caused this? Speaking to Finance Magnates Vincent Cignarella, Macro Strategist and the voice of America’s Global Squawk at Bloomberg believes the flexibility of the FX market played a key role.

On the overall health of the FX market in the country, he continued: “I think it’s quite healthy. Volumes are good. There’s been a lot of activity, especially in the fourth quarter of 2018. Going into 2019 it remains to be seen how that holds up. Volumes in FX wax and wane but I think over the years, we’ve been comfortable with a pretty steady trend to the five trillion mark. It’s one of the purest trading markets out of the asset classes.”

“I don’t think they would decline markedly [in 2019] but I think growth is going to be a little begrudging going forward… it’s still a healthy product with healthy volumes,” he concluded.

The Chief Executive Officer (CEO) of GAIN Capital, Glenn Stevens, also noted that the flexibility of the FX market was one of the key contributors to the solid market performance in 2018.

Source: Bloomberg

TD Ameritrade Claims the FX Market Share in 2018

Finance Magnates also reached out to TD Ameritrade who is now the largest broker in the United States based on current active FX retail trading accounts. We asked what was the biggest contribution to their recent growth in the forex sector.

Source: Twitter

Looking to the future, Mackenzie added: “With markets continuing to be volatile globally and investors interested in participating in the forex markets, we do anticipate continued growth of new accounts and participation from our investors.”

IG Group Re-Enters US Market

Kicking off the month of February of this year was another piece of positive news for the forex sector. This, of course, was the announcement that London-based IG Group has launched its US subsidiary IG US, marking the first new entrant to the market since 2009, as .

Over the past decade, prohibitively high capital requirements in the US and many other firms out of the market. Now, through its subsidiary IG US, the broker will focus on providing forex trading to its clients.

All in all, increased competition and an uptick in demand for retail forex trading makes the US market look the strongest it has in a long time.

Be First to Comment