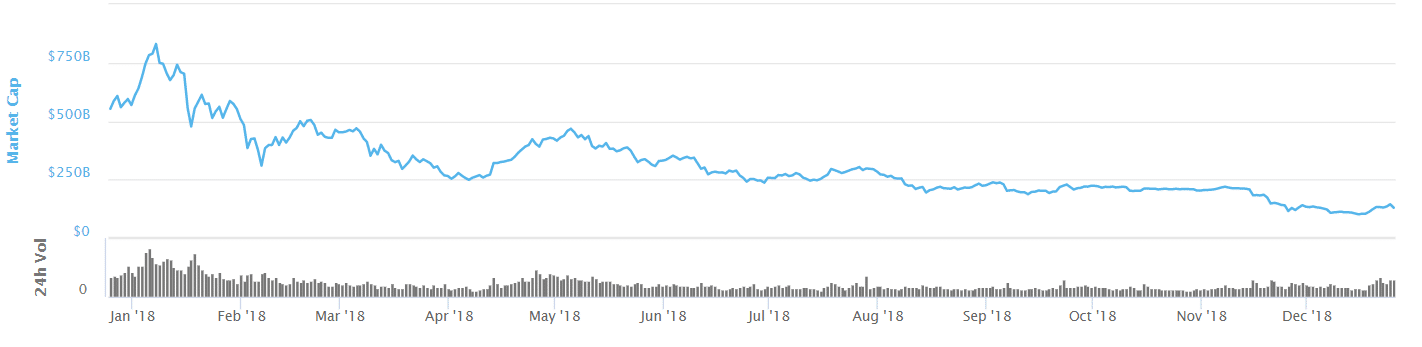

Christmas usually brings joy to the world, but when it comes to the cryptocurrency traders, this holiday is all doom and gloom. The already struggling market pulled out more than $15 billion from its total valuation in the last 24 hours.

Although last Christmas, was trading above $14,000 and the market was booming with demand from all over the world, a similar bear was triggered during the Christmas day trading session, as the market shed around $26 billion. However, the growing demand pushed the price up and in less than 15 days, the crypto market touched its apex valuation of $828 billion.

However, the recent Christmas bloodbath came after massive recovery signs showed by the coins in the past week that was triggered as the market had reached another bottom – $102 billion in total capitalization.

Friends With the Banks

Ripple is one of the leading gainers in the last 10 days as the coin reached from as low as $0.28 to the current value of $0.37 – a 24 percent rally. This was triggered by many market developments like the South Korean blockchain firm Coinone’s tie-up with Ripple for remittance transfer to Thailand and the Philippines along with addition of XRP as the exchange’s base currency.

We will be adding a couple trading pairs with XRP as the quote currency shortly.

And rename ETH markets to ALTS market. Running out of space on the UI.

Merry Xmas!

— CZ Binance (@cz_binance)

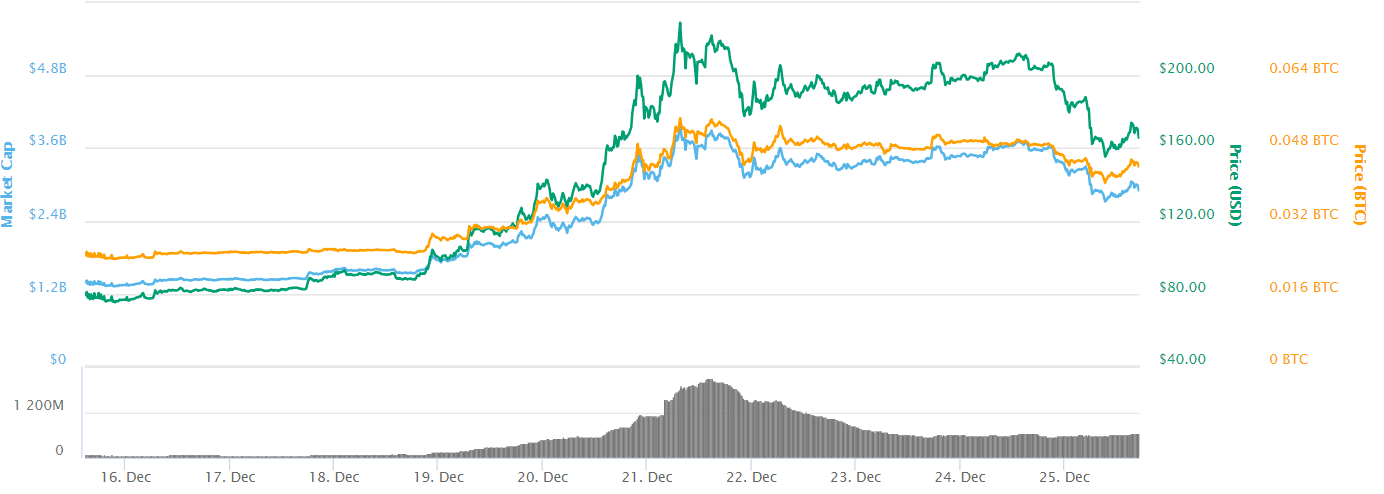

, the split-sister of Bitcoin, is another token which bounced back from the abyss gaining more than 55 percent. This was mainly triggered by Roger Ver’s development talks about Bitcoin Cash’s future. According to Cash.coin.dance, a website showing BCH’s hard fork statistics, “the Bitcoin Cash network has now been upgraded! 5461 blocks have been mined under the new consensus rules! Bitcoin Cash is currently 20.4% ahead on proof of work. Bitcoin Cash is currently 54 blocks ahead.”

Tally the folks freaking out about crypto prices, and you’ll discover 95% of them got into crypto in 2015 or later.

— Erik Voorhees (@ErikVoorhees)

However, in the last 24-hour span the coin shed 17 percent of its value and is trading around $169, according to Coinmarketcap.com.

Now about the original cryptocurrency Bitcoin, the coin does not provide a positive picture at a first glance. Maintaining a strong bearish trend, the coin recently went below 3,300. However, the week-long bull afterward pushed the price above $4,200. But, due to lack of demand, the coin slipped below $3,900 again.

Despite the poor performance of Bitcoin since a year now, many established traders and investors are still going bullish for the

The stock market closed at 1p EST today, but crypto markets never close.

Stop letting other people tell you when you can access your assets.

Long Bitcoin, Short the Bankers!

— Pomp 🌪 (@APompliano)

The recent clash between the US President Donald Trump and the Congress has made a huge dent on the US stock market since last Wednesday. However, crypto investors are optimistic about this as Ross Garber, CEO of Gerber Kawasaki Wealth and Investment Management, pointed out that Trump’s recent policies might trigger an upward Bitcoin rally again.

Trump might be setting up a huge bitcoin rally. This is what it was made for… just saying. is NOT dead. Haven’t sold mine and not going too.

— Ross Gerber (@GerberKawasaki)

Be aware the above scenario is contingent on a bounce upwards to test low 5000s. Currently the short term price action is consolidating into a wedge with hidden accumulation (according to the OBV indicator), this suggest there is more probability of an up move from here.

— Willy Woo (@woonomic)

Be First to Comment