will begin tomorrow, and Finance Magnates is finalizing its interview series with some of the event’s leading executives and speakers. The latest piece touches on the shifting world of payments, having recently undergone by Visa and MasterCard. This included their respective impact on ICOs and cryptocurrencies. Where does the industry go from here?

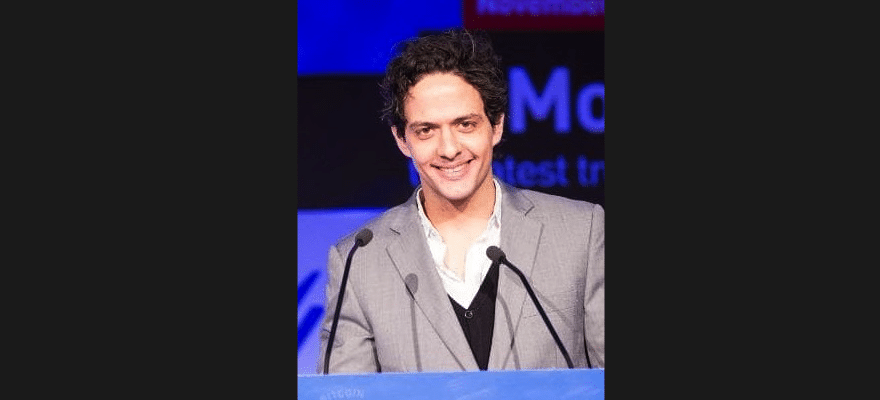

Ecommpay’s Regional Partner & Director, Michael Charalambides delves into the recent shakeup and elaborates on the situation at hand, as well as compliance requirements for EU banks and brokers. Is ESMA just getting started or will 2019 portend a more subdued approach to regulatory changes?

We recently reported that Master Card and Visa will soon restrict payment processing for ICOs and crypto firms. Can you elaborate on the situation as you know it?

If we consider putting in action the Boston matrix as a framework for payment schemes to evaluate industries, I think that they should be placed between the question mark and problem child! ICOs are not easy to uncover all the business operations, shareholders’ investment intentions…even more it’s almost impossible to evaluate if the ICO investment will take off and actually materialize.

So, the ICO market might be a trend of the past 3 years and is already highly fragmented the industry will still undergo through the scrapping process, where a big chunk of the ICO players will be considered “junk”.

Therefore, until some official regulation with risk classification and dynamic scoring inherited from the 5th AML directive and common pool of EDD sourcing for the initial ICO UBOs is readily available, I think that VISA and MasterCard took the all anticipated prudent approach rightfully.

If indeed all products of crypto investment fall under High Risk definitions in the credit cards’ view, what are the implications for the industry and what alternatives are out there?

Simply put it means that these issues will be watered down to all payment schemes members and firstly the banks! Therefore, when banks start to heavily reject and scrutinize ICOs it means that PSD2 fintech companies will have to comply if they want to keep their services active under the EU banking district.

However, this will potentially pave the road to 3rd country banks and schemes to tackle this weakness of VISA and MasterCard, taking on such risk management and possibly open this market in other regions. I believe that economic struggle between east and west if barely showing any true differentiation yet, but this is something which is bound to change in the forthcoming 2 or 3 years.

What are the compliance requirements banks in EU are committed to for accepting (or rejecting) crypto products deposits?

With ripple currently suffering after its dynamic launch, I believe that the ICO will not experience a high level of appreciation for any EU banking institutions. However the PSD 2 paved the road for PSD 3 which if it evolves correctly and considers the threat of the East to manage this risk.

It could take some lessons from the 5th AML directive and “level the plain field” by allowing fintech regulated EMIs and PIs to manage and serve this ICO risk while banks only offer pooling services to fintech company and the ECB dispensation the banking institutions from this liability.

But this is a decision and directive that has yet to mature within the European commission and the ECB policy makers, since the USD correspondence is even shadowing and influencing all SEPA decisions too…despite claims for autonomous decisions making.

How does the ESMA regulations affect EU brokers’ margin? Do deposits decrease, and is average deposit size changing?

ESMA is still trying to overcome problems with binary options and understanding how to regulate crypto exchangers of its members. Each member under ESMA creates its own terms for crypto regulations and some of them will now enforce passporting restrictions to fellow members.

Therefore, ESMA still has a long way ahead, and neighboring competition brewing with the Brexit. So I guess that the current status for margins and leverage is nothing more but suffering and while ESMA taught and fed its members and licensed companies to become what they are today.

Now, ESMA is trimming them while leaving an open window to allow trades via 3rd countries towards EU citizens while payment schemes like visa and MasterCard beg to differ and rightfully managed this risk by restricting PIs and EMIs to accept such business, this makes me wonder, shouldn’t ESMA firmly position itself and set a clear law for this?

Ecommpay is operating in many industries. Do you have any lessons for the financial services and crypto sector from working with other types of merchants?

Ecommpay is ever-growing and managing risk proactively being the among the pioneers of the industry in enforcing the 5th AML directives, PSD2 with combination to payments schemes best practices and dynamic risk profiling.

However, what operators need to understand that any windows in the legal framework (such as 3rd country “licensing” trading with EU citizens) are nothing more that spikes on their balance sheets for sales, which will eventually cliff once the regulation tackles it. One of the most prominent examples I can think of is the lobbying of the poker operators with the regulators to make the game of poker a recognizable game of skill rather than of chance.

This lobbying attitude and mentality should be adopted by the cryptos as it currently is the UK, but also the forex operators should coherently organize their powers, resources and knowledge and become one of the strongest lobby groups in the EU representing their rights and driving the market based on substantiated findings, rather than competing one another and racing to who will find a “window in the law”.

Forex operators have huge and deep knowledge of the market, and a lot of resources, therefore if the mentality changes to long term organic growth rather than revenue plasmatic sales spikes, than there is a shiny future ahead!

Michael Charalambides will be speaking at the upcoming London Summit 2018, grappling the options brokers have after ESMA as well as the plausibility of expanding to other jurisdictions. The informative workshop will be held on November 14 from 10:00-10:45. Learn more and register today!

Be First to Comment