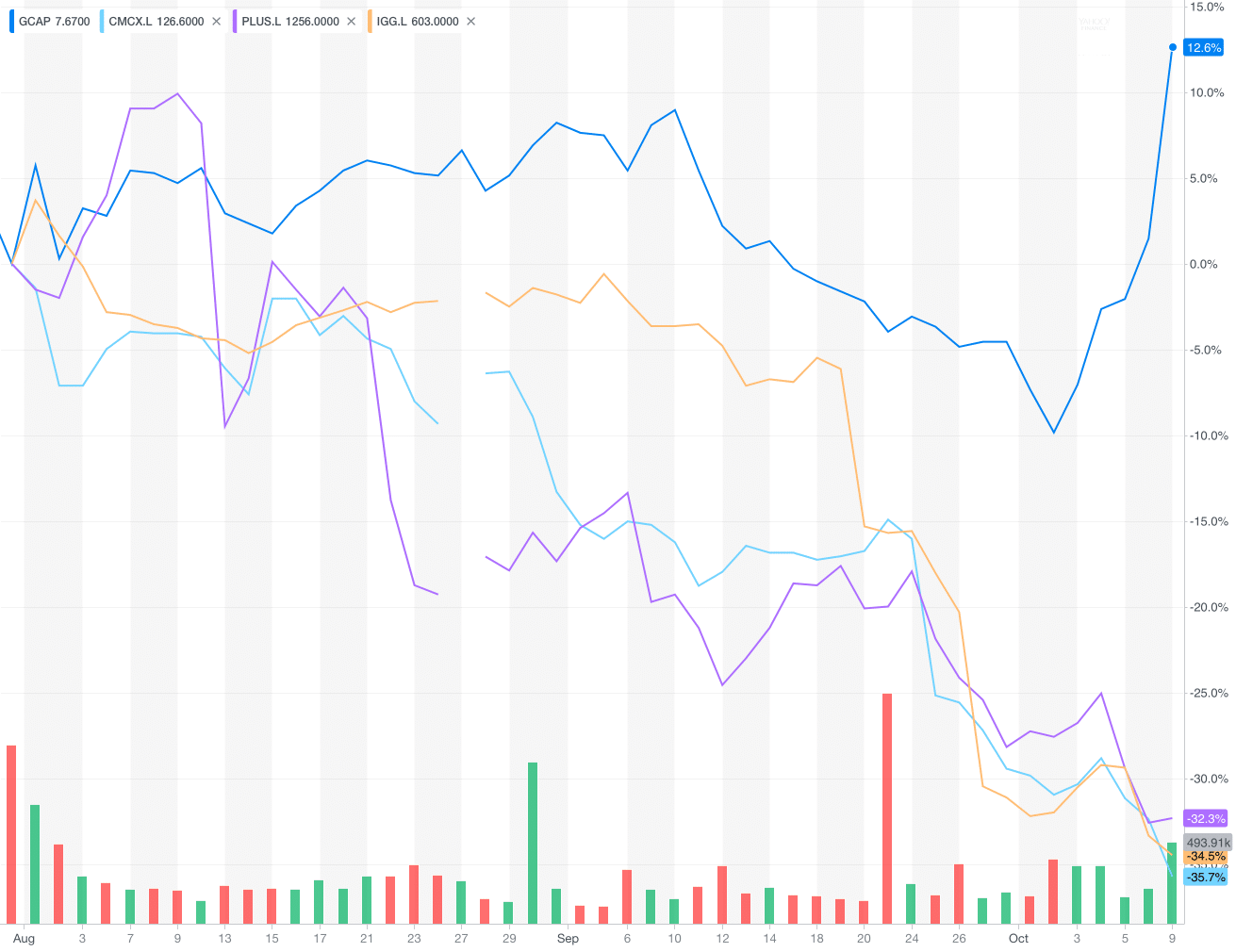

Shares of two publicly-listed retail brokerages are in focus today. GAIN Capital’s stock rallied 12 percent after the market open in New York. The material move higher came after the firm announced a .

Meanwhile, the well-known UK asset management firm owned by Crispin Odey, Odey Asset Management continued to acquire a .

The stock of the Israeli brokerage company has declined over 30 percent since August 1st. On that date, the European Securities Markets Authority (ESMA) implemented new leverage restrictions for retail brokers.

GAIN Capital’s Massive Buyback

Earlier today, GAIN Capital has announced that the company is committing $50 million to execute a new share buyback program. The move makes the company the only publicly traded retail FX and CFDs brokerage, whose stock trades higher when compared to the beginning of August.

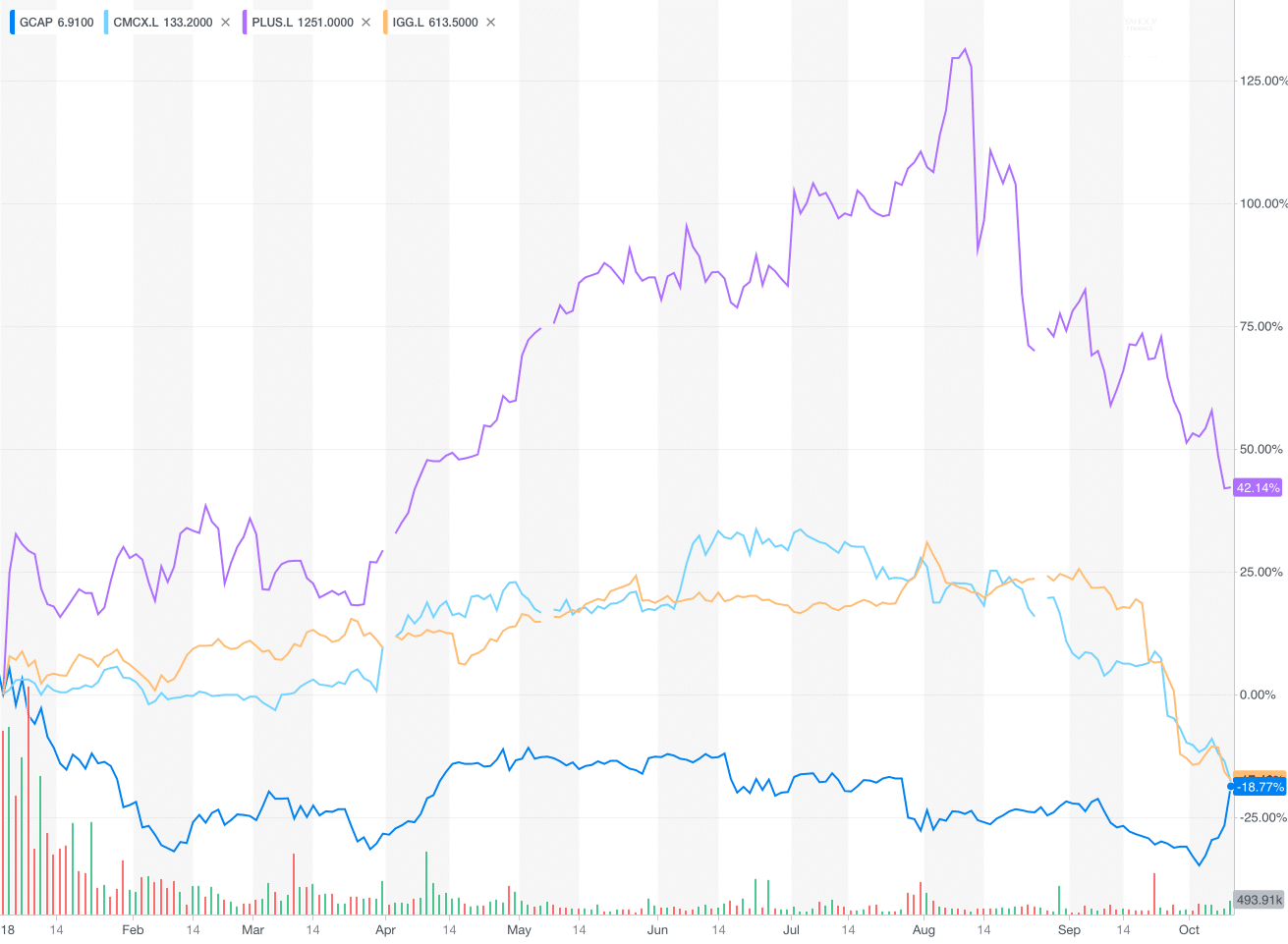

After the market opened for trading, shares of GAIN Capital rallied over 12% to trade at $7.66 as of writing. Shares of the company are still trading about 18 percent lower than on January 1st.

Plus500 and Odey Asset Management

While GAIN is committing its own cash to boost its share price, Plus500 is the only company from the retail FX industry trading higher when compared to January of this year.

The firm posted mind-blowing numbers in the first half of the year, however it warned the market that it expects a tapering in its revenues. Driven by the crypto boom which started in the fourth quarter of the year, Plus500’s shares are still trading over 42 percent higher since January 1st.

Odey Asset Management has been an active buyer of the stock of the Israeli brokerage on the way down. A regulatory filing earlier today shows that the firm added another percent to its holdings.

Crispin Odey’s fund is currently holding 12 percent of the company’s stock. The UK asset manager has been an active trader of Plus500 over the years. Back in 2015, Odey was arguing against Playtech’s bid to acquire the retail brokerage for £460 million.

The current market cap of Plus500 is £1.42 billion ($1.87 billion), while that of GAIN Capital stands at $342.8 million.

Be First to Comment