Cogitate on this Finance Magnates readers: sometimes when people trade with contracts-for-differences brokers, they lose money. Amazing, I know, but just how many people lose money?

According to , the average broker will see its clients lose money 76 percent of the time. In an age in which the unfastidious love to take a statistical disparity, not look into any of nuances involved and then draw an extremely simplistic conclusion, that’s not a good look.

But before we break out the tiki torches and start burning brokers’ offices down, let’s try to examine the statement a bit more closely. If we allow for any level of loss making to count as a loss then there is certain to be wide divergence in how much people have lost.

Amongst our 76 percent of losing traders, there could be a huge number of people that lost one dollar and a small number that lost over ten thousand. Is it entirely reasonable for those people to be classed together? Methinks not.

ESMA rules, Ayondo bants

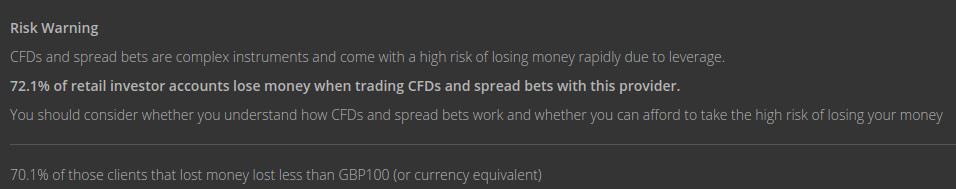

None of this would be problematic but for the . Bane of every broker’s existence, these that firms explicitly state how many of their traders lose money with them.

That leaves brokers with the problem we just looked at. They are forced to give a percentage that doesn’t capture the intricacies of a client’s life-cycle, trading activity or – most importantly – losses.

Thankfully, one broker has come up with a simple, yet effective, way of righting this wrong. Just below its requisite loss-making figures, Ayondo, , has written the following:

“70.1% of those clients that lost money lost less than GBP100 (or currency equivalent)”

Whoa! That changes things a bit.

Now, let’s lack all nuance and say that ALL of those people lost £100. For the average person in the UK this would mean, in a 12-month period, losing less than one day’s wage.

Nonetheless, for the statistically challenged victim-creators those numbers probably make for painful reading. When the person you want to protect is losing less than a day’s wage over the course of a year, it’s harder to argue that they require the cuddly embrace of regulatory prophylactics.

Could such numbers be used to propitiate the gods of ESMA and bring brokers back into their good books? To quote – “don’t count on it.”

Be First to Comment