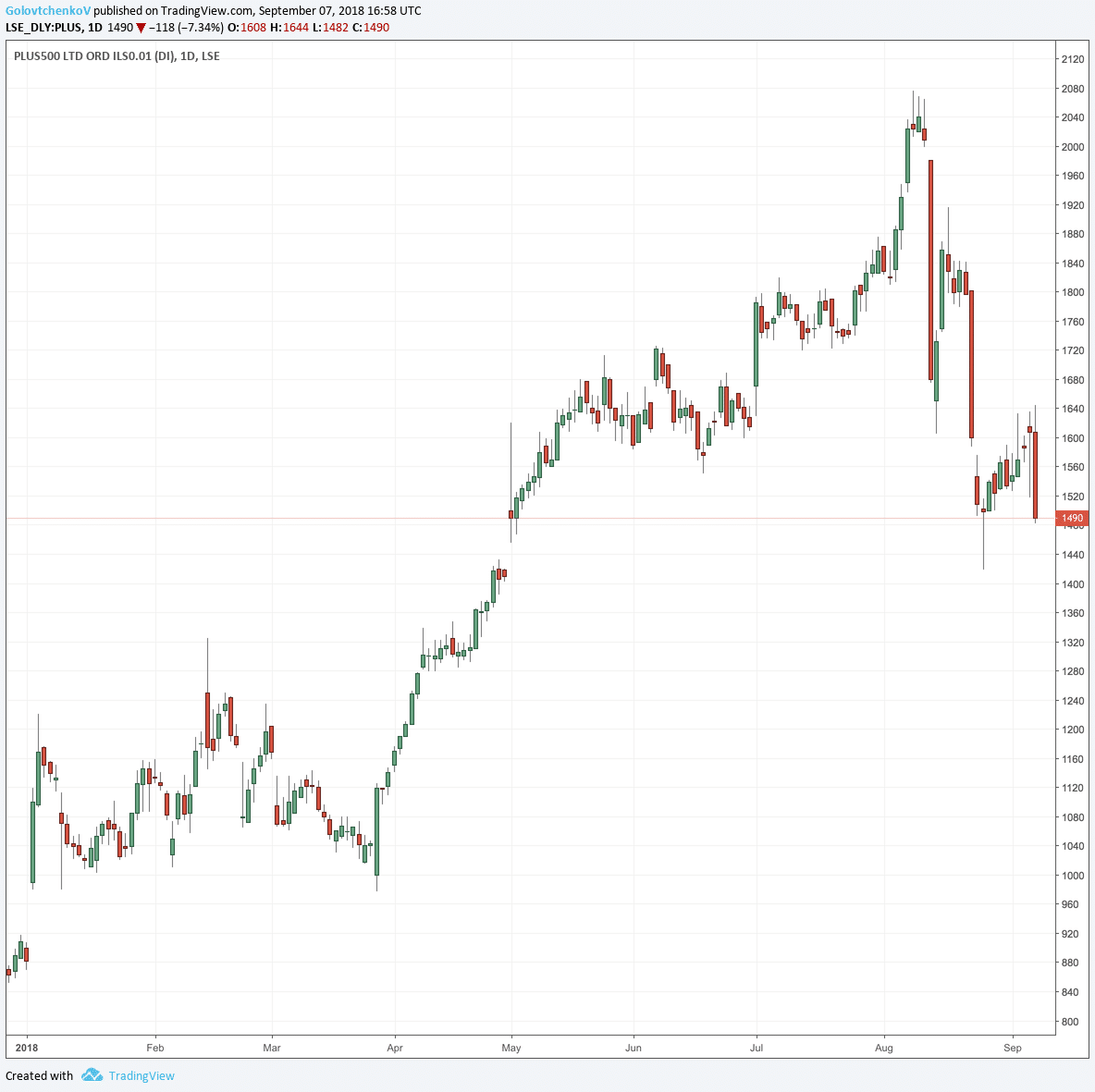

The shares of publicly listed took a beating today. The company’s stock closed 7.34 percent lower after some major announcements over the past 24 hours.

First, the founders of the retail brokerage of close to 8% of the company’s stock after the market close on Thursday. Just before London trading started on Friday, another bombshell, stating in a regulatory filing that the firm sold all of its Plus500 shares.

During the first half of 2018 Plus500 reported a set of ultimately taking the company’s value above £2 billion. As the first half results were announced investors started to sell as the management of the firm signalled that the performance is unlikely to get repeated.

The new ESMA regulations are making the lifecycle of retail clients much longer. In tandem with that, trading volumes are declining substantially, making the industry more competitive as client acquisition costs rise.

Plus500’s management has signalled during the latest earnings call a tick lower in earnings is expected. The performance of the company in the first half was an outlier driven by cryptocurrencies.

Crypto Mayhem

Cryptocurrency trading was a significant boost to the value of Plus500 over the past several quarters. This trend is set to reverse as interest in trading the exotic asset class wanes.

Recent dramatic moves in , especially those of altcoins are causing heavy damage across the board. The substantial decline in the value of Ethereum, Ripple, Bitcoin Cash and flat trading in Bitcoin are taking its toll.

During the first couple of quarters of 2018, trading in cryptos remained buoyant. Throughout the past several months, brokers are reporting diminishing interest on part of clients.

Cryptocurrency trading was one of the main drivers for the onboarding of new clients to Plus500. After the implosion of the crypto bubble, that source of income has become unpredictable.

Be First to Comment