Over the past several months, the focus of the retail trading industry has been largely on the downside risks stemming from the new ESMA regulatory framework. If we are to take a cue from history, things might not be so dramatic after all. Brexit didn’t kill UK banks, nor is it likely to do so. The Swiss National Bank black swan didn’t wipe out everyone in the FX industry. The survival of the fittest principle is likely to work once more, and the new is already behind us.

In contrast to the doom-saying prophets that are predicting the end of the industry as we know it, we will have a look at some positive aspects of the changes. Those might ultimately drive a new phase of growth despite the ESMA’s regulatory restrictions on current products for retail traders.

Now don’t get me wrong here – there will be pain for many, and revenue flows will undoubtedly decline in many areas and for many firms. But let’s face reality as it is – the first official messages about a new regulatory framework appeared in . We all have had a long time to prepare for this. In the following lines, I will list five prospective and maybe unexpected positive long-term effects for retail brokers that adapt to the new environment appropriately.

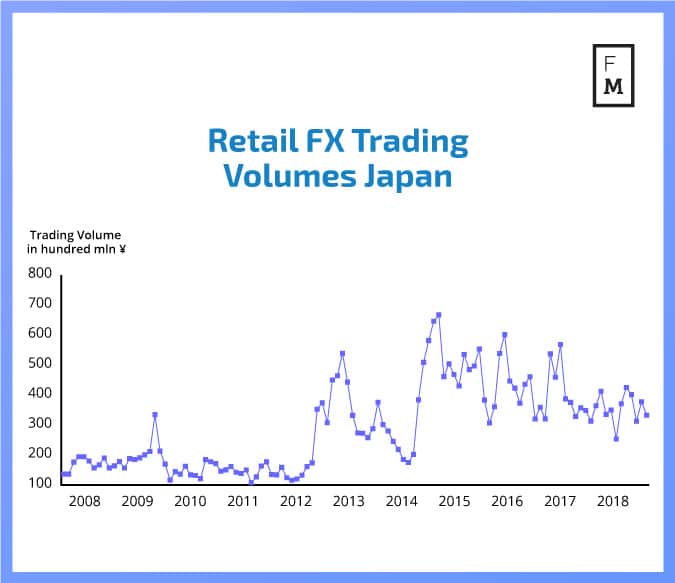

1. Trading Volumes Recover as Time Goes By

We have at least two examples of how a new regulatory framework impacts the retail trading industry in the long run. The post-Great Recession regulatory changes in the U.S. and Japan are now way past their implementation. These are the most prominent examples of how much an industry can change in the aftermath of new legal limitations on trading.

So let’s start with the U.S.: the market has shrunk dramatically ever since FINRA and have ratcheted up capital requirements. Starting from $20 million, those have been the main trigger to consolidate the industry into a tight niche. The cost of operating in the US has turned the business from a solid revenue-generating backbone into a small market fit only for the biggest and oldest brokers in the retail FX trading industry.

As I mentioned above, the changes to the US market have had little to do with leverage, and before you disagree with me, Japan is the living example that leverage doesn’t matter that much in the long run. Yes, capital requirements for many EU-operating firms have increased as well, but nowhere near the $20 million mark which killed retail foreign exchange dealers in the states. Note that leverage was changed to 1:25 in 2011 and was 1:50 in 2009 and 1:100 before that.

Still, the official Japanese retail foreign exchange space currently consists of 53 operators as of the end of June 2018. That is way more than the two firms in the US but also much less than the number of licensed operators in Europe. The industry consolidation has been happening here and now, but companies with sufficient capital buffers will survive.

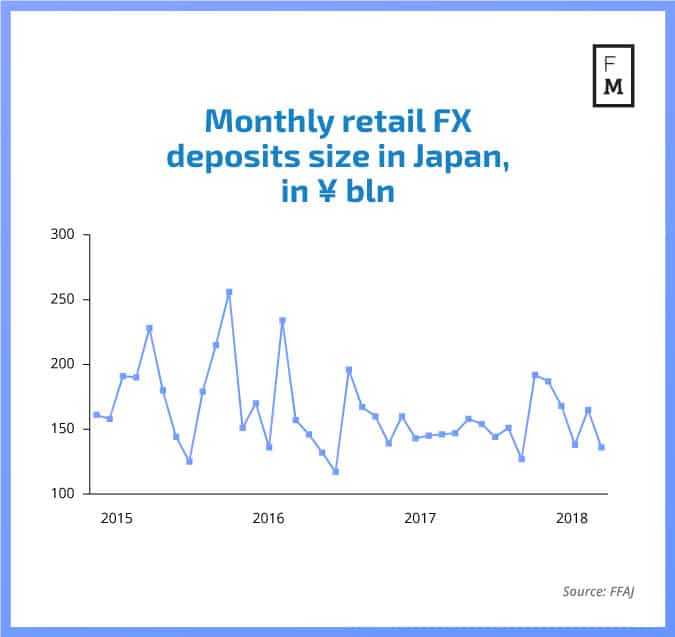

2. Average Deposit Size May Grow

Another point which has been largely overlooked in recent months is related to the size of the deposits. Able customers who have been committed to the market could be prompted to allocate more capital to maintain their trading habits. Traders are creatures of habit, and any disruptions to their trading habits will be one way or another prompt a solution.

One such solution as we have already pointed out is becoming a professional client. Granted, not all will be able to qualify for that categorization. That said, with Finance Magnates that a lot of clients who are responsible for a sizeable amount of trading volumes have adopted the new categorization to maintain their trading conditions.

For those who are ineligible, increasing their account size remains the only viable option to maintain the same exposure to the market that they desire to have. Regulators might be attempting to shield retail clients from risk, but the European Central Bank has become a risk-encouraging mechanism by maintaining low interest rates for a protracted period.

If we take a cue from Japan, where the FFAJ publishes deposits data since the beginning of 2015, we see stability. Market dynamics are way more impactful on the amount retail traders post as collateral than leverage. The country is most certainly on the top of the list of the retail FX trading space despite the hard cap of 1:25 since 2011.

3. The Number of Losing Clients Decreases

This point might not be welcome news for all brokers, as the number of losing clients is a revenue-generating stream for many brokers in the industry. Regardless of whether a broker is a market maker or a proper straight-through processing (STP) shop, this figure has an expanded meaning starting August 1, 2018.

I am referring of course to the fact that brokers will need to pay special attention to their clients’ win/loss ratios due to a new ESMA requirement. The supranational European regulator is set to disrupt the marketing side of the industry with a new set of rules. Brokers will now have to integrate the percentage of clients that are losing money into a disclaimer.

The reduction of leverage is sure to make an impact here since studies in the industry have demonstrated undoubtedly that there is a tradeoff between high leverage and trading losses. Consequently, If the number of losing clients decreases, the regulators should have a better understanding of the effects of the measures which they are taking.

4. Brokers Become more Proactive in Speaking with Regulators

The harsh regulatory crackdown which the European financial regulators undertook in recent months is set to change the retail brokerage industry’s conduct. Adequate regulatory communication has now become of paramount importance at a time when the industry is shifting gears and moving into a more accommodative state. I will once again cite the in this case and mention how brokers in the land of the rising sun have become united and resilient in their communication with the local financial regulators.

It is also worth noting and highlighting that the measures which the ESMA is implementing today are going to be valid for three months. The outcome from the new regulatory framework’s implementation will be reassessed on a regular basis in the coming quarters and providing useful feedback and maintaining adequate communication with financial supervision authorities can only do good to the whole industry.

5. Market Making Brokers Switch more Flow to STP

Last but not least, the dominance of the market making model in the foreign exchange industry is likely to be at least reduced. At most, it can disappear altogether but let’s not get carried away with such prognoses and instead . Stemming from the fact that higher leverage causes more losses to retail traders, its reduction to 1:30 is likely to make client accounts last longer.

This could subsequently create more pressure for companies that have a limited risk tolerance to shift more flows into direct market execution. The changes stemming from this shift could resonate well with regulators, and subsequent revisions of the rules governing the industry are not out of the question.

While far-fetched, this last point wraps up our review of possible positive developments for the industry stemming from the new regulatory framework by the ESMA. We hope that you can find more and add those in the comments section below.

Be First to Comment