FXCM Group has released a comprehensive execution quality report for the two-month period ending on February 28, 2018. The company also published spreads statics for the fourth quarter of 2017, detailing average spreads throughout the three months to December on its trading accounts.

Slippage is the difference between the quoted prices and those at which the client’s orders have been executed by the broker. The less slippage the trader gets, the better his trading results will be.

According to figures stated in the report, the average spreads on the EUR/USD, USD/JPY, GBP/USD and AUD/USD currency pairs were 0.1, 0.2, 0.2 and 0.3 pips respectively at peak trading hours, which FXCM defines as the period from 0600 – 1800 GMT from 1 October 2017 through 31 December 2017, excluding weekends.

The company noted that 59% of EUR/USD, 12.3% of GBP/USD and 38% of USD/JPY trades incurred spreads equal to 0.1 pip or less during the Q4 2017. The report also showed the average total cost to open a 1k position on each pair through the fourth quarter. During non-peak hours, average spreads on the four major pairs were doubled as shown below:

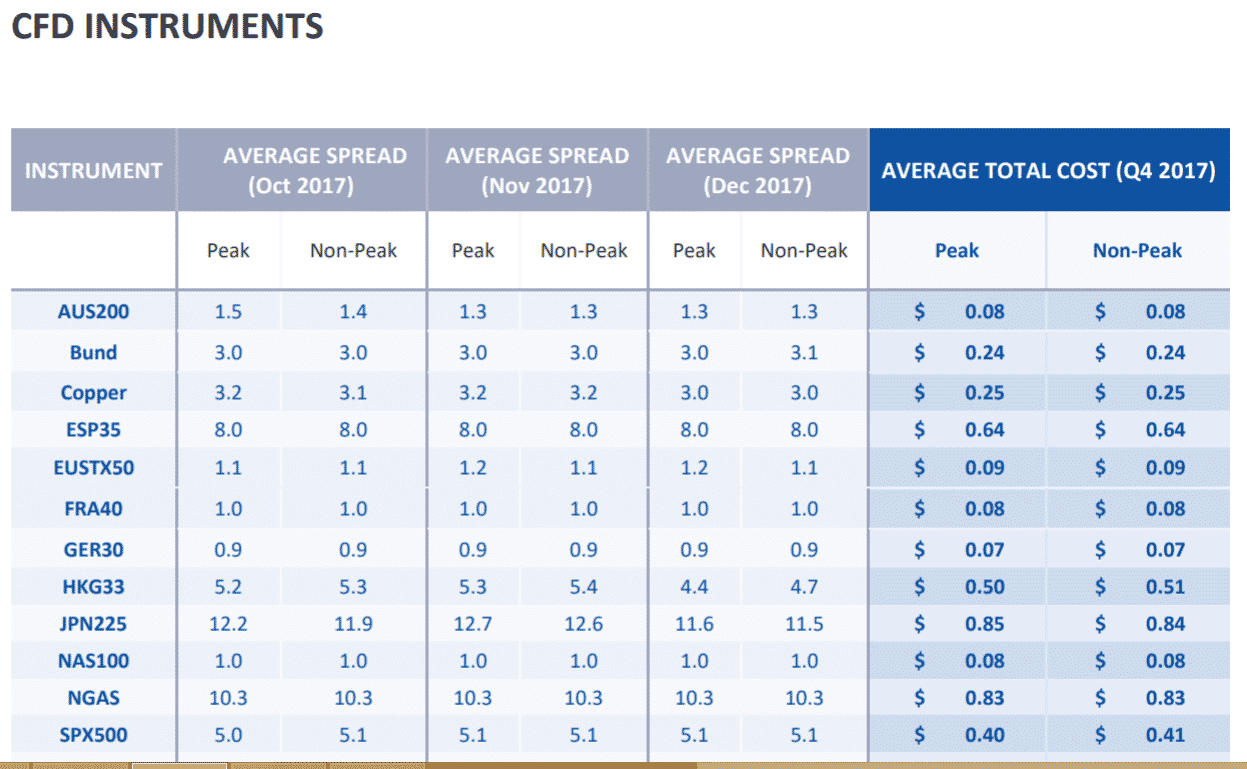

CFD Spreads Highlights

For the GER30, one of the most widely traded instruments in Europe, the company averaged 0.9 pip during the most active trading hours. The average cost to trade GER30, assuming a 1K trade, was $0.07 during peak trading hours.

FXCM has also advertised its price improvements/slippage statics which showed the following highlights.

- 63.68% of all orders had NO SLIPPAGE.

- 25.63% of all orders received positive slippage.

- 10.70% of all orders received negative slippage.

- 60.90% of all limit and limit entry orders received positive slippage.

- 40.07% of all stop and stop entry orders received negative slippage.

- 25.71% out of all stop, limit, ‘at best’ market, and entry orders received positive slippage

- 10.79% out of all stop, limit, ‘at best’ market, and entry orders received negative slippage

- Over 63.34% of all limit and limit entry orders received positive slippage

- 42.07% of all stop and stop entry orders received negative slippage

All in all, over 89% of all orders received positive slippage or zero slippage.

Additionally, the online brokerage has disclosed its Effective Spread Widget, which displays FXCM’s quoted spread for its top FX pairs, and compares the figures with actual spreads, at which trades were already filled, with the difference being displayed in a table key.

Commenting on the findings, Brendan Callan, CEO of FXCM Group, said: “What matters to traders is not what rate a broker quotes them but at what rate the broker fills them. FXCM’s clients experienced positive slippage on 25.79% of their orders and negative slippage of only 10.88 percent*. Due to our relentless work with liquidity providers we’ve been able to get our clients better fills than the spreads quoted on the platform. Many brokers will advertise tight spreads to entice traders in but through slippage and skewing, the trader often unknowingly pays a considerably higher Effective Spread. Choose your broker based on their Effective Spread, not their quoted spread.”

Be First to Comment