This guest article was written by who is a freelance blogger and editor.

As a writer you tend to gain a unique perspective on the industries that you work in. You also learn a lot about things that never used to concern you. I can’t tell you how many times I’ve had to write that article, the one that explains the differences between technical and fundamental analysis, in 500 words or less without actually giving you the slightest idea as to how to use either of them.

You’ll start with the basics, one of them looks inwards and the other looks outwards, right? So, for instance, technical analysis is informed purely by an asset’s historical price action, assuming that whatever is going on in that big wide world out there has already been priced in. Fundamental analysis, on the other hand, concerns itself not with the ticker, but rather with conditions on the ground. Geopolitical intrigues, supply chain dynamics, what may or may not be going on behind the scenes at that company/central bank/ministry, how this or that subset of an economy is faring and so on.

This leads into a brief explanation of what technical indicators are, how chartists use them and why, what economic indicators are and why they’re important to fundamental traders etc. Finally, you tie a nice bow around it with a diplomatic statement to the effect that both kinds of analysis are valuable and that savvy traders don’t stick to one, but use each to confirm or disconfirm the signals being generated by the other. And there you have it, lukewarm, somewhat hacky, online trading content 101.

The allure of the chart

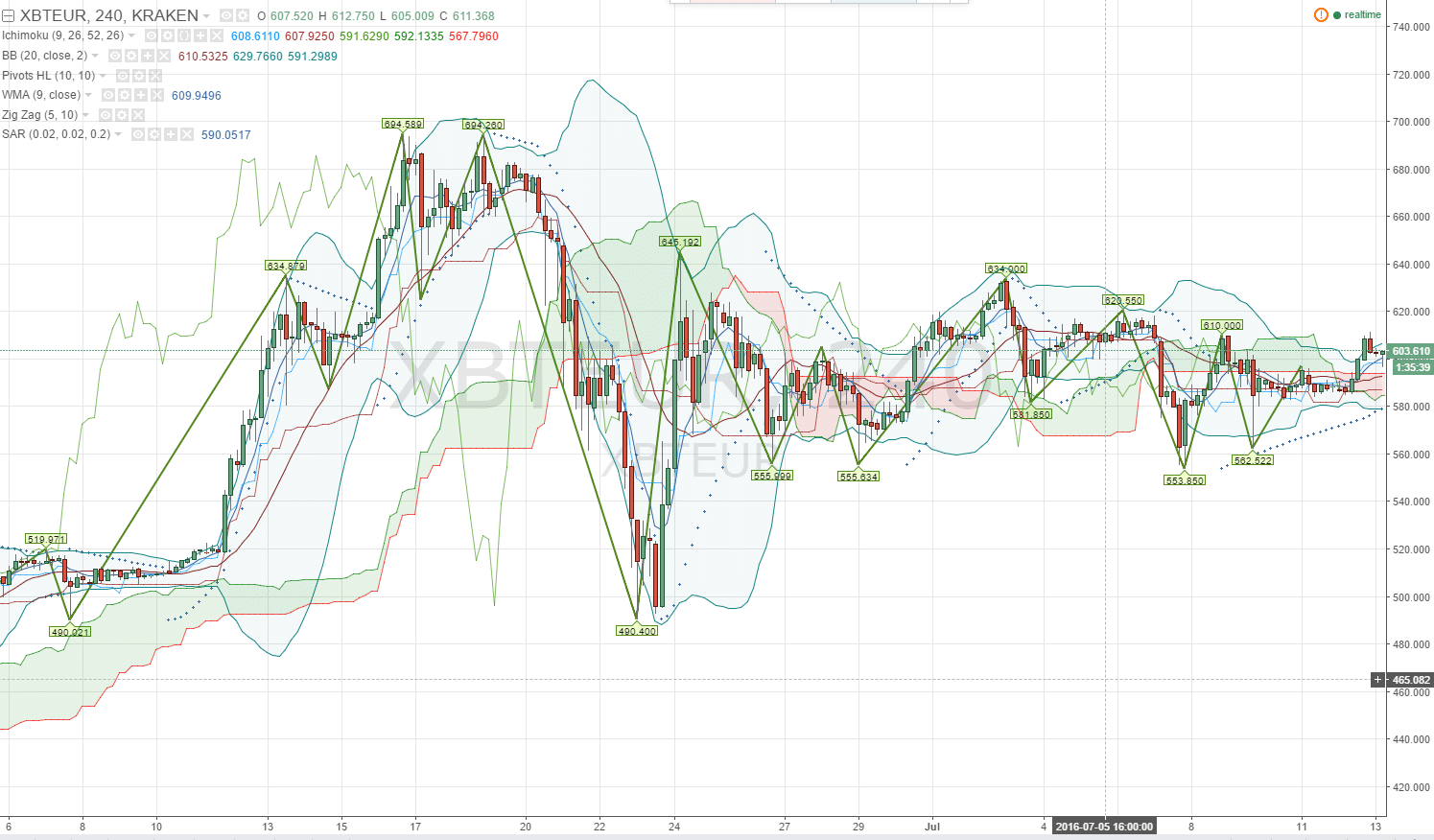

If I’m honest though, TA always seemed like BS to me. It’s not the indicators that bother me as much as the way that people use them. Experience has shown me that the more you interrogate a technical trader’s supposedly airtight strategy, the more you find little holes and exceptions that have to be accounted for by the use of more technical indicators, which also have holes and exceptions in them that need plugging by such and such an array of moving averages etc. Eventually the chart looks like a piece of dodgy impressionist art and the bottom line is that it all rests pretty squarely on the trader’s own discretion, with hindsight bias holding the wheel and confirmation bias working the pedals.

I’ve tested my share of technical strategies in live trading conditions, both mine and other people’s. The conclusion I always seem to draw is that it looks amazing backwards, when you’re seeing what (could’ve) would’ve (should’ve) happened, but when you press play and have to read the chart from left to right, with the next tick yet to be determined, things come unstuck pretty quickly. I always felt like a heathen secretly holding this opinion, even though I think I find myself in pretty good company.

Nassim Nicolas Taleb’s puts it very succinctly in Fooled by Randomness, where he states that: “Things are always obvious after the fact… When you look at the past, the past will always be deterministic, since only one single observation took place.”

Edwin Lefèvre, in his Reminiscences of a Stock Operator, leans heavily in favour of fundamental analysis by the end. The book tells the story of a tape-reading whiz-kid scalper who learns that there’s a lot more to trading when he tries to take his bucket shop skills to Wall Street. He never fully abandons the ticker, but it’s clear that discovering fundamentals was huge to Jesse Livermore’s education as a trader: “Tape reading was an important part of the game; so was beginning at the right time; so was sticking to your position. But my greatest discovery was that a man must study general conditions….”

Internet nerd money

You’re probably wondering where cryptocurrencies fit into all this. Until recently, if you hadn’t looked any further than Bitcoin, you could’ve been forgiven for thinking that Bitcoin is all there is, that and Litecoin, and maybe that weird coin with the dog. Now with Ethereum gaining a great deal of attention as well as the recent DAO debacle, the entire space seems to be much more visible to the public.

There are currently over 500 tradable cryptocurrencies with a total market cap 12.2 billion, of which Bitcoin currently accounts for 10.2 billion. There’s also an extremely interesting community of people who trade them. Both make up a vibrant, fringy, wild-west type market, which incidentally bears more than a passing resemblance to the world that Lefèvre describes from more than a century ago.

What does internet nerd money have to do with Wall Street trading at the turn of the last century? I think it has something to do with cypto’s relatively modest size, which makes connecting fundamental dots easier and more direct than trying to guess why EUR/USD surged from 1.14 – 1.19, or trying to figure out how the market is going to respond to the language in this or that ECB suit’s address.

Also, Mr. Draghi and Mrs. Yellen don’t tend to hold AMAs on Reddit, or make themselves available over email and Slack. For these reasons it’s easy to see crypto as a kind of internet version of those early 20th century heydays, where an insider tip was never too far away, where everybody was busy talking their own book because it mattered and where more than just oligarchs and multinationals could move the market by putting up a sell wall.

Actionable knowledge

What’s interesting to me is how the research journey that cryptocurrency traders tend to go on before placing their first order gives them the opportunity to gather some actionable knowledge of fundamentals. Knowledge that, for instance, the tenfold increase in the price of Bitcoin that occurred in November 2013 wasn’t due to Chinese investors, or the Silk Road bust or the European sovereign debt crisis. It was bots on the now defunct MtGox exchange accumulating Bitcoin for little or no money while boosting the price in an attempt to recoup coins lost during an earlier hack. In much the same way as the crash in the price of Ripple had more to do with Jed McCaleb dumping his coins after leaving the project than any issues with the technology itself.

Similarly, last summer’s Litecoin surge from below $2 to well over $8 had precious little to do with Grexit and everything to do with a Chinese Ponzi scheme that managed to inject millions into the currency before dumping it back down to sub $3 levels. Or back in early 2016 when it became increasingly obvious that Ethereum was massively undervalued in relation to other less innovative coins such as Litecoin. Or the fact that Bitcoin’s recent surge has more to do with pricing the block reward halving in than Brexit. Just like it was obvious very early on that the DAO was destined to be something of a cluster… love. I could go on.

And so, even though history repeats itself and markets will always do what markets do and there’s nothing new under the sun; no amount of drawing coloured lines on charts could have helped a trader make a killing or avoid getting wrecked in the above markets without first having some kind of grasp of the dynamics of the space, the technology and most importantly the stories tying everything together. Trying to trade a market without context is like dealing tarot cards or casting yarrow stalks in my opinion.

My background makes me incredibly biased towards narrative, I admit that, but this has been my experience. Having access to the stories that make the money move is essential if you want to be on the right side of the deeper fundamental trends. I think that beginners who start out on much bigger, more opaque markets, never get to flex those fundamental muscles because they’re always so far away from what’s really going on, so they end up playing a game of divination by default. Of course, I’d be lying if I said that trend lines have never helped me decide when to get in, but I think that question should only be asked after determining why to get in. It’s a subtle distinction, but one well worth considering.

Be First to Comment