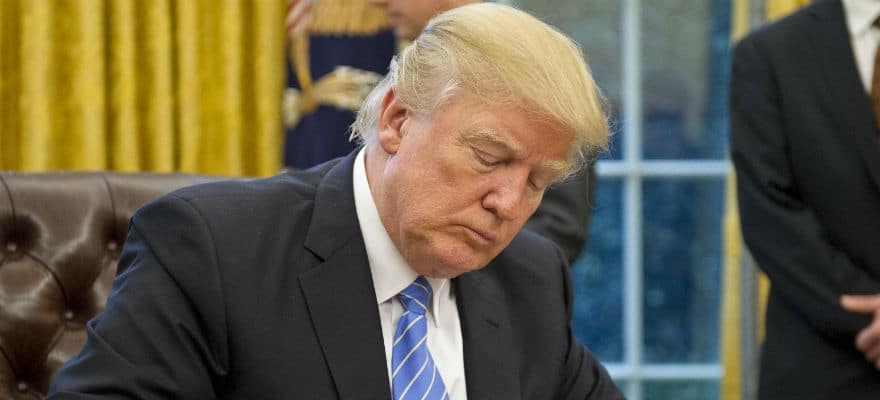

The US President is aiming to deliver on his campaign promise to alter Dodd-Frank.

Trump’s cabinet is preparing a set of measures that aim to unwind certain elements of the Dodd-Frank Act. The news was reported by the Wall Street Journal, which interviewed the White House National Economic Council Director Gary Cohn.

The order is set to be signed later today and is aimed at rolling back a large part of the regulatory overhaul that came with Dodd-Frank. Another executive order aims to discard a controversial retirement accounts rule that restricts how brokers can provide retirement advice.

In his interview with the WSJ, Cohn said that getting rid of “hundreds of billions of dollars of regulatory costs every year” will ultimately help American consumers.

Trump’s executive order is said to be tasked to the new Treasury secretary, whose appointment is still spending.

The ‘too big to fail’ mechanism for saving ailing big banks, the Financial Stability Oversight Council, is also to be revamped.

The changes to Dodd-Frank are meant to revive lending to small and mid-size businesses that have had difficulties accessing the credit market for years.

In his interview with the WSJ, Cohn, who is the former President of Goldman Sachs, said: “We have the best, most highly capitalized banks in the world, and we should use that to our competitive advantage. But on the flip side, we also have the most highly regulated, overburdened banks in the world.”

Roadmap for Deregulation

According to Cohn, the Treasury Department will start with an overhaul of the government-backed Fannie Mae and Freddie Mac, a long-delayed move that the Obama administration had been reluctant to take.

The Consumer Financial Protection Bureau’s role, which has been to oversee mortgage and credit-card rules, will be redirected.

Cohn also shared with the WSJ that the Vice Chairman of Supervision post at the Federal Reserve will be filled seven years after the passing of Dodd-Frank.

During his campaign, Trump claimed that Dodd-Frank prevents financial institutions from lending at a time when they have healthy balance sheets – apparently this wasn’t an empty promise. If anything, for better or for worse, for now none of the promises that Trump made during the campaign appear to be empty.

The overhaul could put smaller banks back in the lending business especially if the Federal Reserve is to accelerate its rate-tightening path.

Cohn concluded: “We don’t want to do it an unregulated way. We want to do it in a smart, regulated way.”

In the meantime we are also expecting Mr Trump to he made last April 1st, delivered to you via Finance Magnates.

Be First to Comment