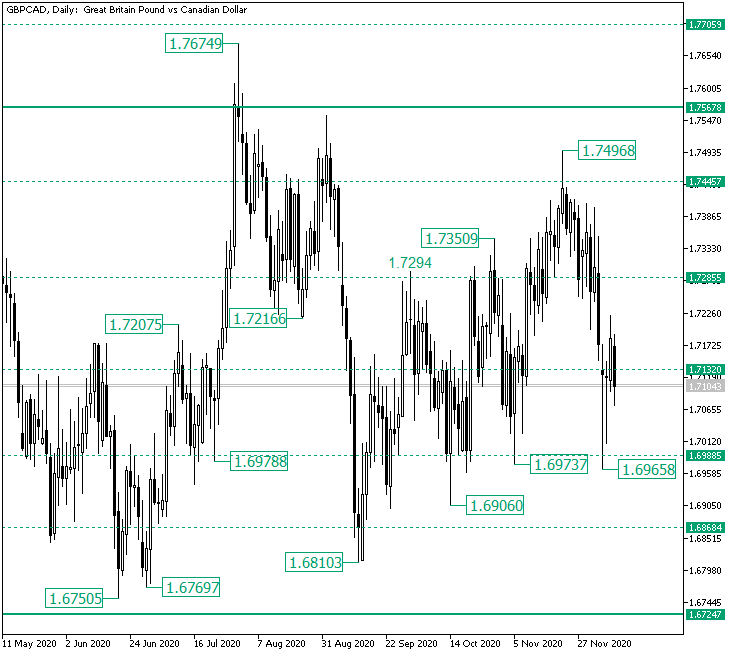

The Great Britain pound versus the Canadian dollar currency pair seems to be taken over by the bears. Can the bulls pull off a comeback?

Long-term perspective

The fall that came about after the validation of the firm resistance area of 1.7567 extended until the 1.6810 low.

From there, the bulls started to recover, as the series of higher lows and highs suggest.

During their path, the bulls validated as support each and every intermediate level they stumbled upon.

However, 1.7445 proved to be a challenge for the bullish endeavor. This is because the level allowed only a false break, the one that printed the 1.7496 high.

Considering the previous high, the one that caused the drop to 1.6810, respectively, it can be said that 1.7496 came into a zone well defended by the bears.

As a result, the appreciation above 1.7445 was short-lived and set in motion a fall that would prolong until the 1.6965 low, thus piercing two intermediate levels that could have served as support areas, 1.7285 and 1.7132.

Still, the bulls managed to guard the 1.6988 level, causing a rejection that sent the price above the next upper intermediate level, 1.7132.

If the bulls do manage to establish the price above 1.7132, then they could hope for another chance to conquer 1.7445 after they reach their first objective, 1.7285.

However, if 1.7132 becomes resistance, then 1.6988 may be paid a new visit.

Short-term perspective

From the 1.7469 high, the price entered into a descending trend which, after it allowed the price to slip under the firm support area of 1.7244, accelerated towards the solid support of 1.6965.

From 1.6965, the bulls drove the price above the 1.7094 intermediate level, then came close to touching 1.7244 but stopped at the 1.7222 high.

If 1.7094 remains support, then the next stop is the double resistance defined by the 1.7244 level and the falling trendline. On the flip side, if 1.7094 turns resistance, then 1.6965 is the next bearish objective.

Levels to keep an eye on:

D1: 1.7132 1.7285 1.6988

H4: 1.7094 1.7244 1.6965

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment