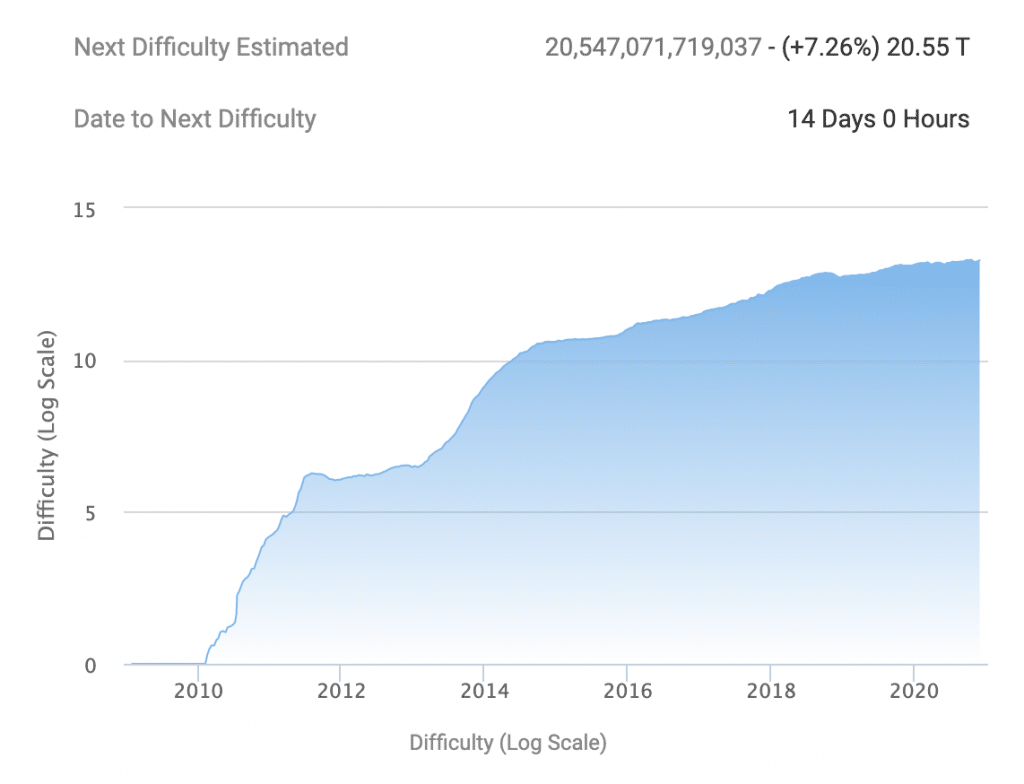

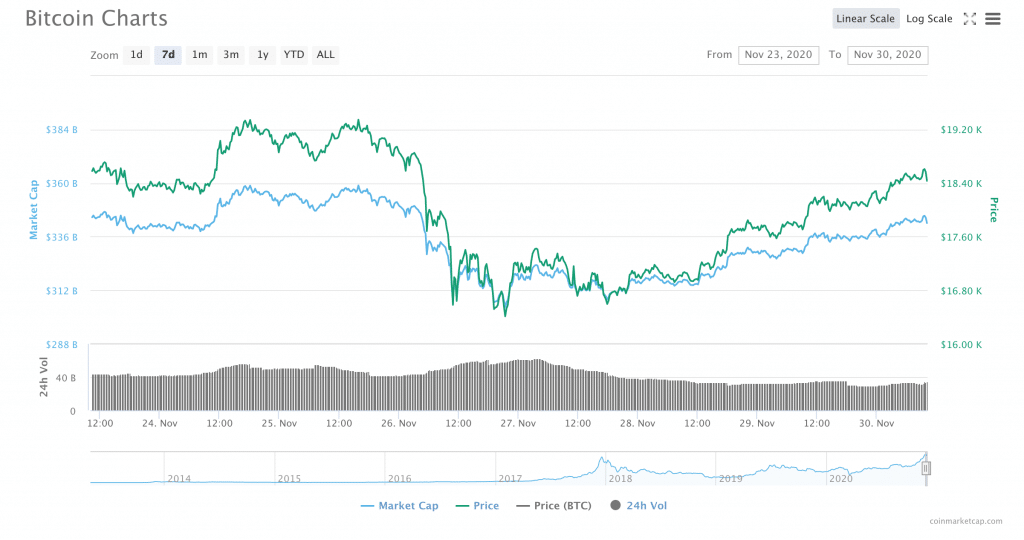

Coinciding with a two-year price high of more than $19,000, Bitcoin’s mining difficulty is showing some upward motion. BTC’s mining difficulty has increased by 7.26 percentage points. Yesterday, the increase read at 8.9 percentage points. At press time, mining difficulty appeared to be continuing along the way up.

According to blockchain data analytics provider, , yesterday’s increase brought Bitcoin’s mining difficulty within 4.4 percentage points of its current all-time-high.

mining difficulty increased by 8.9% today.

It is now only 4.4% below its ATH.

Chart:

— glassnode (@glassnode)

Mining difficulty is a term that describes how difficult it is for nodes on the bitcoin network to solve the cryptographic equations that are necessary for mining activities. The difficulty increases along with the number of miners on the Bitcoin network to ensure that new Bitcoins are not put into circulation too quickly.

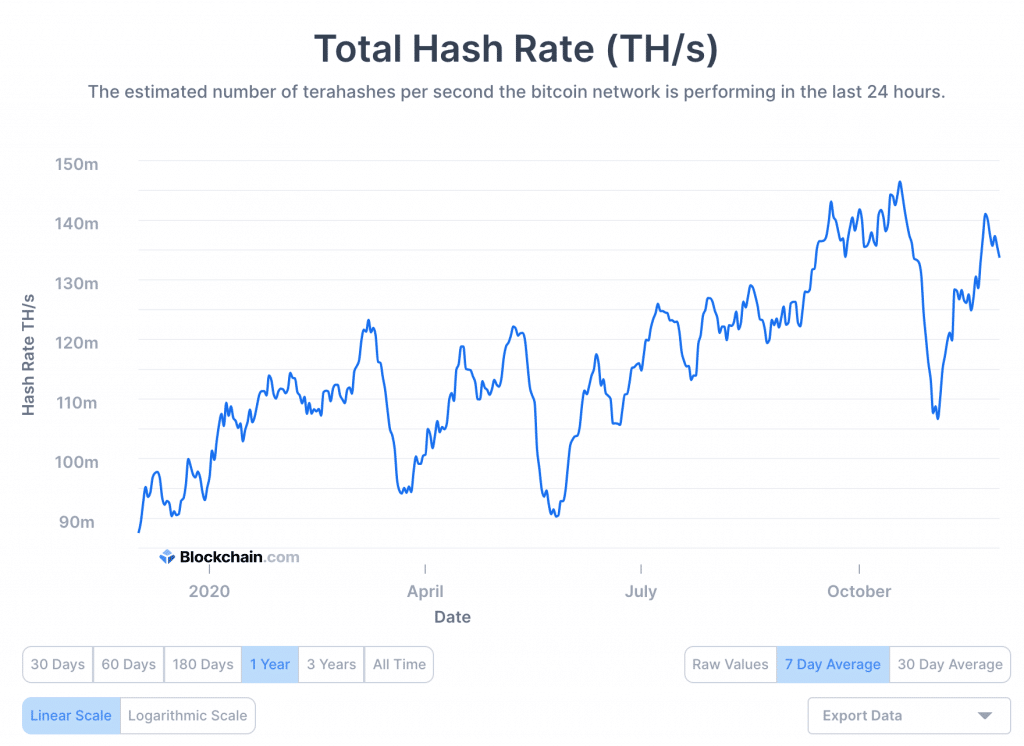

Therefore, the increase in difficulty seems to indicate that there has been an increase in the amount of mining activity that is currently happening on the Bitcoin network. This is supported by an increase in the amount of hash power (computer power needed to solve cryptographic equations) on the Bitcoin network throughout the month of November.

”Price follows hash rate.”

According to some analysts, both the increase in mining difficulty as well as the increase in hash power are long-term bullish indicators for the price of Bitcoin.

For example, renowned market analyst and broadcaster, Max Keiser always says that “price follows hash rate”: if the hash rate goes up, the price will follow (and vice versa).

Therefore, in spite of a percentage drop of more than 10 points that occurred last week, it is possible that Bitcoin’s recovery could lead it to

As the price of Ether (ETH) has risen to its highest point in over a year, mining difficulties on the Ethereum blockchain have also shown serious growth. According to Glassnode, Ethereum’s mining difficulty was at a two-year high on Friday. Interestingly, the increase in mining difficulty followed a three-day drop in token prices from $600 to $513. At press time, Ethereum’s price was roughly $580.

Be First to Comment