The Great Britain pound versus the US dollar currency pair may fall in bearish hands. But will the bulls allow this?

Long-term perspective

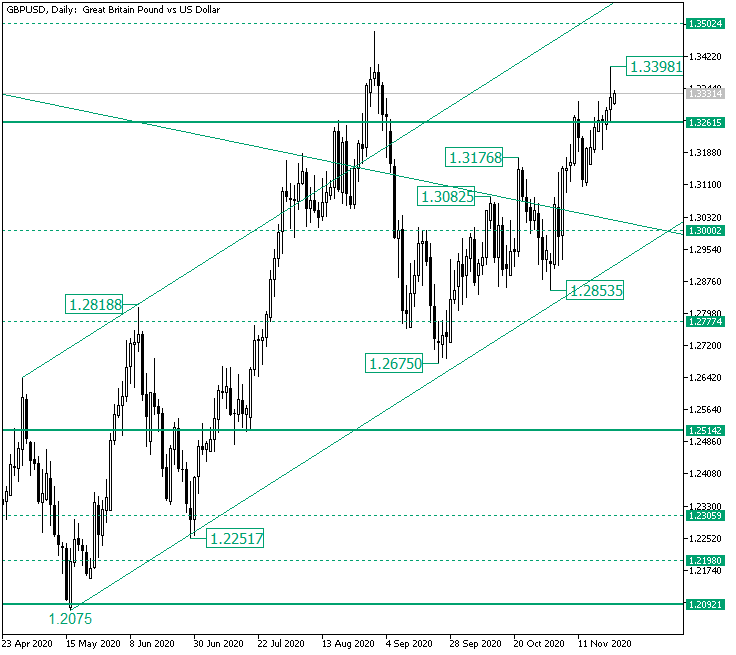

After the low of 1.2075 validated the firm support of 1.2092, the price started an ascending trend that extended nearby the 1.3502 intermediary level.

However, as the 1.3502 high was well above a triple resistance area — defined by the descending trendline, the upper line of the rising channel, and the 1.3261 level — validating it as support was a must for the bulls.

Unfortunately, they were not able to accomplish this, and as a result, the price dropped until the lower edge of the ascending channel.

After printing the 1.2675 low, the bulls started a new push, consistently winning the small battles with the bears. One of them is noted by the 1.3176 high, signifying that the bulls were still up to the task, like is the 1.2853 low, which managed to spawn a sustainable appreciation, extending until the 1.3261 resistance.

From 1.3261, the bears attempted to make the bulls step back. However, the bulls did anything but, as the 1.3398 high suggests.

Even if the price made a retracement back to the 1.3261 level, the bulls still aim for 1.3261. So, as long as it does not cede, the bulls can resume their climb towards 1.3502.

Only if 1.3261 becomes resistance, then 1.3000 is the next stop.

Short-term perspective

From the 1.2853 low, the price is in an ascending movement, as the series of higher lows and higher highs point out.

So, as the bulls seem to have confirmed 1.3268 as support, if they can conquer 1.3349 as well, then their next movement is to 1.3515.

On the flip side, if the price returns and 1.3268 fails as support, then 1.3175 may receive a visit.

Levels to keep an eye on:

D1: 1.3261 1.3502 1.3000

H4: 1.3268 1.3349 1.3515 1.3175

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment