The Australian versus the US dollar currency pair seems to be under bullish dominance. Are the bears going to do something?

Long-term perspective

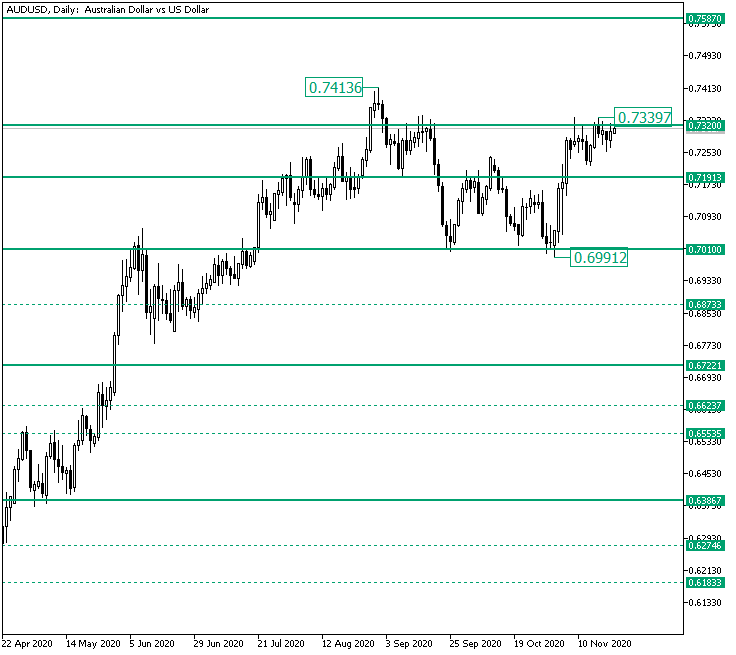

After validating the 0.6386 level as support, the price continued to climb, eventually reaching the 0.7413 high.

From there, it slipped under 0.7320 but was rejected by the next support area, 0.7191. However, the new impulsive swing proved to be a throwback, one that validated 0.7320 as resistance after it has been pierced by the fall from 0.7413.

As a result, the bears took over, sending the price beneath 0.7191 and to the next support zone, 0.7010.

From there, the bulls attempted a recovery, but the bears sent the price back to 0.7010, and even under it for a short while, as the low of 0.6991 points out.

Nevertheless, the bulls put themselves together and washed off the bearish resistance, driving the price back to 0.7320. Even more, they etched the high of 0.7339 and did not allow the retracement to fall under bearish control, as it was short-lived and led the price to rotate and come back to 0.7320.

In this context, the piercing and validation as support of 0.7320 is just a matter of time. The main bullish target is 0.7587, with 0.7400 and 0.7500 — not highlighted on the chart — as intermediary targets.

However, if 0.7320 is falsely pierced, thus not allowing the price to oscillate above it for too much, then 0.7191 may be paid a visit.

Short-term perspective

The rise from 0.7002 stopped after touching the 0.7341 intermediary resistance level. To be more exact, it stopped twice, and on both occasions, the falls — the first until 0.72221 and the second to 0.7254, thus a higher low — were followed by appreciations.

As a result, it can be considered that the bulls are preparing the piercing of 0.7341, which, if successful, can spawn an appreciation until 0.7390.

On the flip side, if 0.7341 remains resistance, 0.7236 can become the support of a range trading phase.

Levels to keep an eye on:

D1: 0.7320 0.7587 0.7191

H4: 0.7341 0.7390 0.7236

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment