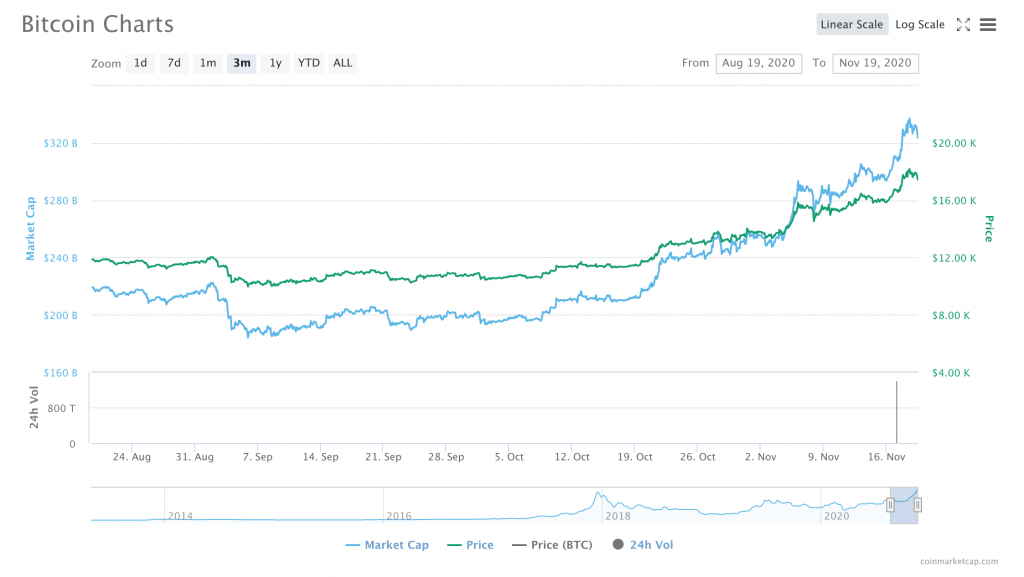

Though the week is not over yet, it has been another big one for Bitcoin. Although BTC was sitting around $17,700 at press time, Bitcoin had briefly passed over the $18,000 mark, earlier this week.

For many analysts, the move over $18k seemed to signal that another important price goal was just around the corner $20,000.

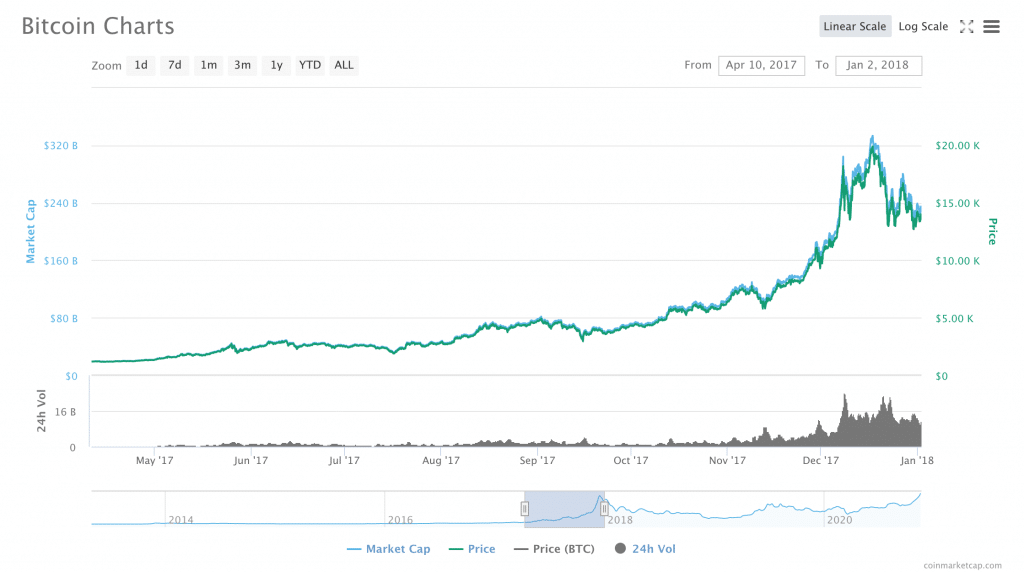

Bitcoin has, of course, passed the $20,000 mark before the ICO boom of late 2017 and early 2018, which elevated Bitcoin (along with many other cryptocurrencies) to a fever pitch before prices came crashing down.

However, a number of analysts have said that this time is different. Here’s why.

This Time, Bitcoin’s Price Rally Is More Stable and Seems to Be Driven by Larger Players

For one thing, “Bitcoin’s current run has been far less volatile than previous extreme price movements which gives more solidity to its current rally,” wrote Clara Medalie, Market Analyst at digital assets data provider, Kaiko, to Finance Magnates.

Indeed, in the past, Bitcoin’s pass up to $20k seemed to be driven by hype and FOMO (fear of missing out). Now, analysts believe that the factors that would support a move to $20k is more sustainable.

Growing Institutional Interest Is Feeding Bitcoin’s Rally

“Bitcoin’s current bull run was, without a doubt, initiated by the growing institutional interest that began around mid-October,” Clara explained to Finance Magnates.

And indeed, there have been a number of high-profile institutional investments over the last several months: “each successive announcement of institutional involvement with Bitcoin, from the likes of StoneRidge Asset Management,,, and , caused a near-instant market reaction, propelling BTC to 2020 highs, and this week, 3-year highs above $18k,” Clara said.

But why is so much institutional money flooding into the space in the first place?

Clara believes that this increased level of institutional interest could be coming from a desire to diversify investments after a shaky year for the dollar: “Bitcoin’s record-breaking month has been primarily driven by institutional interest in the crypto-asset in addition to uncertainty brought by the U.S. election and shaky economic outlook, causing investors to search for alternative assets not directly tied to the U.S. economy,” she said.

Indeed, Philip Gradwell, Chief Economist at blockchain data analysis firm, Chainalysis, told Finance Magnates earlier this month that “[…] the trend in place since mid-March is that Bitcoin is seen as an asset to hold in a world of macroeconomic uncertainty,” he added.

Bitcoin in 2017: “We Saw a Digital Gold Rush.”

But, Bitcoin’s growth is not completely driven by institutional interest: “it’s a mix of both” retail and institutional investment, explained Garrick Hileman, the Head of Research at Blockchain.com, to Finance Magnates. For example, “PayPal allowing people to buy, sell, and hold crypto was a big win for retail crypto adoption.”

And indeed, beyond the institutional space, analysts have also observed that retail investors are engaging with Bitcoin in different ways than in 2017.

“In 2017, we saw a digital gold rush,” Garrick explained. “Bitcoin was in the news, the price was skyrocketing but felt like a bubble ready to burst, and it was.”

“This feels different in part due to the more hushed discussion and absence of hype around recent price moves,” Hileman said. Indeed, while Bitcoin may be enjoying more of the spotlight now, BTC’s recent price rise happened largely in the backdrop of some major world events, namely, the United States presidential election.

In fact, when Bitcoin past over $15k earlier this month, “anti-authoritarian technology” investor, Nic Carter referred to BTC’s

Quietest bull run ever

— nic carter 🧊 (@nic__carter)

In any case, the lack of hype around BTC (despite its climb toward $20k) may indicate that this latest push is driven by more stable retail interest in Bitcoin. Garrick Hileman pointed out that “we see this in Google Search data comparing now vs 2017, when ‘buy bitcoin’ was a much more common search term.” In other words, the retail investors that are buying Bitcoin now are likely people who already know how to buy it.

Interestingly, “we also don’t see much search engine data differences between this past week and earlier this year,” Hileman said.

Clara Medalie also told Finance Magnates that “this momentum is different from the 2017 bull run because it has been largely driven by fundamental news events, such as PayPal’s plan to enable cryptocurrency purchases for millions of vendors worldwide, rather than pure market sentiment.”

Beyond institutional and retail investors, Garrick Hileman also pointed out that “ should not be overlooked either;” nor should the “growing acknowledgement of the inevitability of CBDCs,” which he believes “[..] will be hugely beneficial to bringing new users into the crypto space.”

Why Does $20k Matter for Bitcoin?

But, why should we care about Bitcoin reaching $20k (or not)?

Hileman explained that this figure is more than just a symbol of prosperity: “ultimately, for Bitcoin to fulfill its promise as a widely held global reserve asset, it must at some point remain above $20k indefinitely,” he said.

After all, while Bitcoin is increasingly spoken of as a store-of-value asset, it has a lot of growing to do: “at current prices, Bitcoin’s total market value is approximately $330 billion, which (while significant) is still well below the trillions in value respectively stored in gold, sovereign bonds, and major reserve currencies.”

A larger, more stable Bitcoin could also potentially fill a wider range of financial roles: “Bitcoin is still far too volatile to be a widely used currency, but volatility has been declining through the years and it has seen some use as a currency,” Hileman said.

“A store of value seems more likely in the near term, and it is not inconceivable to see Bitcoin on the balance sheet of central banks in the future. The state of the world around Bitcoin, from mainstream adoption to geopolitics, will continue to drive how it’s viewed and used.”

Retracements Ahead Are Likely

However, even though Bitcoin is seemingly closer to $20k than it has been in years, the road to $20,000 could be a steep one.

Part of the reason for this could be psychological: as BTC had to break its “Curse of $10,000”, the “Curse of $20,000” could be next. Harumi Urata-Thompson, CFO of Celsius Network, “whenever the market had some peak and came down the way Bitcoin did in 2017, it does create a psychological (and physical, as there will be a lot of sell orders that will be placed around that level) top that will take a bit more than a few buys to breakthrough,” she said.

“A lot of market participants are likely long position at this time, so no doubt that we will see some profit-taking before we reach $20,000, but only the reason I can think that might cause a sell-off will come from bad economic numbers that will trigger an equity market sell-off; Bitcoin itself is not likely to be the primary reason for this.”

Garrick Hileman also pointed out that in spite of the hype-filled narrative that drove Bitcoin to $20,000 in 2017, BTC retraced many times before reaching anywhere close to $20k: “on the way up to nearly $20k in 2017 there were four retracements of 30% or more,” he said.

And, in fact, there’s some evidence that the retracements are already happening: “on Tuesday night we saw Bitcoin almost break $18,500, and then we saw an almost $1,000 drop off on the same night,” Hileman said. “Retracements should be expected and can be healthy.”

Still, “it feels like we have the momentum and support to break $20k in the near future.”

Be First to Comment