The total value of the assets under management (AUM) in has decreased to the tune of $1.6 million throughout the month of November. According to a new report from CoinTelegraph, the drop in Bitcoin Cash AUM follows the announcement that BCH would be undergoing a hard fork on November 15th.

Indeed, data from CoinDance shows that the Bitcoin Cash network has split into two blockchains. CoinTelegraph that “miner action appears to be favoring the community-driven Bitcoin Cash Node, or BCHN” – miners have focused their efforts almost exclusively on mining blocks on the BCHN exchange over the Bitcoin ABC (BCHA) blockchain.

Additionally, since the hard fork was announced, BCH users have been which seems to indicate that users have been selling their tokens.

The Fork Was Caused by Controversy over the ‘Coinbase Rule’

The BCHN fork reportedly came about as a response to an announcement from Bitcoin ABC, the team that originally created Bitcoin Cash, that the blockchain would be introducing a new ‘Coinbase rule’ that would divert 8% of block rewards to a development fund led by BCHA lead developer, Amaury Sechet.

Bitcoin Cash community members fired back at the announcement, saying that the rule is unnecessary and that the blockchain can be funded without the new rule. The apparent dominance of BCHN over BCHA after the fork seems to indicate that most community members are against the new rule.

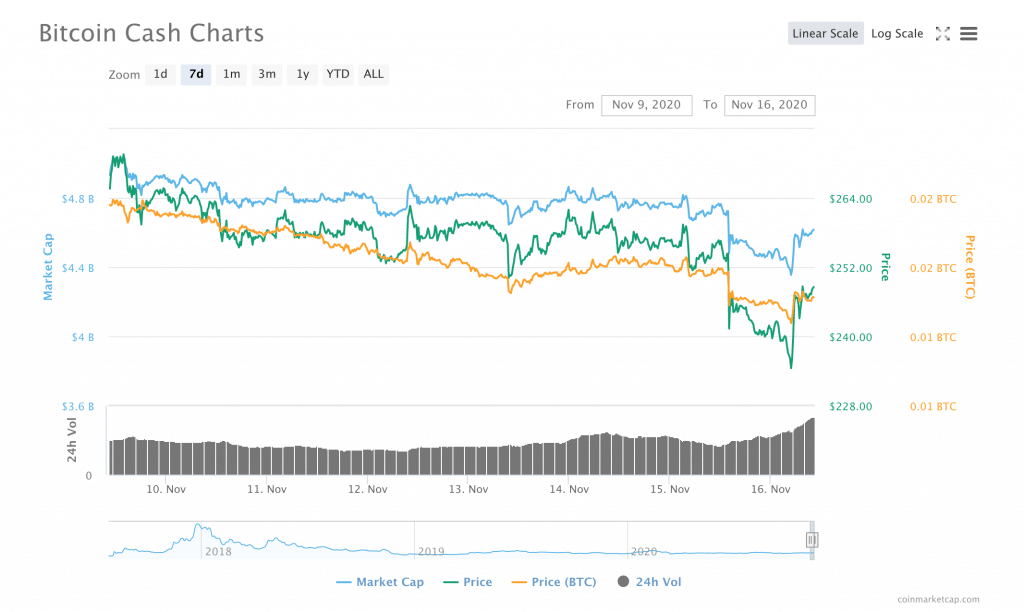

The price of BCHN has experienced some volatility since the fork took place yesterday, but no major damage has been done. According to data from CoinMarketCap, on Saturday, November 14th, BCHN sat around $260; at press time, BCHN was trading at $248.55.

Many major exchanges have stated that they expect no major disruptions as a result of the fork and have signaled that they are ready to accommodate the fork. However, some, including Coinbase, announced a temporary pause in deposits and withdrawals of BCH, as a result of the fork.

Grayscale’s Bitcoin Cash Trust AUM Shrinks by $1.6M after BCH Hard Fork

More from AnalysysMore posts in Analysys »

Be First to Comment