The Australian versus the United States dollar currency pair crystalized on the chart a very convincing appreciation. Do the bears still have a say?

Long-term perspective

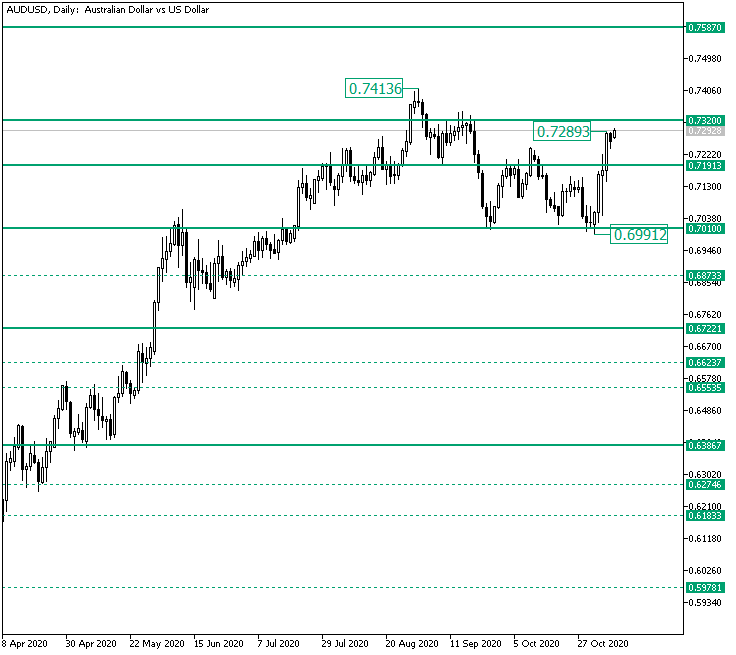

The rally that validated 0.5516 as support managed in spawning the 0.7413 high.

From there, a deep retracement came into being, one which started with the confirmation of 0.7320 as resistance and ended with rotating at the 0.7010 support area.

The rise that followed topped a little above the 0.7191 level before falling back towards the 0.7010 support.

However, the bulls were determined to defend the 0.7010 zone, and this can be seen as the 0.6991 false piercing fueled an ascension that not only conquered 0.7191, but also printed the 0.7289 high.

So, as long as 0.7191 keeps its supportive role, 0.7320 is just a matter of time. Of course, this target can also be met after a short-term consolidation pattern, such as a pennant or flag.

Therefore, after 0.7320 is conquered by the bulls, 0.7587 is the next target, with the psychological level of 0.7400 — not highlighted on the chart — as a partial profit booking area.

Only if the price falls beneath 0.7191, then the bears could drive the price back to 0.7010.

Short-term perspective

The fall from the 0.7243 high extended to as low as 0.6991.

If the fall came after the validation of a significant resistance area, 0.7236, the low was limited but yet another firm level, 0.7002.

The resulting appreciation managed to pass above 0.7236. As long as the price consolidates above it and validates it as support, the intermediary level of 0.7294 should cede, opening the door to 0.7341.

Only if 0.7236 becomes resistance, the bears could aim for 0.7170.

Levels to keep an eye on:

D1: 0.7191 0.7320 0.7587 0.7010

H4: 0.7236 0.7294 0.7341 0.7170

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment