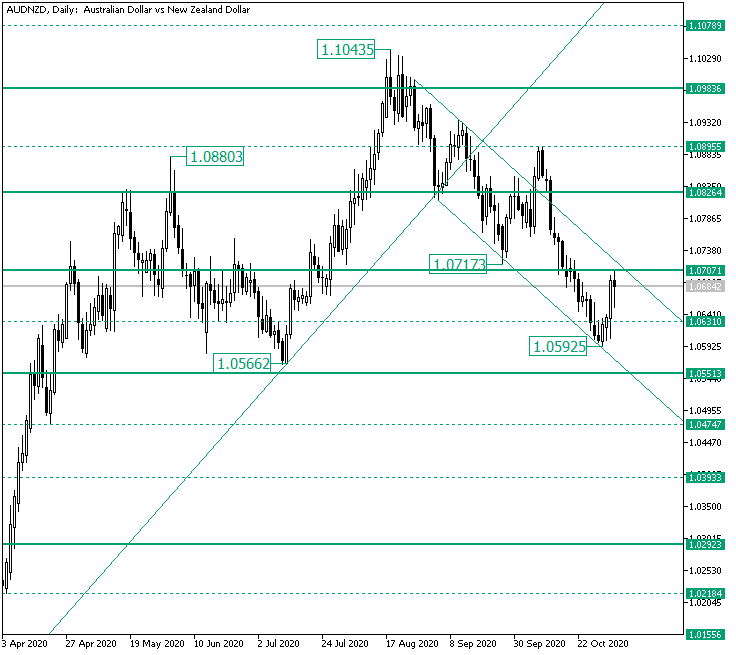

The Australian versus the New Zealand dollar currency pair managed to rotate from the 1.0592 low, thus acknowledging the lower line of the descending channel.

Long-term perspective

The appreciation that started after the firm support level of 1.0013 was validated succeeded, in a first instance, to climb until the 1.0880 high.

From there, the correction took it back to the 1.0566 low, from where a new appreciation commenced, etching the 1.1043 high.

However, the 1.1043 high was formed above the firm resistance area of 1.0936, and since the price — later on — fell beneath it, the bears went very optimistic.

As a result, they send the price beneath the 1.0895 intermediary level and to the 1.0854 former resistance.

The area of 1.0854 was seen by the bulls as their opportunity to start the rally anew. Still, the optimistic bears captured the bullish plan, invalidating it by stopping the price just above the — then — double support area crafted by the ascending trendline and the 1.0895 intermediary level. After that, they pierced the area, and since then, the bears shaped a descending trend that touched the 1.0592 low.

As long as the double resistance zone — defined by the upper line of the descending channel and the 1.0707 level — holds, 1.0551 is in the cards.

On the other hand, validating this area (1.0707) as support opens the door to 1.0826.

Short-term perspective

From the 1.0893 high, the price started a depreciation that ebbed until the 1.0593 low.

From there, the price rotated, validated 1.0621 as support, and then touched the next intermediary level, 1.0681.

If 1.0681 stays resistance, then a flat, with 1.0621 as support, may be in place. On the flip side, if 1.0681 is validated as support, then 1.0741 could be paid a visit.

Levels to keep an eye on:

D1: 1.0707 1.0551 1.0826

H4: 1.0681 1.0621 1.0741

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment