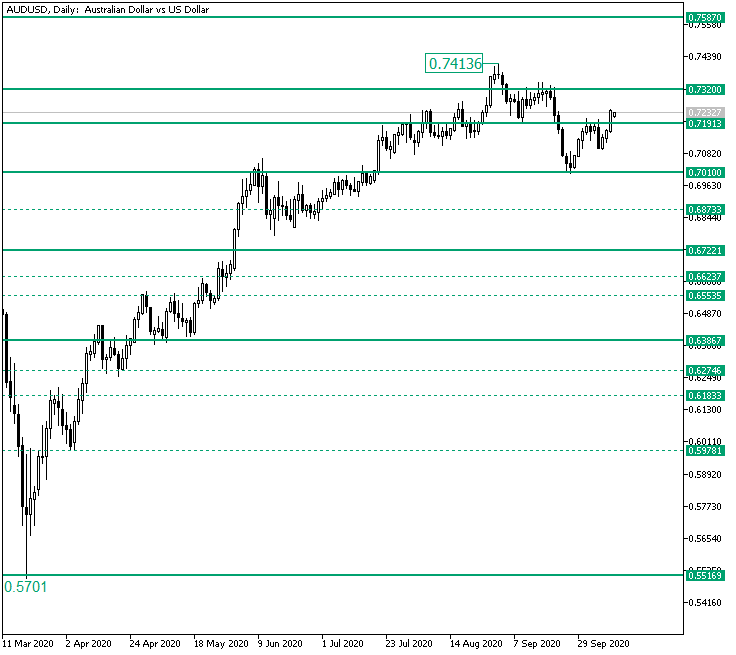

The Australian versus the United States dollar currency pair seems to be determined to reach for 0.7320.

Long-term perspective

The rise that took place from the 0.5701 low extended all the way to the 0.7413 high.

From there, the price slipped under the 0.7320 level, which had just been pierced. The resulting drop reached the next support area, 0.7191.

From 0.7191, the bulls attempted a recovery, but their efforts were limited by 0.7320, which began behaving like a resistance area.

As a consequence, the bears took the price to 0.7010, the next major support area.

Yet again, from here, the bulls started a new recovery, but as the price reached 0.7191, it seemed that history repeats itself, as 0.7191 started acting as resistance.

But as the price started falling, the bulls took decisive action, invalidating the very convincing bearish candle that took shape on October 6.

Thus, they succeeded in closing the candle on October 9, at a relevant distance from 0.7191.

So, as long as the price trades above 0.7191, the bulls have a chance of reaching 0.7320 once more, which, if conquered, opens the door to 0.7587.

On the flip side, if the price falls again, this time under 0.7191, then 0.7010 may receive a new visit.

Short-term perspective

The drop from 0.7345 ended at the solid support area of 0.7002. From there, the rise crafted the 0.7209 high, and then the 0.7095 low.

From the low, the resulting appreciation not that it only took out 0.7209, but it also reached the 0.7236 firm level.

So, one possible scenario is for a short-term consolidation phase to occur — like a pennant or flag — just under 0.7236. The second scenario is for a retracement towards 0.7170 to take place. For both scenarios, the bullish objective is 0.7294.

On the other hand, if 0.7170 fails as support, then 0.7081 is the next bearish target.

Levels to keep an eye on:

D1: 0.7191 0.7320 0.7587

H4: 0.7236 0.7170 0.7294 0.7081

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment