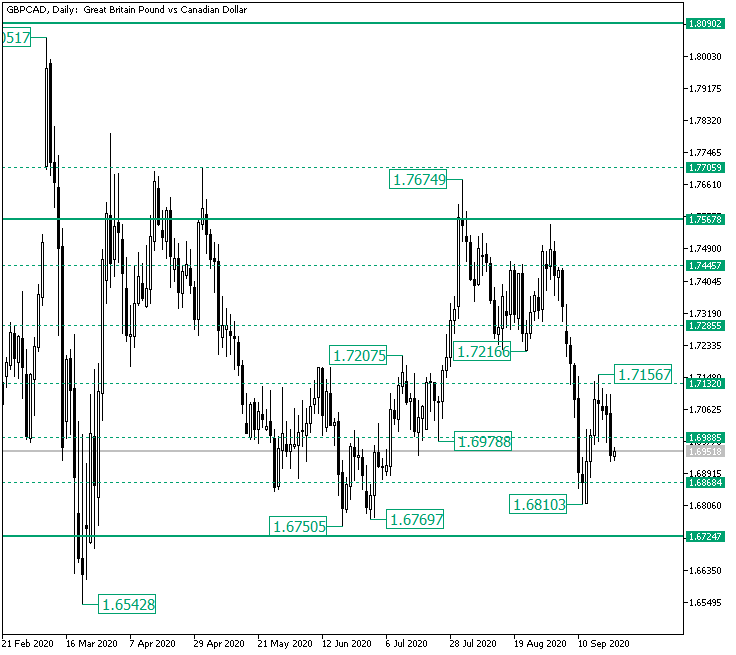

The Great Britain pound versus the Canadian dollar currency pair seems to have ceased the appreciation phase. Is this only a small correction?

Long-term perspective

The appreciation that started after the double bottom — defined by the 1.6750 and 1.6769 lows, respectively — played its role, ended after the 1.7567 level interrupted the movement twice — first by rendering the 1.7674 high as a false piercing and then by stopping the advance that started from 1.7216.

After the candle on September, the 1st, pinpointed that the bulls don’t have enough power, the bears seized the moment and commenced a sharp depreciation.

The resulting downward movement etched the 1.6810 low, piercing along the way respected intermediary levels.

From the low, the bulls retook the lower intermediary level, 1.6868, and then the second one, 1.6988. Then, they extended until the next one, 1.7132, but here they encountered bearish resistance.

As a result, the 1.7156 high was printed on the chart, thus validating 1.7132 as resistance and steaming a new fall. The drop got under the 1.6988 level.

So, if the bulls do manage a comeback and conquer 1.6988, then they could hope for conquering 1.7132 as well. However, if the price oscillates under 1.6988 or fails to sustain the gains above it, then 1.6868, followed by the firm 1.6724 support level, are the next bearish targets.

Short-term perspective

From the 1.7554 high, the price dropped until the 1.6810 low. Reaching the low meant getting beneath the firm 1.6965 support level. But as the bulls took the price above 1.6965, they seemed to have the situation in check.

However, their efforts were hampered by the 1.7094 intermediary level, which limited further appreciation by printing the 1.7156 high. As a result, the price went beneath 1.6965.

As long as the oscillations unfold under 1.6965, further decline is possible, 1.6842 and 1.6698, respectively, being bearish objectives.

On the flip side, if 1.6965 is recaptured by the bulls, then they could reach out for 1.7244.

Levels to keep an eye on:

D1: 1.6988 1.7132 1.6868 1.6724

H4: 1.6965 1.6842 1.6698 1.7244

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Be First to Comment