Five years ago, in 2015, a British financial technology company headquartered in London started a project that completely changed the way millennials look at their daily banking operations. After half a decade, it achieved the title of the most valuable financial technology startup in the United Kingdom reaching £5.5 billion in valuation. Revolut, which is the company’s name, launched the digital revolution now known as neobanking (or challenger banking), which has already been joined by several dozen similar startups around the world.

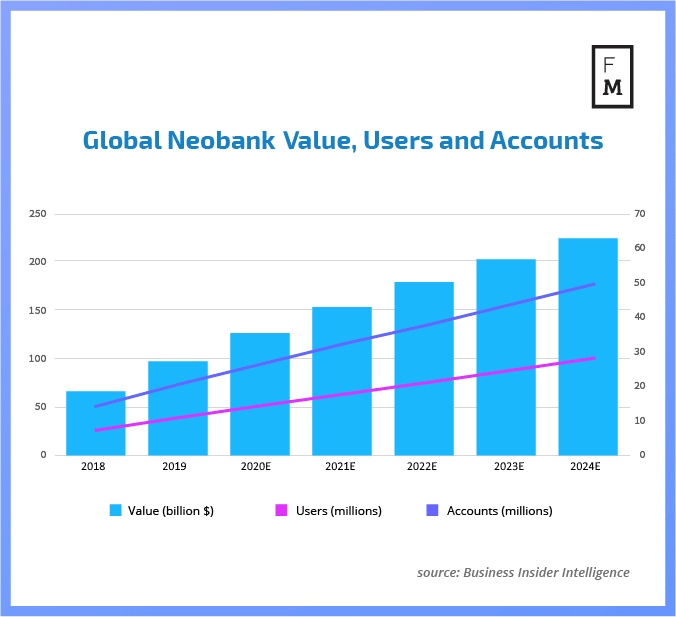

Neobanking on the Rise: From 18.6 Billion to 63 Billion Dollars in 6 Years

Back in 2018, the global neobank value was estimated at around 18.6 billion dollars, while forecasts for 2020 clearly show that the overall value has almost doubled. What is more, in four years from now, industry experts see the value of the neobanking market at $63 billion dollars per year, servicing 186 million accounts and almost 100 million users.

Following in the footsteps of , more digital neobanks have started to emerge in the world, whose activities are fully based on mobile applications. Additionally, the trend was picked up by traditional banks, adapting to the needs of modern consumers.

“Globally, a vast army of neobanks is targeting all sorts of consumer and small-business niches. Banks have long been the only option for borrowers, but for those who want to streamline the process, fintech presents another option. There is no question that neobanks are swiftly emerging as a huge threat to traditional banks,” Jeffrey Siu, Chief Operating Officer at ATFX Group commented.

Neobanking services have changed consumers’ attitudes to daily finances, triggered a revolution in the investment market by introducing commission-free trading, and may soon revolutionise the Forex and CFD industry.

Challenger Banks and What Forex Brokers Can Learn from Them

Brokers need to remember, that according to 2019 data gathered by Finance Magnates, over 43% of Forex retail traders are millennials and only 15% of traders are over 45. What is more, 35% of traders search for a broker using their smartphones and slick onboarding, easy deposit and withdrawal options, and look for a well-designed mobile trading app that is a must for brokers.

Moreover, Challenger banks took advantage of the fact that a large group of consumers felt neglected by traditional banks and brokerage houses. The example of showed that young people want to invest, but the tools available so far have not been adapted to their needs. Digital banks rely on the gamification of trading services, which has attracted a huge number of new clients. Could such a solution work in the FX market?

By complementing the mobility oriented offer with artificial intelligence (almost 50% of traders believe it can improve their investment decisions), and moving to the parts of the world where access to financial services is low but the mobile penetration is high can benefit in faster business growth and takeovers from much larger and often much more experienced market players.

To get the full article and the bigger-picture on the neobanking revolution and its impact on FX/CFD industry, get our latest Quarterly Intelligence Report.

Be First to Comment