SoftBank Group Corp, a Japanese multinational conglomerate holding company, recently announced that it has agreed to sell its chip designer Arm Holdings to for up to $40 billion, according to numerous media reports.

According to a report from Reuters, Nvidia will pay SoftBank $21.5 billion in shares and $12 billion in cash to acquire Arm, which designs microprocessors for smartphones, including $2 billion on signing the deal. The conglomerate could also be paid an extra $5 billion in cash or shares if the company performs well. Employees of the unit will be paid $1.5 billion in Nvidia shares.

Following the acquisition confirmed on Sunday, following a report from The Wall Street Journal on Saturday, SoftBank and Vision Fund will take a stake in Nvidia of between 6.7 per cent and 8.1 per cent. The deal is expected to close in March of 2022.

The deal is subject to regulatory approvals in the United Kingdon, China and the United States and might very well face pushback from regulators and rivals to Nvidia. This is because the acquisition would boost Nvidia, which makes graphic processors, into a dominant force in the chip industry.

The deal announced today comes only four years after the conglomerate bought out the British chip technology firm for $32 billion, and according to the Chief Executive Officer (CEO) of the firm, Masayoshi Son, the company has decided to give up the division because he is slashing his stakes in major assets to raise cash.

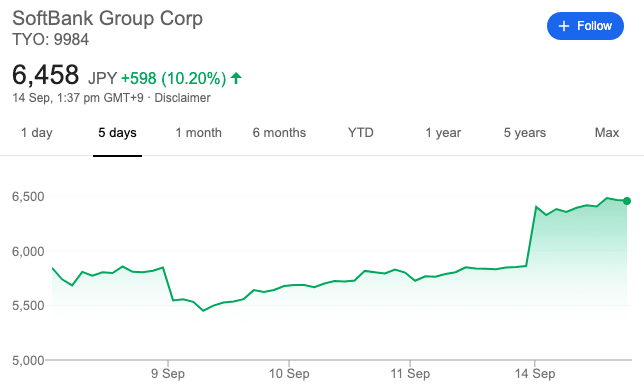

SoftBank Shares Soar Amid Acquisition News

As , on 7th September, SoftBank’s shares took a beating in early trading, dropping by 5 per cent after the company made big bets on equity derivatives linked to listed technology companies.

However, following the news of the acquisition, SoftBank’s share price has surged upward today, climbing by more than 10 per cent at the time of publishing.

Be First to Comment