SushiSwap’s SUSHI token holders were left holding the bag this weekend after ‘Chef Nomi’, the project’s pseudonymous founder, suddenly sold $13 million worth of the tokens. The apparent financial exodus from the project has led some to decry the automated market maker (AMM) as an exit scam.

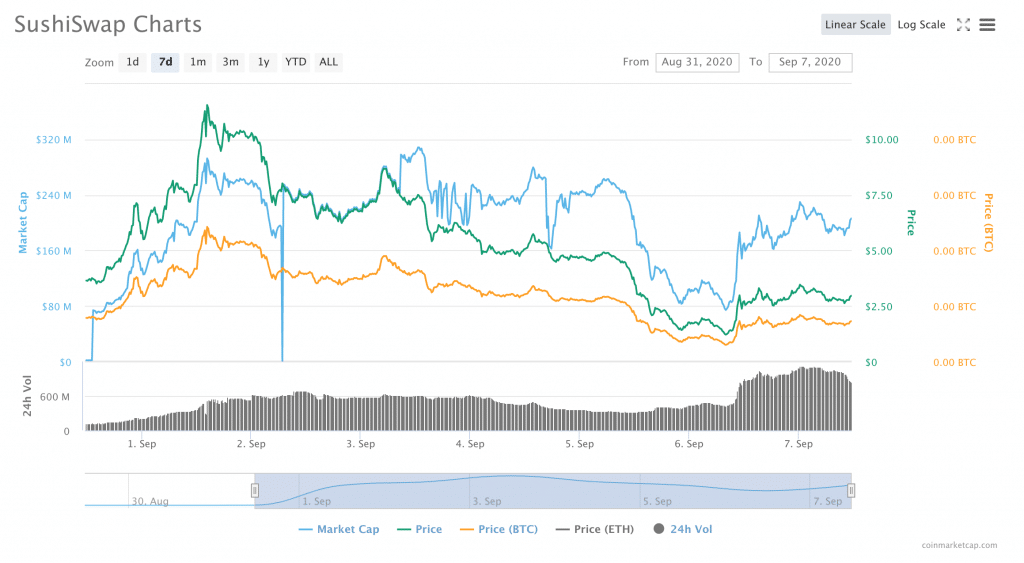

The selloff contributed to a significant drop in the value of the tokens, which peaked at $11.27 on Tuesday and fell to $1.21 on Sunday, a decrease of roughly 90 percent. At the time when Chef Nomi sold his tokens, SUSHI immediately dopped from $4.44 to $1.21.

At press time, the value of the tokens had recovered to $2.75, making the drop slightly less severe.

Despite Chef Nomi’s selloff, he has pledged to stick with the protocol, and said that the decision to sell was well within his rights as the platform’s founder.

“People asked if I exited scam. I did not. I am still here. I will continue to participate in the discussion. I will help with the technical part. I will help ensure we have a successful migration,” he said, adding that

People asked if I exited scam. I did not. I am still here. I will continue to participate in the discussion. I will help with the technical part. I will help ensure we have a successful migration. did that and Litecoin had no problem surviving.

— Chef Nomi #SushiSwap (@NomiChef)

The crypto community, however, is not happy.

Hackles are raised against SushiSwap, Binance

Since the sale of the tokens, Chef Nomi has become the target of much vitriol–and a –on Twitter.

Additionally, crypto lawyer Preston Byrne, who practices at Anderson Kill Law, advised Twitter users that “If you lost money in the SushiSwap exit scam, file a report with the FBI and lawyer up.”

“This coin is regulated as a security, appears not to comply with Section 5 or an exemption from registration and therefore a sale is subject to a right of rescission,” he said. With an alleged ‘exit scam’ you could also probably find common law claims. There are ways.”

If you lost money in the SushiSwap exit scam, file a report with the FBI and lawyer up.

— Preston Byrne (@prestonjbyrne)

Cryptocurrency exchange Binance has also come under fire for listing the SUSHI token without knowing who the founder of the platform is.

However, Binance chief executive Changpeng Zhao allegedly deflected the criticism in a tweet that appears to have been deleted, saying that “for SUSHI, I don’t know who the founder is. If we don’t list new DeFi coins, traffic goes to other exchanges, and we become…obsolete. We provide access to liquidity, we don’t force you to buy.”

“All coins are high risk, especially DeFi.”

can list scam token like because they will get good traffic then why not ? At least is not a scam and everyone knows their founder and team.

— Monesh Kumar (@iMoneshKumar)

Adel Meyer, the head of the DAPScoin project, wrote on Twitter that “the whole $Sushi and @cz_binance story is exactly what’s wrong with the #crypto industry. Few days old project with unknown founder gets listed instantly on @binance FOR FREE where legit projects get charged $$$ or just never get a chance.”

The whole and story is exactly what’s wrong with the industry.

Few days old project with unknown founder gets listed instantly on FOR FREE where legit projects get charged $$$ or just never get a chance.

Disgraceful! 👎

— Adel (@AdeldMeyer)

Finance Magnates has reached out to Binance to verify the validity of the deleted tweet. Binance did not immediately respond. Comments will be added as they are received.

A bit of background information

SushiSwap is a fork of Uniswap, a popular ‘automated market maker’ (AMM) on the Ethereum network. AMMs are fully decentralized protocols that automatically provide liquidity.

The new, Sushi-themed AMM took Uniswap’s protocol and added incentives for providing liquidity through a liquidity provider (LP) token: this is where SUSHI comes in. SUSHI token holders are reportedly entitled to a portion of the ShushiSwap’s revenue.

This is what seems to have made the protocol so popular. Just eleven days after SushiSwap was launched, a whopping $1.27 billion was “locked” inside the protocol–a figure equivalent to 77.4 percent of Uniswap’s tradeable assets, according to Sushiboard.

1/ THE SAGA OF SUSHI 🍣🍣🍣

Things that went right and wrong in .

Enter the thread 👇

— Mikko Ohtamaa (@moo9000)

Additionally, Sushiswap used a technique called “Zombie mining” to reward users with even more SUSHI token tokens in exchange for providing liquidity to the ETH/SUSHI pool on Uniswap. A promotional measure offered rewards up to ten times higher than they would typically be for a limited time.

All of this created a mad dash to collect as much SUSHI as possible: in fact, the protocol was so popular that its launched was blamed for the astronomical gas fees that took over the Ethereum network last week. Uniswap also saw an exponential rise in its “locked” assets as a result.

Eventually, once enough SUSHI liquidity was generated, Chef Nomi planned on using token dispersals to “migrate” the liquidity created on Uniswap through SushiSwap. The date was postponed from Friday to Sunday as SushiSwap’s popularity seemed to continuously grow.

Be First to Comment