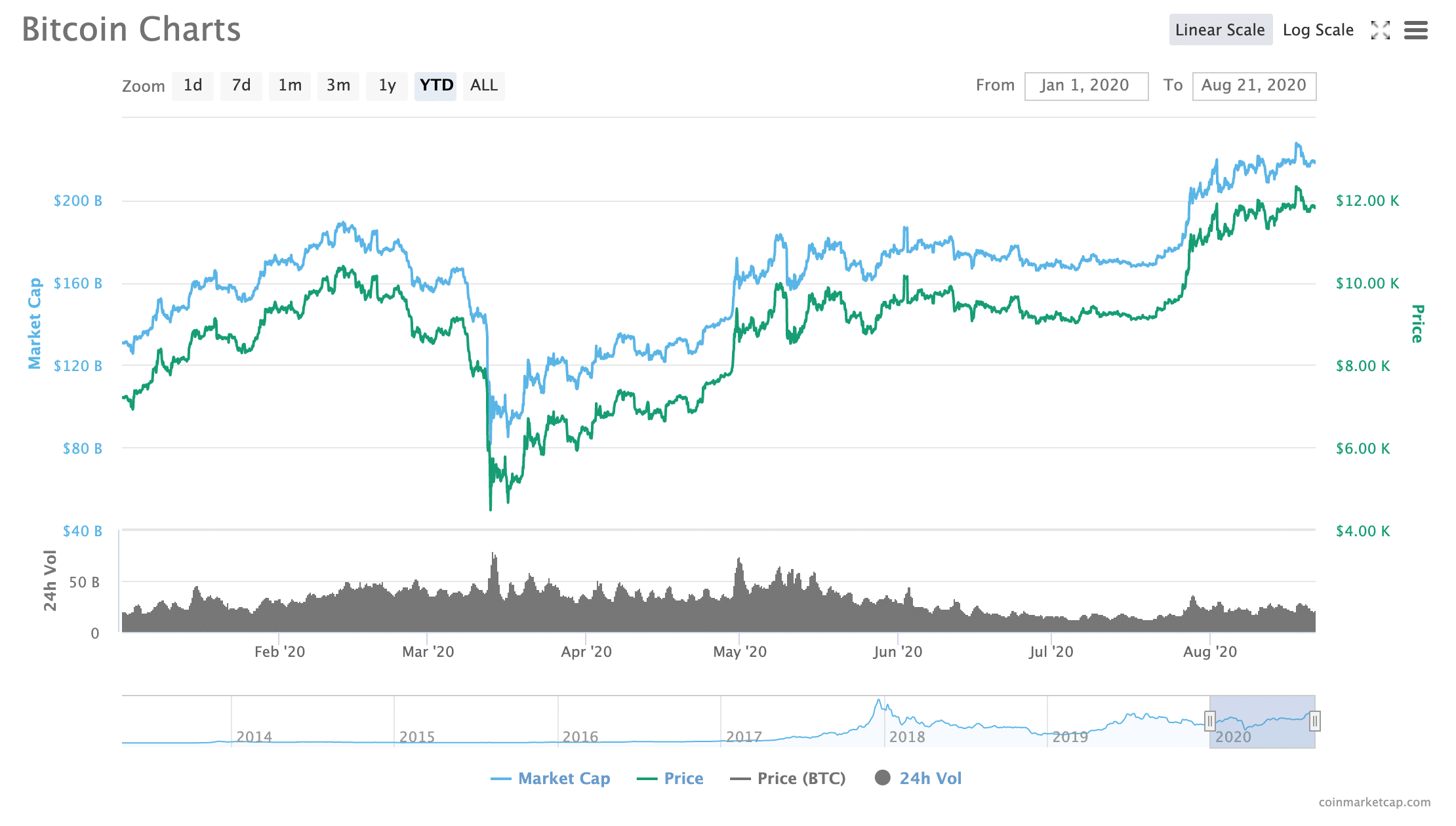

Now that Bitcoin has been dancing between roughly $11,000 and $12,000 for the better part of a month, investors are wondering what’s going to come next.

2020 has been a crazy year in the financial world: has led to unprecedented economic chaos, major changes in monetary policy, and a drastic public reconsideration of what “value” really means.

Therefore, it seems that Bitcoin–which has been described as inherently non-inflationary–could be gaining a foothold as a so-called Therefore, this dance between $11k and $12k could be the beginning of a larger trajectory to much higher prices.

However, others believe that Bitcoin is overbought, and imminently due for a market correction. What’s in the cards for BTC?

A bigger bull run?

For some, the fact that Bitcoin has managed to hold a level over $11,000 for several weeks is a sign of a larger bull run to come: some analysts have targeted $25k, $50k, or even $100k within the next two years.

What could be

Investment firm Grayscale saying that Bitcoin’s ability to sustain higher price levels is demonstrative of an increasing number of long-term holders in the space.

In other words, Grayscale believes that there is a higher ratio of people who are buying and holding Bitcoin to day traders and short-term speculators.

In addition, the reported noted a historically low level of BTC on exchange wallets, which could indicate that fewer people are making moves to trade or sell their Bitcoins. However, the report also found that daily active addresses are at their highest level since 2017’s all-time highs, signaling higher-than-usage of Bitcoin

Grayscale believes that this kind of market structure is a positive thing for Bitcoin’s future. In fact, the report drew a parallel between Bitcoin’s current market makeup and the Bitcoin market of early 2016, just “before [Bitcoin] began its historic bull run.”

Therefore, Grayscale has made a prediction that the demand for Bitcoin will continue to grow–and significantly.

”Loose monetary policy” could be a driving force behind Bitcoin’s upward trajectory

According to Grayscale, one of the largest forces at play is the influence of “loose monetary policy” that has influenced markets over “the last half century”, as well as is the ongoing influence of stimulus efforts from the United States Federal Reserve, as well as other financial institutions from around the globe.

“Loose monetary policies resulted in money being funneled into financial assets instead of the general economy or main street as intended, increasing the disconnect between the equity market and the economy,” the report said. As a result, the United States’ ratio of debt to GDP has nearly doubled since 2008.

Therefore, Grayscale–along with many others in the crypto space–seem to believe that Bitcoin is increasingly seen as a sort of “antidote” to inflation: “Because of Bitcoin’s unique qualities – such as its verifiable scarcity and a supply that can’t be controlled by a central authority – we believe it can be leveraged as a store of value and as a way to escape this great monetary inflation,” the report says.

After all, there can only ever be a maximum of 21 million Bitcoins in circulation at any time–many of which have been permanently lost, and many of which have yet to be mined.

Bitcoin may not be the “safe-haven” some seem to think it is

However, not everyone believes that Bitcoin is such a strong hedge against inflation.

For example, in May, finance giant Goldman Sachs said in a presentation that “Bitcoin does not show evidence of hedging against inflation.”

Specifically, Goldman said that although Bitcoin itself may be a “scarce resource”, cryptocurrencies as a whole are not a scarce resource: that there are several thousand cryptocurrencies in existence, and more are being created all the time.

Goldman also pointed out that several of the largest cryptocurrencies by market cap were created as “forks” from the Bitcoin blockchain, and are therefore very similar to Bitcoin: specifically, Bitcoin Cash (BCH) and Bitcoin SV (BSV).

Goldman also argued that Bitcoin is “a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it”, and that therefore, Bitcoin “is not a suitable investment.”

Additionally, the firm said that because infrastructure of cryptocurrency is still relatively young, it may be susceptible to hacking or other technical issues that result in financial loss.

Is a market correction overdue?

Additionally, while Bitcoin’s performance has been so positive over the last several months, there are some within the space who believe that a price pullback is imminent.

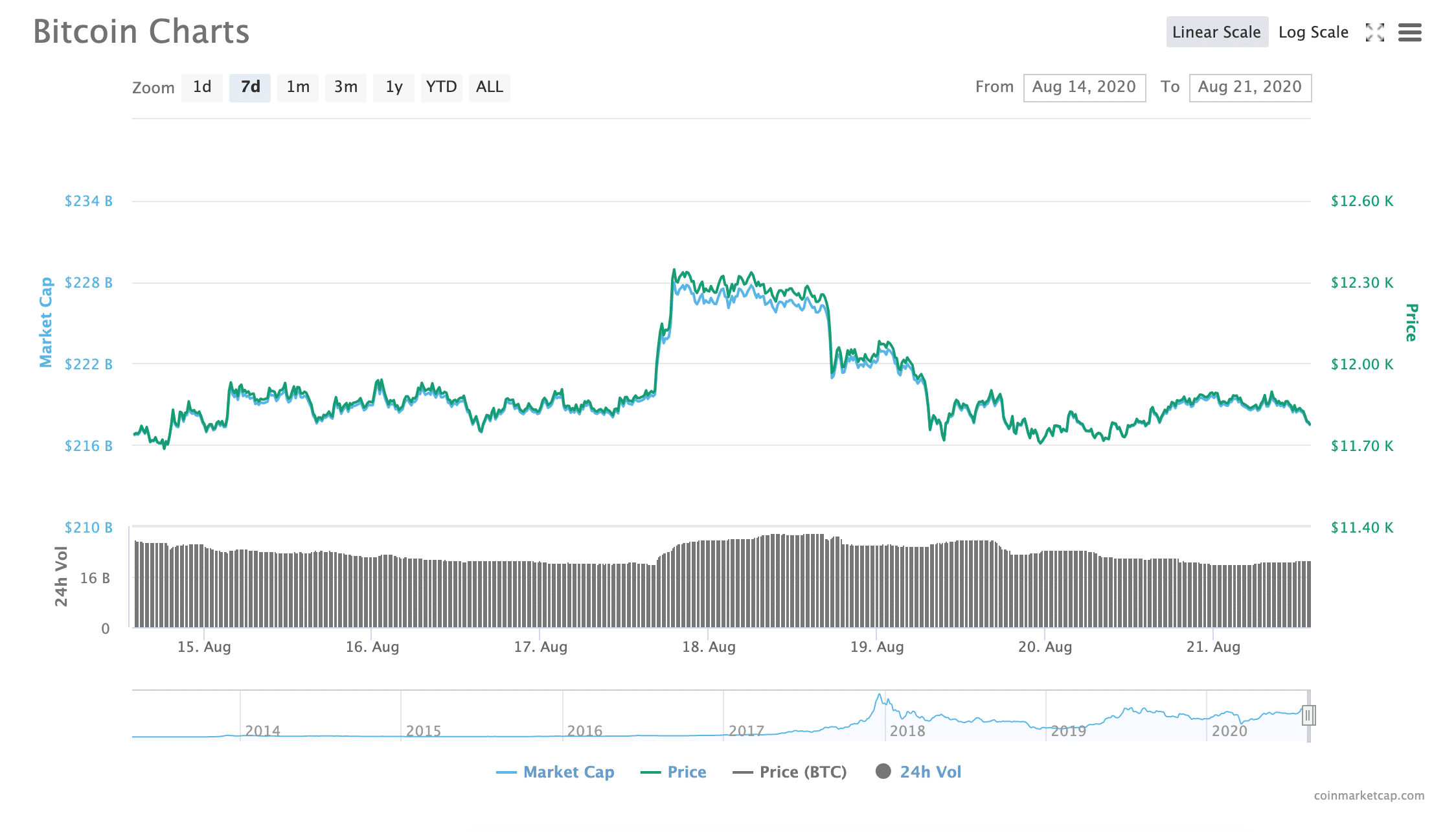

For example, CoinDesk reported this week that a short-lived jump up to $12,400 on Monday of this week represented a “failed breakout” that could be a sign of “bullish exhaustion”. In other words, the failure to maintain levels above $12,000 could represent a combination of slowing price gains and weakened buying pressure.

Singapore-based digital economy trading firm QCP Capital also this week that “Monday’s breakout of $12,000 was almost entirely short-squeeze driven.”

A short squeeze is what happens when the price of an asset suddenly jumps higher, thereby forcing traders who “shorted” the asset, or bet that its price would fall, to buy it in order to prevent greater losses. This kind of activity can artificially prop up the price of an asset for a short time.

Therefore, QCP believes that Bitcoin’s “resultant failure [to breakout] just ahead of larger offers [sell orders] at $12,500 has solidified the price range of $12,000-$12,500 as a key resistance area for an extended period.”

BTC’s future hinges on the dollar’s performance in 2020

QCP also noted that while certain other market indicators could appear bullish at first, it’s possible that the market may be overbought at the moment.

For example, open interest in bitcoin futures on major exchanges rose to record highs of roughly $6 billion on Monday, an increase of 200% from the March low of $1.93 billion, according to data source Skew; additionally, Skew reported on Tuesday that Bitcoin options’ “total open interest [were] sitting at $2bln, up 6x since the start of the year.”

options total open interest sitting at $2bln, up 6x since the start of the year. Watch this space!

— skew (@skewdotcom)

CoinDesk reported that it’s precisely this kind of “bloated bullish positioning” that can lead to “deeper price pullbacks,” particularly in cases where it’s “accompanied by overbought readings on technical indicators,” as it seems to be now.

However, QCP Capital also said that much depends on the continued movements of the dollar, which hit its lowest point in two years earlier this year.

“No doubt the US has a capital leakage problem, evident from all the USD selling we see everyday during US hours,” QCP said. “We therefore look again to the late EU/early US sessions especially into August month-end for clues to the next big move, and whether or not a short squeeze is nigh.”

QCP also noted that there could be quite a bit more movement in the USD throughout the rest of the year due to upcoming political events in the United States: “the prospective catalysts are there for a large squeeze,” QCP said, including “[possible] disappointment over failed fiscal stimulus, democratic/republican conventions,” and more.

Keeping an eye on the $11.6k-$11.7k range

In the short- and medium-term, therefore, the $12,500 resistance level may not be a realistic goal.

Instead, QCP says that “we see this $11.6-11.7k level as the new key short-term pivot to watch,” and that it’s possible to see a “retest” of the $11,000 level.

“Only a break and close under $10.5k will make us change our medium-term bullish bias,” the firm said. $10,500 was the highest that Bitcoin reached earlier this year before the COVID-19 economic crisis caused crypto markets to crash in March.

However, while a retest of the $10,500 level is certainly possible–and may even be necessary to fortify Bitcoin’s price floor in the future–it seems as though for the foreseeable future.

It may be too soon to speak–after all, CryptoSlate pointed out that so far, this hold past $10k is only the 4th-longest time that BTC has managed to stay above the $10,000 mark.

Still, though, researchers at Bloomberg said earlier this week that Bitcoin will only lose its value-building momentum if “something unexpected” stops it.

“Something unexpected needs to happen for Bitcoin’s price to stop doing what it’s been doing for most of the past decade: appreciating,” wrote senior strategist Mike Mcglone on Twitter. “Demand and adoption metrics remain favorable vs. the crypto asset’s unique attribute of fixed supply.”

Bloomberg Intelligence Commodity Primer – Something unexpected needs to happen for ‘s price to stop doing what it’s been doing for most of the past decade: appreciating. Demand and adoption metrics remain favorable vs. the asset’s unique attribute of fixed supply.

— Mike McGlone (@mikemcglone11)

What are your thought’s on Bitcoin’s next moves? Let us know in the comments below.

Be First to Comment