Futu Holdings, the operator of a Hong Kong-based , has published its financials for the second quarter of 2020 ending on June 30, showing an excellent growth in both revenue and profit.

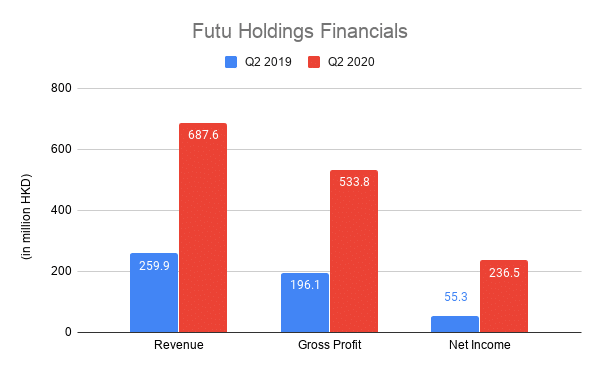

The broker reported a 164.6 percent increase in its year-on-year revenue for the period to HKD 687.6 million ($88.7 million).

This resulted in a gross profit of HKD 533.8 million ($68.9 million) and a net income of HKD 236.5 million ($30.5 million) – a year-on-year increase of 172.2 percent and 327.7 percent respectively.

During the quarter, the brokerage on-boarded 64,566 new paying clients, an 84 percent year-on-year jump, taking the total number to 303,102.

“The growth rate of our China mainland paying clients hit a record high since the fourth quarter of 2018, and the growth of Hong Kong paying clients further accelerated to 125.2% year-over-year,” Li added.

The unaudited financials also detailed that it generated HKD 409.5 million ($52.8 million) from brokerage commissions and handling charge alone, that increased 234.8 percent year-on-year. Another HKD 207.9 million ($26.8 million) came from interest incomes.

With the increasing revenue, the operating cost for the quarter also jumped 141.1 percent to HKD 153.8 million ($19.8 million).

“We believe that the increase in US-listed Chinese companies seeking secondary listing in Hong Kong and the surge of high-profile will act as major tailwinds to our growth,” Li continued.

Strengthening international presence

The broker also received capital markets services (CMS) license from the (MAS) for its local entity Futu Singapore Pte. Ltd.

“This marks a milestone of our internationalization, and we will continue to look for new markets to extend the footprint of our business,” Li said.

Be First to Comment