While it looks like the worst in global COVID-19 pandemic is behind us, a more in-depth analysis of traders’ behavior from shows even better results. As the March and April shows, retail FX traders broke all activity records but also started to withdraw money.

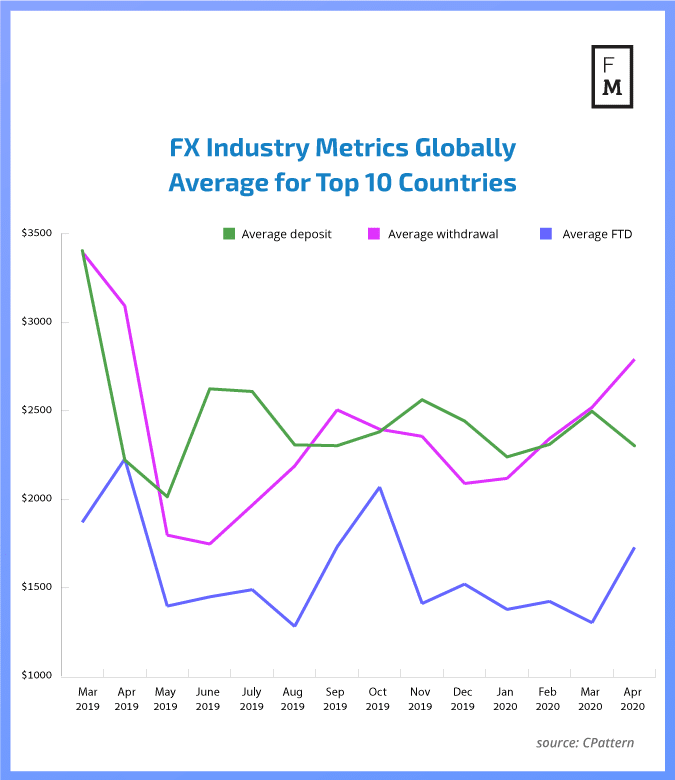

In March, the average deposit being made to retail forex accounts grew to $2,502 from $2,315 seen a month earlier. But already in April, this value decreased to $2,307. Surprisingly, or not, April brought us growth in the average withdrawal size to $2,795 from $2,524.

One would be forgiven for assuming that retail traders where withdrawing profits made in a period of higher activity. However, data on the average FTD (first-time deposits) also shows growth, suggesting that it could also be an explanation for eventually increased withdrawals. The average FTD grew to $1,732 from $1,307 seen in March.

Retail FX traders were even more active

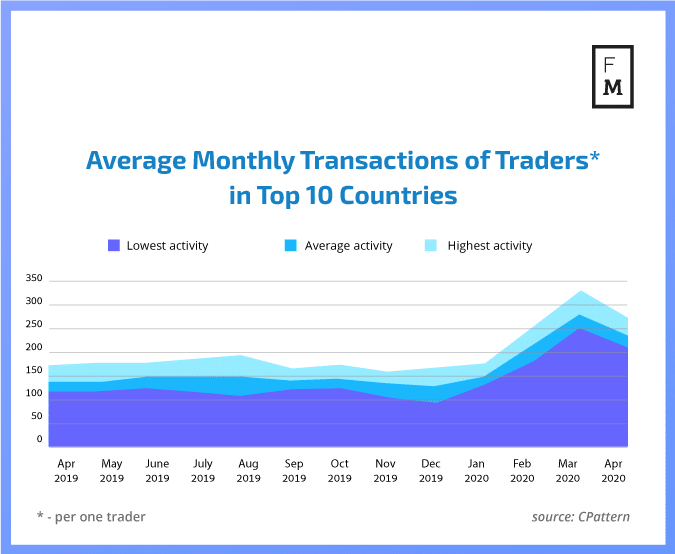

But the biggest changes were seen again in the trading activity of traders. While February data already delivered a higher number of transactions, in March, the average trading activity skyrocketed to a whopping 275.5 transactions per average trader.

In April, the average number of transactions per trader retraced to 229.8 per month. Traditionally, the most active traders were found in Asia. Thai retail FX traders made 252.3 transactions in March, while in April, Chinese traders made even more – 267.1 transactions per month.

The pandemic situation in China improved noticeably in April. Meanwhile, Tencent, a Chinese multinational conglomerate holding company, pledged to in new technologies, including blockchain. “Expediting the ‘new infrastructure’ strategy will help further cement virus containment success,” Tencent’s senior executive vice president said in a report.

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, cryptocurrencies, Forex, and CFDs trading.

For this reason, the has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts that will serve as a valuable knowledge base for your decision making.

Be First to Comment