Stemming from the confined venue of speculation and economic theory, there is much to address regarding the probability of whether Bitcoin will ever reach $100,000.

To bring light upon the query in motion, we’ll analyze long-standing economic theories versus economist’s doubts while taking under due consideration deeply-rooted market variables, projections, and global acceptance that are all bound to distill a change in the value of Bitcoin in one way or another.

With these truths in mind, let’s begin.

What Crypto Enthusiasts Project

Cryptocurrency enthusiasts have long poised the likelihood of Bitcoin reaching $100,000.

Evidence of this can be noted from high-profile individuals such as Anthony Pompliano, Co-Founder and Partner of Morgan Creek Digital.

“…I still think Bitcoin will hit $100,000 by end of December 2021. Fixed supply. Increasing demand. Time will tell.”

Charles Hoskinson, Ethereum Co-Founder, had tweeted in late 2019:

Bitcoin’s price is going down? Remember everyone, after the FUD, news trading and manipulation clears out, we still have a global movement that’s going to change the world. We will see 10k btc again and welcome 100k. Crypto is unstoppable. Crypto is the future

— Charles Hoskinson (@IOHK_Charles)

Then, of course, we have the more recent actionable insights rendered through ” The Great Monetary Inflation” proclaimed by macro investor Paul Tudor Jones, who acquired Bitcoin as a hedge against inflation earlier this month.

Despite acquisitions and proclamations attesting to Bitcoin’s impending worth, one should also assess whether these claims are rather a publicity stunt to increase Bitcoin participation or rather a deep-rooted belief originating from a coupling between past experiences and a desperate desire of riches to prolong extravagant lifestyles.

Regardless, these speculations should be taken with a grain of salt and weighed accordingly.

Addressing Economic Theory & Models

While crypto enthusiasts rely upon speculation in the , investors and Bitcoin participants tend to primarily formulate their assumptions upon tangible evidence that is derived from projection models and macroeconomic theories.

Projection models such as the Bitcoin S2F Model and M2 capitalization theory project astronomical valuations for Bitcoin but as time has shown us one of these models has already been debunked.

M2 Capitalization Theory

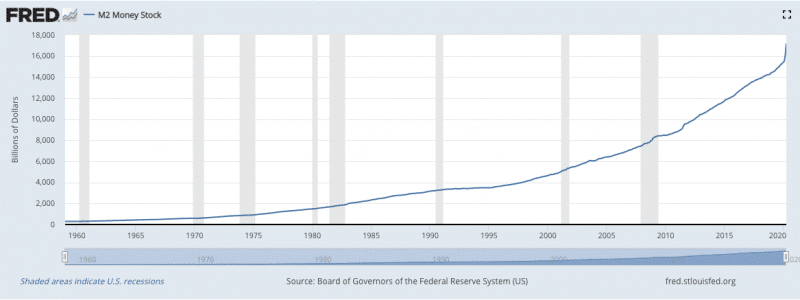

Over the past few years, and more prominent now as a method used to combat the financial ramifications of the Coronavirus pandemic, quantitative easing has been performed by countries’ central banks.

Take for instance the U.S. Federal Reserve, which has been printing U.S. dollars at an exponential rate since 1970.

Generally, a healthy economy would be characterized through depreciation in prices due to entities finding more efficient and affordable alternatives for similar goods and services but that is not the case.

To highlight the core point of this theory, should the Federal Reserve continue to print U.S. dollars at an exponential scale then, as a result, the U.S. dollar price of Bitcoin will also continue to rise at an exponential rate until it has reached a value of $100,000 per Bitcoin.

Bitcoin Stock-to-Flow Cross Asset Model

Also known as the Bitcoin S2F model, the Bitcoin Stock-to-Flow Cross Asset Model ratio created by @100trillionUSD seeks to measure the effect of scarcity on BTC price through measuring current Bitcoin circulation and production rate.

As @100trillionUSD suggested in 2019 through , “The predicted market value for bitcoin after May 2020 halving is $1trn, which translates in a bitcoin price of $55,000. That is quite spectacular. I guess time will tell and we will probably know one or two years after the halving, in 2020 or 2021. A great out of sample test of this hypothesis and model.”

While it doesn’t take a mathematician to deduce how significantly short this economic model failed, up to 8 additional flaws have been reported regarding the Bitcoin scarcity valuation model.

As a result, we can no more put stock in economic theory than we can through unwarranted speculations.

Economists Debate

The most level-headed forerunners for predicting future Bitcoin prices may be contributed to economists who have yet to be proven incorrect regarding their cynical-based projections.

Such examples include the projection laid upon us by Kenneth Rogoff, an economist and Harvard University professor, who went on to express the following during a

“I think bitcoin will be worth a tiny fraction of what it is now if we’re headed out 10 years from now … I would see $100 as being a lot more likely than $100,000 ten years from now.”

“Basically, if you take away the possibility of money laundering and tax evasion, its actual uses as a transaction vehicle are very small,”

It should be noted that Rogoff isn’t the only economist who feels that Bitcoin won’t amount too much value in the future.

Joe Davis, a lead economist for Vanguard, a high-profile investment firm,, “I’m enthusiastic about the blockchain technology that makes bitcoin possible… As for bitcoin the currency? I see a decent probability that its price goes to zero,”

“The bitcoin – its value is based off of scarcity – and an artificial scarcity that’s out there,” “It’s really tough to imagine where the long-term return comes from other than speculation.” – Joe Davis

If speculations regarding Bitcoin’s future applications are truly the driving force behind the volatility then the valuation of BTC as a whole is crippled as a result of diminished cash flow.

Black Swan Consideration

While speculation and debunked theories are two sides of the same coin, black swan events are an entirely different entity that has been known to characterize an era of hardship and uncertainty.

Unforeseen black swan events, such as the recent Coronavirus Stock Market Crash, have gone to illustrate that no economy is impervious to flaws while also dismantling the long-standing ideology that Bitcoin is a ‘safe haven’ asset.

Given the ramifications that can materialize from the wake of black swan events, no Bitcoin valuation can be complete without the possible occurrence of these devastating events.

To expand, modern times must be taken into account.

Such as, those of us reading this have already survived one black swan event but given how countries are starting to open their borders and governing states are once again re-opening their economies, the likelihood of another black swan event occurring as the byproduct of a second outbreak of Coronavirus only increases with each easing of confinement limitations folded back.

Therefore, it would be optimistic to the point of foolishness not to weigh these truths in your mind when speculating the possibility of BTC reaching $100,000.

Bitcoin Adoption Feasibility

One variable piece of the puzzle that can significantly influence Bitcoin’s likelihood of $100,000 per coin would be the mainstream adoption of Bitcoin.

Should a significant surge in Bitcoin participation become present, then the generalized economic theory of supply and demand can be implemented as an increase in participation will likely be contributed to an increase in demand.

Through an increase in demand comes an appreciation of value, which given how Bitcoin supply is limited, should further strengthen the ideology that an increase in Bitcoin demand will increase the price of Bitcoin.

Bitcoin Market Capitalization

Let’s ditch the economic theories and speculations to conduct some simple arithmetic.

The maximum sum of Bitcoins that will exist is 21 million.

Should the value of Bitcoin reach $100,000 per coin then the total potential market capitalization of Bitcoin, once all mined, would be equivalent to $21 million x $100,000 = $2,100,000,000,000 or $2.1 trillion.

in late 2019, the value of the global equities market surpassed $85 trillion, or $85,000,000,000,000.

It should be noted that the global value of the equities for 2019 started under $70 trillion, meaning it saw an increase of no less than $15 trillion throughout the year 2019.

To put that into perspective, should Bitcoin reach a value of $100,000 per coin (even if all were mined) that would mean that the market capitalization of Bitcoin would be more than 40x’s less than what the value of the global equities market was at the end of 2019.

($85,000,000,000,000 global equities value / $2,100,000,000,000 = 40.4761904762)

Putting the Pieces Together

Putting stock in speculations asserted by advocates will get you no further than faulty economic theories that can in no way, shape, or form take under due consideration all the innumerable variables that nest their way into the ever-changing Bitcoin valuation equation.

Through M2 capitalization theory and the renowned principles of supply and demand, we are rendered rather convincing insights into the possibility that Bitcoin could reach $100,000 which is further strengthened when you compare the capped off Bitcoin market capitalization of $2.1 trillion to that of the $85 trillion for global equities in 2019.

While, at first, it may have seemed like a highly unrealistic projection of Bitcoin reaching $100,000, but when you stop to put it in perspective with the total value of global equities then it may appear, to some, as only a matter of time.

Regardless, and to conclude, it is impossible to accurately predict the value of Bitcoin in 10, 20, or even 40 years from now but if history has taught us one thing it would be that anything is possible.

Be First to Comment