In the last seven years we have seen Asian market volumes increase quite significantly and, in some cases, outperform the West.

There are many factors involved in the evolution of the Eastern market which present an array of predictions for the future. What these factors are and how they manifest into regional differences is a hotly debated topic.

General growth of the region means increased demand for local expertise and local execution

Asia has for a long time been seen as a key growth point for our industry.

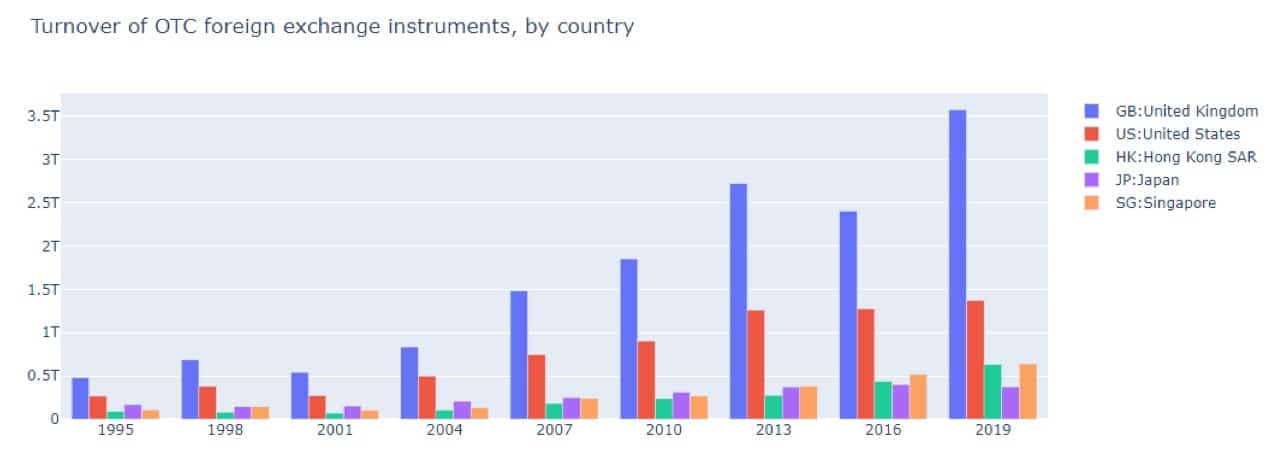

In the 2016 BIS Triennial Survey, the market saw combined OTC FX volume from Hong Kong, Singapore and Japan overtake the US for the first time and this lead grew throughout 2019.

We also witnessed significant growth in retail FX activity in EM markets, NDFs and carry trade strategies in 2019 with Asian retail clients increasingly diversifying into adding oil exposure.

From an institutional perspective we have seen both complexity and market fragmentation increasing which has naturally lead to the further electronification of trading across the region.

This increase in both volume and complexity is now driving demand for local expertise and local execution. It is no longer enough to execute clients in and around Asia all the way over in NY4, they rightly expect their trades to be seamlessly and quickly executed in data centres closer to their client base.

Similarly, expert knowledge on pricing and execution in order to get clients the best sustainable liquidity is more important now than ever.

Gone are the days when it was acceptable to “wait until London or New York is in” before giving quality feedback.

Historically lower volume in the Asia time zone

There are strong levels of volume in JPY and CNH across primary markets during the Asian trading time zone, which is roughly in line with London hours.

Once you get outside of these currencies there can be significantly less volume across primary and secondary markets compared with other time zones, especially in the FX witching hour, between 1700 and 1900 New York (EST).

This generally makes both the spread wider and the available size for that spread lower.

These lower volumes mean that liquidity providers (LPs) may take longer to exit risk and also face more severe adverse market impacts.

This can cause a client trading during Asian hours to be perceived as having flow that is harder to manage than the same type of flow during other time zones.

Therefore, careful selection of LPs is a must and an open dialogue with clients can get on top of these issues as soon as they arise.

Multiple data centres in Asia

One of the unique features of Asia maturing, is multiple competing data centres in FX. While in both Europe and the US there are several data centres, the vast bulk of trading takes place in NY4 York and LD4.

In Asia however, you have TY3 and the ever rising SG1, which both offer local price discovery and execution. It is going to be important for brokers and liquidity providers to take this into account when planning their future infrastructure spends.

The Future

One of the key differences in the landscape of Asian liquidity vs the West is the future.

As we mentioned previously, in 2019 the average daily OTC FX volume of HK, Japan and Singapore combined outpaced the US even more so than in 2016.

The growth in these areas suggests SG1 is in a strong position to grow significantly as an execution centre. An example of one of the benefits of executing in SG1 is the physical advantage in terms of regional latency.

You will save over 60ms versus TY3 from Singapore, Thailand, India, Indonesia, Philippines and Malaysia.

There is an argument that all algorithmic strategies that care about latency can be co-located in any data centre. Our view is that there is a large intersection of end clients who care about latency, but won’t go as far as to co-locate.

Clients using systems that are hosted locally to them still expect their providers’ service to be optimised.

A prerequisite for prime of primes offering local execution, is having local execution from bank and non-bank liquidity providers. As this is set up in SG1, CFH will lead local service and execution.

This has been achieved in TY3 and is being rolled out in SG1. A notable example is both Citi and BNP announcing launches of matching engines in SG1 at the beginning of the year.

CFH believes the future is bright for the and we are looking forward to being part of it.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.

Be First to Comment