Well, folks, Bitcoin is on its way up again–at press time, the price of BTC had climbed past $10,300 and seemed to be giddily moving further up. Price levels this high haven’t been reached since July of last year, when Bitcoin briefly scraped the bottom of $13,000 before crumbling back below $7,000 over the course of several months.

What’s going to come next? Sure, BTC could hit $13,000 this time, or even surpass it–but once again, will the price slowly fall back below that precious $10,000 support level into the $8, 7, 6,000s?

It certainly could–but this time, a number of analysts are saying that this price run is different.

*** Update: my 2 sats on price:

– 2020: btc stays above $8200 (so we are NOT dropping to $6k or $4k levels that others are predicting now)

– May 2020 halving: will be above $10k

– 2021: bull run starts after the halving and tops $100k before Dec 2021

— PlanB (@100trillionUSD)

There’s no singular magical ingredient that seems to be causing this hypothesis to be shared by so many Bitcoin pundits–instead, it seems as though a perfect storm of institutional capital, geopolitical tensions, and various forms of societal turmoil has been brewing–add that to Bitcoin’s upcoming halvening that’s due this May, and baby, you’ve got yourself a stew goin’.

2020 is off to a great start.

– Warren Buffett now owns Bitcoin

– SEC exploring 3 year grace period for token issuers

– Bitcoin halving in May

– ETH 2.0 launching in Q2

This is the calm before the storm.

2020 is the start of the roaring 20s for crypto 🚀🌝👍💯

— Ian Balina 🚀🌝💰🤫 (@DiaryofaMadeMan)

Let’s take a look at each of the possible reaons for Bitcoin’s push past $10k.

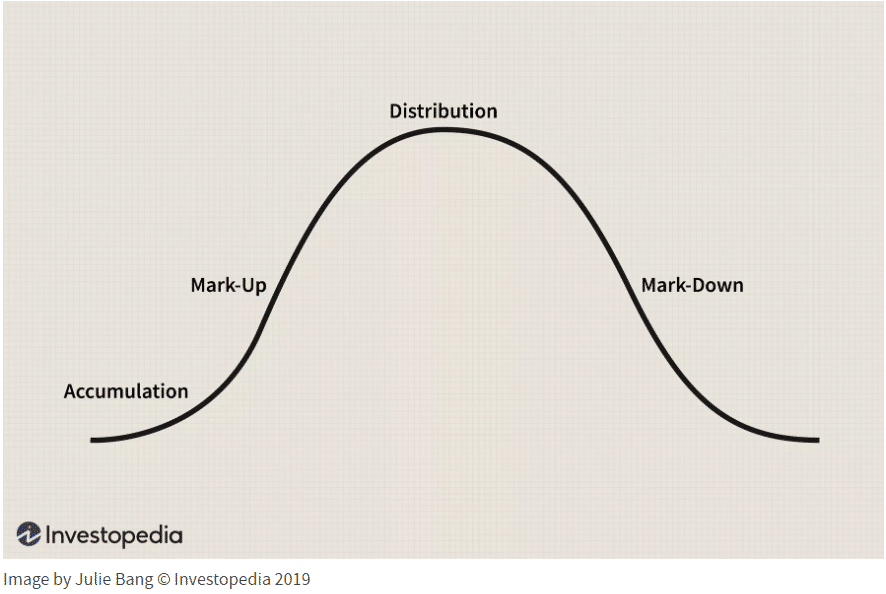

Bitcoin is moving from accumulation into distribution

On February 9th, Willy Woo, renowned crypto market analyst and partner at Adaptive Fund, tweeted that “this breakout is the real deal.” The reason? “Fundamental investment activity.” In particular, Woo pointed to “investor velocity”, an Adaptive Fund metric that tracks the presence of “buy and hold” investors in the Bitcoin network–in other words, investors who aren’t moving their coins onto exchanges and other platforms.

“This metric corrects for degradation of signal from coins moving off the blockchain onto layer 2 (exchanges etc),” Woo explained in a follow-up tweet.

Lower chart tracks investor velocity (the buy and hold people, not short term traders). This metric corrects for degradation of signal from coins moving off the blockchain onto layer 2 (exchanges etc), that was something NVT was prone to. It’s proprietary to

— Willy Woo (@woonomic)

Woo originally predicted that a price run was on the way in December, when he tweeted that “we are in the re-accumulation phase of a bull market,” citing an increase in on-chain activity.

Are we in a bear market?

No, we are in the re-accumulation phase of a bull market.

— Willy Woo (@woonomic)

Although the price of BTC was declining at the time of the post, Woo wrote that “When we say accumulation we mean coins pass from dumb money to smart money as all trades are matched. Price can go up or down during this phase, what matters is what happens after this phase that determines distribution from accumulation.”

“Smart money”, in this case, refers to “the capital that is being controlled by institutional investors, market mavens, central banks, funds, and other financial professionals,” according to Investopedia. “Dumb money” is comprised of capital from “average individual investors”.

The accumulation phase that Woo mentioned is a normal part of a typical market cycle, wherein the market has already bottomed after a period of initial hype. During this period, early adopters, innovators, and contrarians will use this period as an opportunity enter the market at a “discount”–over time, the market sentiment shifts from negative to neutral. This phase is followed by mark-up, distribution, and mark-down phases, wherein Bitcoin rises and falls–but hopefully not to the same lower levels as before.

Bitcoin, of course, has had a number of these cycles–and over time, the floor of the mark-down phase has lifted.

Yusaka Senga, chief executive of Singapore-based inter-blockchain swap protocol firm Swingby, told Finance Magnates that while “it’s always risky to say ‘this time it’s different’,” the steady presence of “smart money” within the space seems to be playing an important role: “this breakout above $10,000 does feel like it has a stronger ground than previous price runs.”

“In addition, we have seen BTC test the $10,000 ceiling and reject a few times before holding above,” Senga commented. “There seems to be some caution in this price run that was missing in the 2017 mania at least.”

The next ”halving” will increase scarcity, which could already be driving BTC prices up

For Senga, however, “the elephant in the room here is the halving coming down the road in a few months.”

“Halving” or “halvening” on the Bitcoin network refers to instances when BTC mining rewards are cut in half. On the Bitcoin network, halving happens regularly at preset intervals of every 210,000 blocks. This is built into the Bitcoin protocol; the next halvening is scheduled for around May 14th of this year.

“Previous halvings have been,” Senga noted.

Indeed, a blog post by US-based crypto trading firm Coinbase noted that although “one might assume that fewer miners would secure the network as the mining reward successively drops after each Halving,” historically speaking, this hasn’t been the case.

In May 2020, will experience its third “Halving.” Bitcoin is a digital asset with a fixed & predictable supply, unlike dollars. Bitcoin is designed to be scarce, like gold. Here’s what that means and why it matters in historical context:

— Coinbase (@coinbase)

Instead, “the economics of Bitcoin tend to be resilient and self-balancing,” the blog post said. After two halvings in the past that limited rewards to miners, mining power (aka hashrate) has recently reached all-time highs.”

Why is this? Jeremy Britton, chief financial officer at Boston Trading Co., explained to Finance Magnates that the reason for this has to do with scarcity: “as with mining any scarce resource (eg. silver or gold), if mining becomes more difficult or more expensive, the price of the underlying asset will increase,” he said.”

Therefore, when the next halving occurs in May, “the price to mine a single bitcoin will increase to a minimum of $6000. Whatever the new ceiling is, the floor will be $6k, as miners will refuse to sell for a loss.”

Willy Woo also pointed to the halvening as a potential catalyst for upward price movements in December.

On-chain momentum is crossing into bullish. Prep for halvening front running here on in. Can’t say what this indicator is, as it’s proprietary to , but it tracks investor momentum. The bottom is mostly likely in, anything lower will be just a wick in the macro view.

— Willy Woo (@woonomic)

Is Bitcoin really a “safe haven”?

The “Bitcoin-as-safe-haven” narrative has also appeared in the news quite a bit since the beginning of the year–basically, it is believed that over time, Bitcoin is becoming an increasingly attractive “risk-off” asset in the face of economic crisis, geopoltical turmoil, and catastrophic world events.

Indeed, there have been many reports from Venezuela, Turkey, Zimbabwe, and other countries that have faced economic crises that Bitcoin is becoming an increasingly attractive option for protecting savings .

However, the narrative picked up even more momentum at the beginning of the year: in early January, a US drone strike killed Iranian major general Qasem Soleimani of the Islamic Revolutionary Guard Corps. When Iran struck two US military bases in Baghdad less than a week after Soleimani’s death

The correlation between the US-Iran tensions and a rise in the price of BTC was also supported by data from Google Trends during the week ending on January 8th, which showed that the search term “Bitcoin Iran” had spiked twice–once on January 4th, the day after Qasem Soleimani’s death, and again on January 8th, following Iran’s strike on US military bases. By the end of the week, searches for “Bitcoin Iran” had risen a total of roughly 4,450%.

While the tensions eased–and the price of BTC dropped, temporarily, as well–BTC-as-safe-haven appeared again with the growth in global coverage of the Coronavirus, a previously-unencountered virus strain that had at press time.

However, the role of the Coronavirus news cycle on Bitcoin is not entirely clear. “It’s an interesting time in the world with the global risk from the coronavirus playing on the equity markets, and nations responding with huge fiat injections,” Yusaka Senga told Finance Magnates.

“Retrofitting the data to a narrative”?

Indeed, Cynthia Huang, chief executive of Altcoin Fantasy, told Finance Magnates that there is also a narrative that “growing mistrust from Chinese about the government due to the handling of the Corona Virus could be causing more people to move their money to what they consider safe havens,” including Bitcoin. Even if this isn’t the case, speculation from outside markets that this is happening could lead some to buy BTC in an attempt to make a quick profit.

Jeremy Britton also pointed out that geopolitical events and incidences like the Coronavirus are not likely to have major long term effects on Bitcoin: “it seems like every year there is a different killer virus (Bird flu, SARS, ebola, coronavirus, et cetera),” he said. “There are wars in many countries, and corruption abounds. To quote the wise king: ‘There is nothing new under the sun.’”

However, “geopolitical events over the past ten years have been arguably similar to the last 1000 years, and all we know for sure, is that over each century, paper money devalues by 90%+, whereas scarce commodities (gold, silver, bitcoin) increase in value over time.”

”Fear and greed will drive daily prices”–but the role of emotion may diminish over time

Still, “as with stocks and bonds, fear and greed will drive daily prices. Traders are either irrationally exuberant or irrationally depressed. Prices fluctuate more in crypto, as there is no governing body like the SEC to investigate companies, and no NYSE or LSE to shutter markets when things go berserk,” Britton commented.

“During mass panics like the global financial crisis, 9/11, and wartime, the local stock market can easily cease trade for a few days or even weeks. This allows rational decisions rather than panic to rule once more. Crypto does not have checks and balances, nor does it have a protective governess, which leads to wilder swings, and greater potential for gains or losses.”

At the same time, however, Bitcoin’s burgeoning “critical mass” of long-term hodlers and smart money could signal that geopolitical turmoil may have less of an effect on BTC prices over time: “mass adoption grew in 2019 when the number of Americans who held at least one crypto wallet doubled. One can compare early adoption of crypto to early adoption of other tech like the first people who had cellphones, and the first people who had the internet in their home.”

“Within the next 5-7 years, crypto will have critical mass. Fans of traditional fiat currency could compare crypto to a virus which doubles every year and will eventually take over the world.”

The usage base that BTC has already accumulated may have already reduced volatility in price: “thankfully, markets are a lot more temperate than they have been previously and the knee jerk reactions to news are more subdued,” Yusaka Senga noted.

“Black swan events are also less common and less disruptive, and more trading is conducted on regulated and insured exchanges. [This] reduces the wild emotional overreactions and fears this time around.” The term “black swan events” refers to unpredictable events that are beyond what is normally expected of a situation that can have potentially severe consequences. The term was popularized by Nicholas Taleb in The Black Swan: The Impact Of The Highly Improbable.

Regulatory acknowledgment may be pushing BTC upward

And indeed, regulation does seem to have a hand in normalizing and legitimizing the use of cryptocurrencies, which could be having a stabilizing effect on Bitcoin–if not fueling the price outright.

The effect of government regulation and even acknowledgement of crypto has proven to be quite powerful: in the fourth quarter of 2019 to adopt blockchain technology “as an important breakthrough for independent innovation of core technologies.” The statement is thought to have contributed to a mini-price rally that briefly brought BTC past the $10,000 mark.

In the United States, crypto is also in the regulatory air: in addition to several pieces of crypto-related legislation that are currently making their way through the House of Congress, , also known as “Crypto Mom”, recently proposed a three-year grace period for startups wishing to raise funds through a token sale.

In a talk at the International Blockchain Congress, Peirce says initial token sales may sometimes require time in order to determine whether or not their underlying asset constitutes a security: “the analysis of whether a token is offered or sold as a security is not static and does not strictly inhere to the digital asset.”

What global events–regulatory and otherwise–do you see as supporting Bitcoin’s price run? Do you think that this price run is the “real deal”? Let us know in the comments below.

Be First to Comment