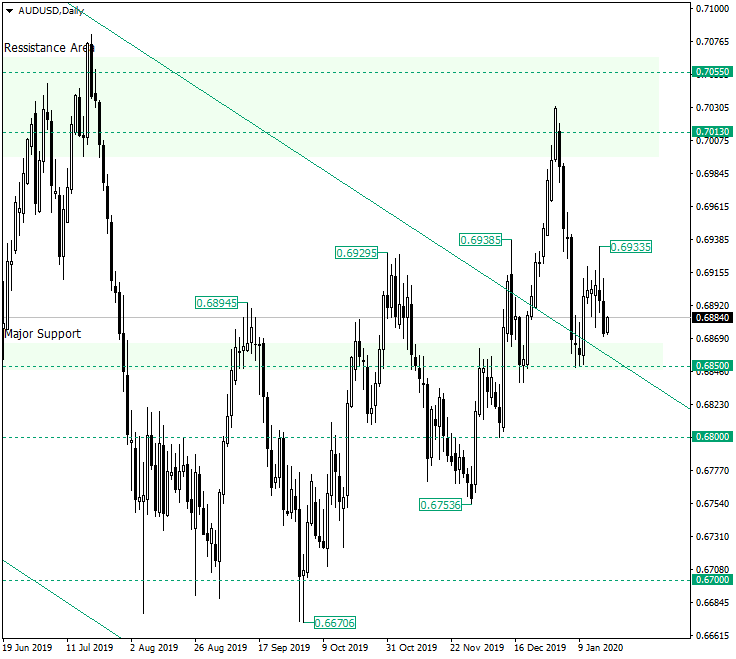

The Australian dollar versus the US dollar currency pair seems to be pursuing lower prices. The only possible barrier is 0.6850. Will this level be able to stop the depreciation?

Long-term perspective

After it bottomed at 0.6670 and confirmed the psychological level of 0.6700 as support, the price began an appreciation that slowly but steadily gain traction. Thus, the bulls were able to print new higher highs, conquer 0.6850, and pierce the resistance line of the descending channel.

But all this advancement was halted after the strong extension towards 0.7013 was invalidated by the retracement that immediately followed it.

In itself, the depreciation that resulted from the confirmation of the important resistance area marked by 0.7055 and 0.7013, respectively, is so strong that it raises some questions regarding the bullish determination to further push the price towards the north.

But if put in context, the questions seem to find the answers. The context is represented by the fact that this phase is accompanied by two peaks, one before — at 0.6938 — and one after it — at 0.6933.

This presentation is typical for a head and shoulders pattern and could not be even better printed, as the right-side shoulder is smaller than the left-side one, it has a neck-line in an area of great importance (the major support of 0.6850), and it is preceded by an ascending movement — the one that starts at the low of 0.6753.

Given all these ingredients, the bears can hardly wait for the neckline to be pierced. Even more, once that materializes, the price will once again be under the resistance line of the descending channel, which alongside the 0.6850 level serves as a double resistance area.

So, after the bears will take control of the 0.6850 level, the expectations are for a depreciation to extend until 0.6800, at least in the first phase.

Even is 0.6850 does not give way, the head and shoulders pattern remains in place as long as 0.6938 is not taken out.

Short-term perspective

After the depreciation that started at the 0.7003 level, the price entered a consolidation phase limited by the Fibonacci retracement levels of 61.8 and 50.0, respectively.

But as the support seems to give way, the message is that the drop is preparing to resume. A fist target is represented by the 0.6855 level. The 38.2 projection is the second target, which is followed by 23.6.

Only if the bulls manage to conquer the 61.8 level, then the price could revisit 0.7003.

Levels to keep an eye on:

D1: 0.6850 0.6800

H4: 0.6855 0.7003 and the Fibonacci retracement projections of 38.2 23.6 61.8

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment